We cover some very interesting technologies in this piece, from a nano-cap company with a call option on survival, a stroke therapy firm that may improve the lives of millions, to a big-cap genomic sequencing leader that has exposure to the development of a liquid biopsy test for cancer.

By Brian Nelson, CFA

NeuroMetrix May Not Survive

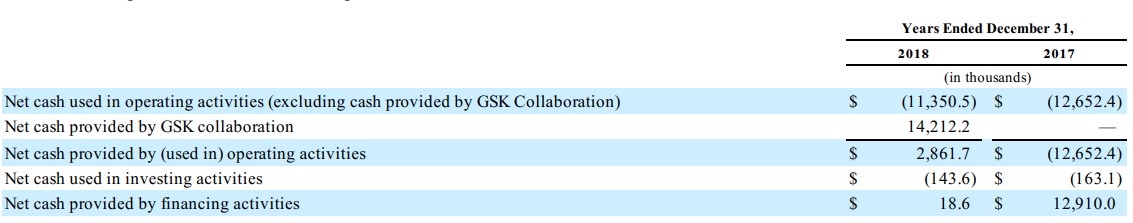

NeuroMetrix (NURO) is a nano-cap entity, a rarity when it comes to our commenting on ideas, and it comes with some unusual risks even beyond those inherent to the healthcare/biotech space. The company has incurred accumulated losses of $191 million since inception, and while it held $6.8 million in cash at the end of 2018, it may need to raise additional capital to support its operating and capital needs during 2020.

NeuroMetrix is not shy about expecting further losses either, as the company markets Quell, its over-the-counter wearable neurostimulation device for chronic pain. A collaboration with GlaxoSmithKline (GSK) will buy it some time, but management is very clear that if additional financing resources become unavailable, it raises “substantial doubt about (its) ability to continue as a going concern.” That means equity holders could eventually get completely wiped out.

The company reported an improvement in net income during the first quarter of 2019, to $2.1 million, an increase of 79% over the mark in last year’s quarter. The problem, however, is that Quell shipment volume and sales were lower as a result of reduced advertising spending. It seems there may not be a lot of leverage in the business model. NeuroMetrix must spend to grow, and it doesn’t have tremendous resources to do so, even with GlaxoSmithKline backing it for now.

To us, NeuroMetrix is but a “call option” that is most likely to expire worthless, despite it having a viable product. In 2018, NeuroMetrix sold the rights to Quell in markets outside of the US in exchange for $26.5 million in milestone payments, and while these milestone payments are far in excess of the company’s market capitalization, the bottom line is that investors should be aware that its “independent auditor has expressed substantial doubt about (its) ability to continue as a going concern.”

We don’t think NeuroMetrix is going to make it. Cash burn, excluding contributions from GlaxoSmithKline that may run out soon, is far too great.

