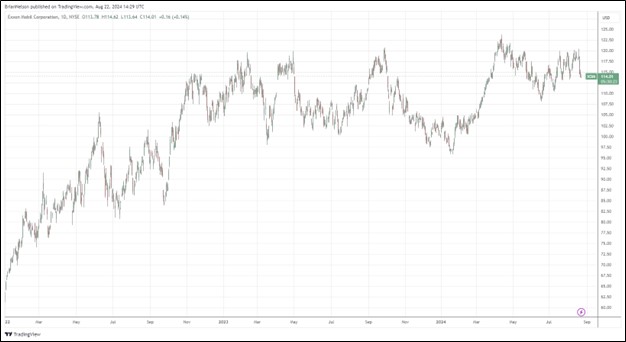

Image: ExxonMobil’s shares have done quite well since the beginning of 2022.

By Brian Nelson, CFA

ExxonMobil (XOM) recently reported better than expected second quarter results with both revenue and non-GAAP earnings per share coming in higher than the consensus forecast. Total revenue and other income increased 12.2% from the prior-year quarter, while non-GAAP earnings per share came in at $2.14 per share, up $0.08 on a sequential basis. Exxon Mobil returned $9.5 billion to shareholders in the quarter, consisting of $4.3 billion in dividends and $5.2 billion in buybacks.

Management was upbeat about the performance:

We delivered our second-highest 2Q earnings of the past decade as we continue to improve the fundamental earnings power of the company. We achieved record quarterly production from our low-cost-of-supply Permian and Guyana assets, with the highest oil production since the Exxon and Mobil merger. We also achieved a record in high-value product sales, growing by 10% versus the first half of last year. We closed on our transformative merger with Pioneer in about half the time of similar deals. And we’re continuing to build businesses such as Proxxima, carbon materials and virtually carbon-free hydrogen, with approximately 98% of CO2 removed, that will create value long into the future.

Year-to-date non-GAAP cash flow from operations, excluding working capital, was $27.8 billion, down slightly from the $29.6 billion in the same period a year ago. Non-GAAP free cash flow generation, excluding working capital, was $17.6 billion year-to-date versus $20.3 billion in the year-ago period. Cash dividends to ExxonMobil shareholders were $8.1 billion during the first half of 2024, revealing ExxonMobil’s strong free cash flow coverage of the payout. Its net-debt-to-capital ratio was 6% at the end of the quarter. Total short- and long-term debt was $43.2 billion at the end of the quarter versus $26.5 billion in cash and cash equivalents.

We like the cash-flow profile of ExxonMobil, and its purchase of Pioneer offers the company continued integration and synergy benefits. Exxon’s record production in Guyana and Permian was welcome news, with total Upstream net production advancing 15% in the second quarter from the first quarter of the year. The company has achieved $10.7 billion in cumulative structural cost savings since 2019, and management noted that it is on track to deliver cumulative savings totaling $5 billion through the end of 2027 versus 2023. Our fair value estimate of ExxonMobil stands unchanged at $114 per share.

—–

NOW READ: What to Do During This Market Selloff

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.