By Brian Nelson, CFA

There are two primary cash-based sources of intrinsic value, and Microsoft (MSFT) and Alphabet (GOOG) (GOOGL) have gobs of them: net cash on the balance sheet and free cash flow. Both Microsoft and Alphabet reported calendar second-quarter results after the market close July 25, and while much will be said about their respective earnings reports, the reality is that the fundamental backdrop for both remains incredibly strong. We think both deserve a hearty weighting in the portfolio of the Best Ideas Newsletter, and we don’t plan to make any changes to our long-term fair value estimates as a result of the quarterly prints.

Let’s talk about the health of Microsoft’s and Alphabet’s respective balance sheets. At the end of June, Microsoft held $111.3 billion in total cash and cash equivalents, exclusive of $9.9 billion in equity investments, and short- and long-term debt of $47.2 billion–good for a very nice net cash position. For Alphabet, at the end of June, total cash and cash equivalents stood at $118.3 billion, while long-term debt stood at $13.7 billion–again, a very solid net cash position. These two companies have two of the strongest balance sheets in our coverage, and we continue to like that total cash on the balance sheets advanced for both, while total debt fell. Net cash is an add-back to the present value of future enterprise free cash flows within the discounted cash-flow construct to arrive at equity value, so we continue to be big fans of companies with net cash on the balance sheet.

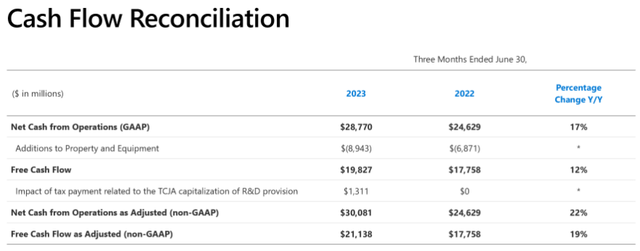

Image: Microsoft’s free cash flow continues to be phenomenal.

Let’s now talk about traditional free cash flow for Microsoft and Alphabet. For the three months ended in June, cash flow from operations at Microsoft surged to $28.8 billion, while capital spending came in at $8.9 billion, good for free cash flow generation in the quarter of $19.8 billion (see image above). For Alphabet, cash flow from operations at Alphabet jumped to $28.7 billion in the quarter, while capital spending was $6.9 billion, resulting in free cash flow generation during the period of $21.8 billion. It’s hard to believe that these are quarterly measures of free cash flow given just how big they are, but this is the day and age we live in. Microsoft and Alphabet are nothing short of net-cash-rich, free-cash-flow generating, secular-growth powerhouses, and we couldn’t like them more than we do.

Microsoft’s quarterly results showed revenue advancing 8% (up 10% in constant currency), while operating income leapt 18% (up 21% in constant currency). Microsoft Cloud revenue advanced 23% on a year-over-year basis, while Office Commercial products and Office 365 Commercial jumped at a mid-to-high teens percentage pace. ‘Azure and other cloud services’ leapt 27% on a constant currency basis in the quarter. Alphabet’s quarterly results showed revenue on a constant currency basis of 9% in the quarter, while operating income jumped 12.3%. Google Search and other showed a 4.7% year-over-year revenue advance in the quarter. Artificial intelligence remains a huge catalyst for both companies, and we look to a very bright next couple of years in this area. We remain bullish on both and expect continued strength for some time to come.

———-

NOW READ — Questions for Valuentum’s Brian Nelson

NOW READ — ALERT: Big Yield Additions to Dividend Growth Newsletter Portfolio and High Yield Dividend Newsletter Portfolio

NOW READ — ALERT: Going to “Fully Invested” in the Best Ideas Newsletter Portfolio

NOW READ — Expect Huge Equity Returns This Decade, Much More Volatility However

NOW READ — There Are No Free ‘Income’ Lunches

———-

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, and RSP. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.