Image Source: NeuroMetrix’s 10-K

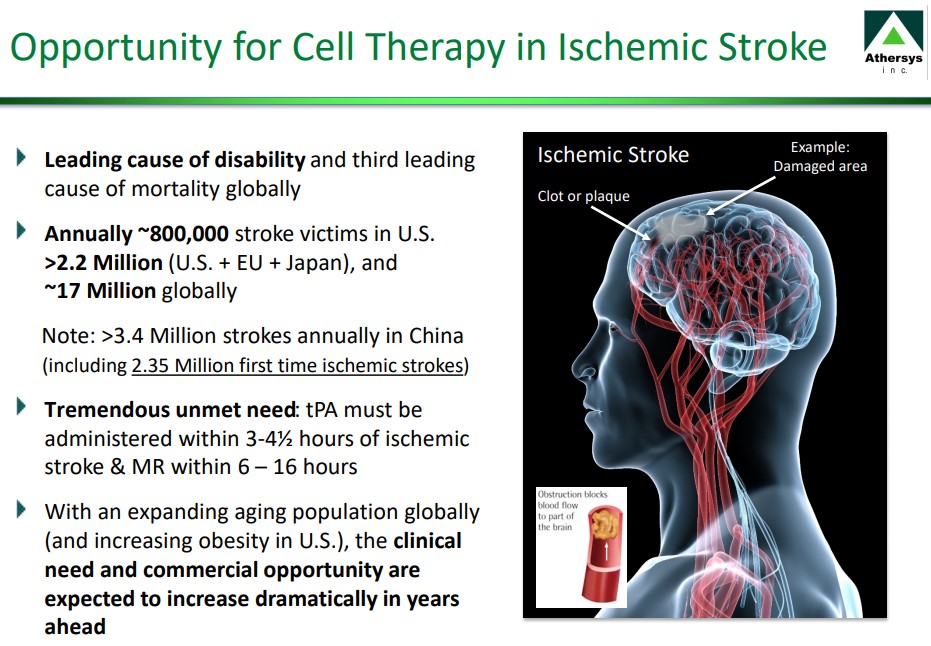

Under the Radar Player on Ischemic Stroke

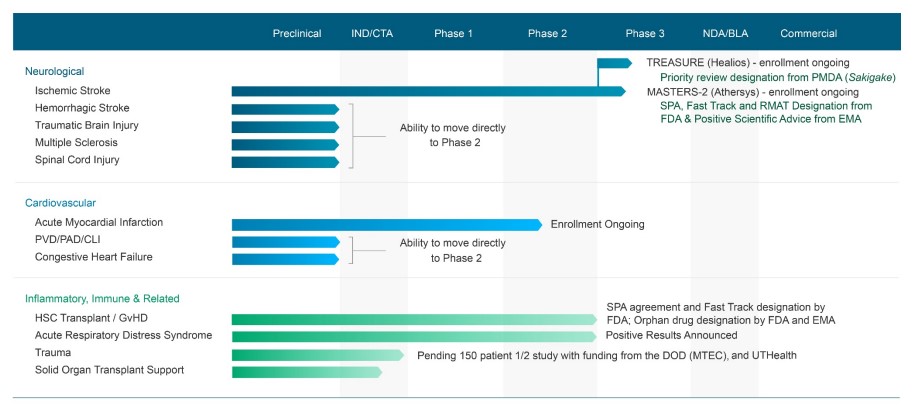

Biotechs are risky, but they can also pay off big if a key drug with tremendous promise is commercialized. From what we can tell, Athersys (ATHX) has a rather intriguing clinical and preclinical pipeline. Among its key therapies is MultiStem for the treatment of ischemic stroke (MASTERS-2 and TREASURE). The therapy can greatly extend the treatment window for stroke patients (from just 3-4.5 hours to almost 3 days). The company has a trial in Japan and is preparing to initiate a Phase 3 clinical trial in North America and Europe under a Special Protocol Assessment. The opportunity in this area is considerable.

Image Source: Athersys Investor Presentation

The intravenous administration of MultiStem regulates a number of factors that are important to brain recovery following a stroke. Though the therapy looks very promising, there’s still a rather meaningful chance that, despite an accelerated approval pathway, the therapy may not meet its primary goals in Phase 3 testing. Given that Athersys sports a market capitalization of ~$270 million, there’s substantial downside risk should this happen, but the company has other opportunities in the pipeline.

Image Source: Athersys Investor Presentation

In any case, investors are taking on considerable risk, in our view, but the risk/reward could be balanced (as the payoff could be considerable, too). The existing financials at the company aren’t dire either, so Athersys has some time. At the end of the first quarter of 2019, Athersys held ~$51 million in cash and cash equivalents. It burned through roughly $5.5 million in operating cash flow in the period, giving it about 2 years or so of cash burn based on its current quarterly run-rate. Revenue at the moment is immaterial, so an investment in Athersys is almost exclusively an investment in its pipeline.

As we look ahead to the back half of 2019, advancing its trials will be key. The company’s shares will undoubtedly move materially on any news with respect to its ischemic stroke therapy pipeline, not only with respect to trial news in US/Europe and Japan (and China), but also as it relates to MultiStem cell therapy in other areas (acute respiratory distress system, for example). Athersys is a speculative biotech, and while the risk may be far too much for out taste, if the company delivers on its pipeline, commercialization of its MultiStem cell therapy could pay off huge.

