Image Source: Facebook

Let’s not beat around the bush with this article. Let’s talk about why we like Facebook in layman’s terms. The company is a veritable free-cash-flow generating powerhouse, and its balance sheet is pristine. We value shares at $238 each, and its rating of 7 on the Valuentum Buying Index isn’t bad considering the frothiness of the market.

By Brian Nelson, CFA

Shake off the idea that technology is riskier than any other sector because it might not be. Don’t worry about the concept of “fake news” tarnishing the Facebook (FB) brand, as that’s just noise.

Facebook operates at the heart of society, and while there will inevitably be changes to its platform along the way, literally everyone and their mother is on Facebook! If advertisers want to continue to engage what we believe to be a better avenue to target potential buyers than Twitter (TWTR) or Snapchat (SNAP), they are going to have to pay Facebook. It’s that simple.

Many point to the idea that Facebook may be losing favor with the younger generation, but we’re not worried about that. Monthly active users continue to march higher (up to 2.13 billion in the fourth quarter of 2017 from 1.59 billion in the fourth quarter of 2015), and those that may not like the platform may eventually find a need to come back in the years ahead, whether they’re changing jobs, getting married, or a loved one moves far away.

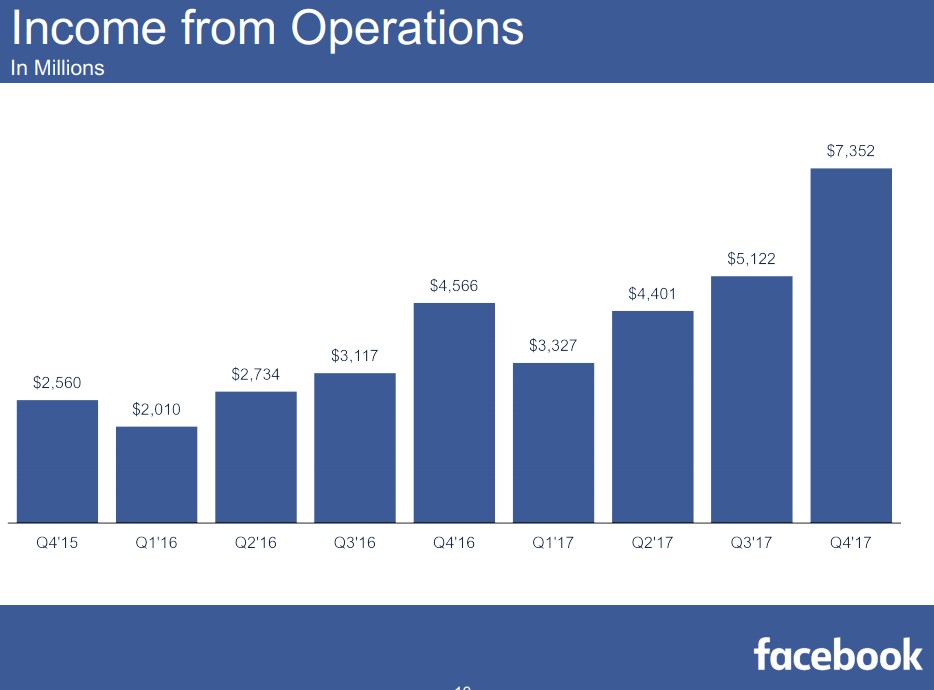

Just like a book, don’t judge a business by image. The core of what determines intrinsic value comes from the generation of free cash flow and balance sheet health—think of free cash flow as your salary less expenses—and balance sheet health as your cash in the bank less all your obligations, or your net worth (including other illiquid assets). Facebook’s free cash flow expanded to $5.4 billion during the fourth quarter of 2017, roughly double that achieved during the fourth quarter of 2015. It holds $41.7 billion in net cash on the books and has no debt.

The future will always be unpredictable, but now that Facebook has huge reach, it has an open-ended opportunity to continue to pursue monetization efforts, and we believe it is in the early innings with this. Perhaps Facebook is still getting warmed up and hasn’t yet taken the field? Its opportunities range from a continuation of its ongoing fantastic fundamental trajectory to literally becoming the new ‘Internet’ where family and friends not only meet up to socialize but also to buy anything and everything there.

We value shares at $238 each, and the company has a rating of 7 on the Valuentum Buying Index, our methodology that combines intrinsic valuation with behavioral considerations and self-fulfilling technical dynamics.

Related: MILN, SOCL

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Brian Nelson does not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.