Illumina: Great Company, Pricey Stock

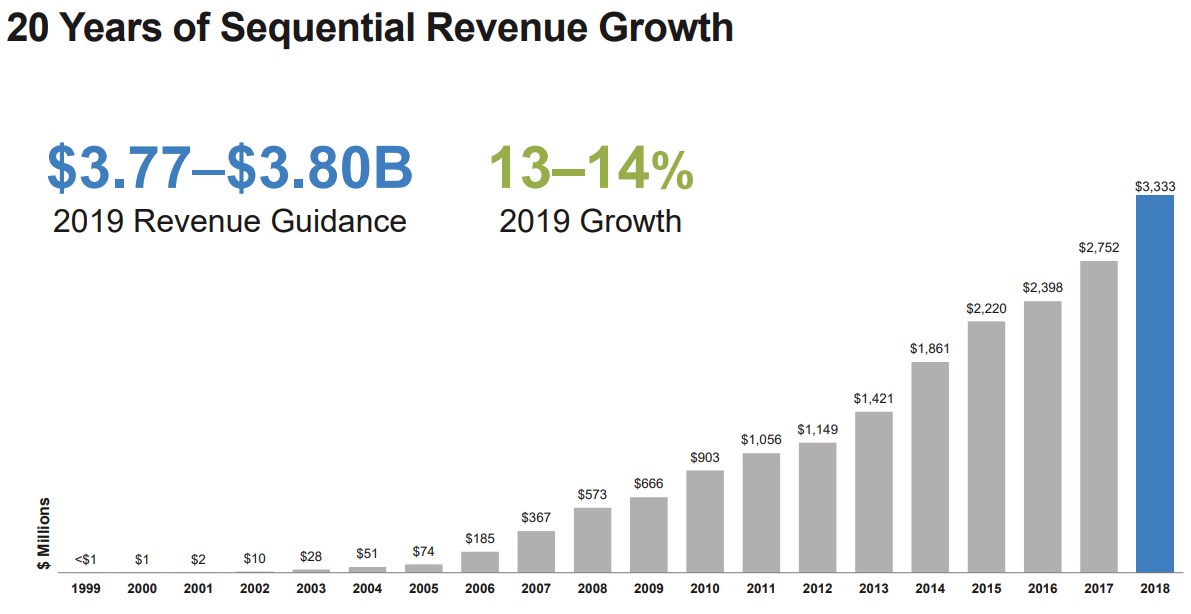

Illumina (ILMN) is a self-described leader in “sequencing and array-based solutions for genetic and genomic analysis.” Its customers include some of the top genomic research centers, academic institutions, government laboratories and hospitals. The company also has invested in early-stage companies including GRAIL, which was created to “develop a blood test for early-stage cancer detection” and Helix, which allows “individuals to explore their genetic information by providing sequencing and services for consumers through third-party partners.”

Illumina, in many ways, has changed the economics of genetic research by helping in projects that were once thought impossible. Its technology supports “population studies, genome-wide discovery, target selection and validation studies,” among other processes. The company’s revenue stream is generated from the sales of instruments and consumables (reagents, flow cells, and microarrays), most of which are based on its proprietary know-how. Instrument sales represent about 20% of revenue, consumable sales about 65% of revenue, and services represents the balance. The company competes with Agilent Technologies (A), BGI, Oxford Nanopore Technologies, QIAGEN (QGEN), Roche Holding (RHHBY) and Thermo Fisher (TMO), but it has carved out a nice niche.

We like Illumina, but its valuation is something that is difficult to get comfortable with. The company held roughly $1.5 billion in net cash on the books at the end of 2018, and while cash flow from operations has been robust at $1.14 billion (2018), $875 million (2017) and $779 million (2016) during the past three fiscal years, it’s hard to get comfortable with its $46 billion market capitalization in such a context. Capital spending wasn’t immaterial during this time period either, averaging approximately $290 million during each of the past three years, still good enough for strong free cash flow generation, however ($846 million in 2018, $565 million in 2017, and $519 million in 2016). For fiscal 2019, the company is targeting revenue growth in the range of 13%-14% and non-GAAP earnings per share in the range of $6.63-$6.73, implying the stock is trading at 45+ times current year earnings on the basis of the high end of the range.

Image Source: Illumina Investor Presentation, Barclays (March 2019)

Illumina may very well grow into this lofty earnings multiple, but shares are still too pricey for our taste. The firm holds a 19% equity stake in forward-learning enterprise GRAIL (was 52%), and this company is making progress in developing a liquid biopsy test for cancer, but the deconsolidation of GRAIL in February 2017 makes the impact of any success in this area much less impactful than it could have been. We think Illumina remains a classic case of a great company, but too risky of a stock given its valuation. That said, unlike the other two companies highlighted in this piece, Illumina operates on much sturdier financial ground, even if its equity may still be quite volatile.

Related: IBB

—–

The research and analysis provided for NURO, ATHX, and ILMN was requested by paying members to Valuentum.

Brian Nelson does not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.