Image Source: Exxon Mobil

By Brian Nelson, CFA

Exxon Mobil (XOM) recently reported better than expected third quarter results, though performance faced some headwinds from lower industry refining margins and reduced natural gas prices. Total revenues and other income fell 0.8% in the quarter on a year-over-year basis, while earnings excluding identified items (non-GAAP) fell to $8.6 billion from $9.2 billion in the year-ago period. Diluted earnings per common share came in at $1.92 versus $2.25 in the same period a year ago. Management had the following to say about the quarter:

We delivered one of our strongest third quarters in a decade. Our industry-leading results continue to demonstrate how our enterprise-wide transformation is improving the structural earnings power of the company. In the Upstream, we’ve doubled the profitability of the barrels we produce on a constant price basis. In Product Solutions, we’ve high-graded our refining footprint and increased high-value product sales. And across the entire company, we’ve achieved $11.3 billion of structural cost savings since 2019. Our strategy is delivering leading returns of 20% so far this year for our shareholders, and we are continuing that growth with a 4% increase in our quarterly dividend payment…We’ve now increased our annual dividend for 42 years in a row, a claim that less than 4% of the S&P 500 companies can make. Furthermore, we lead industry in total shareholder returns for the past 3, 5 and 10 years.

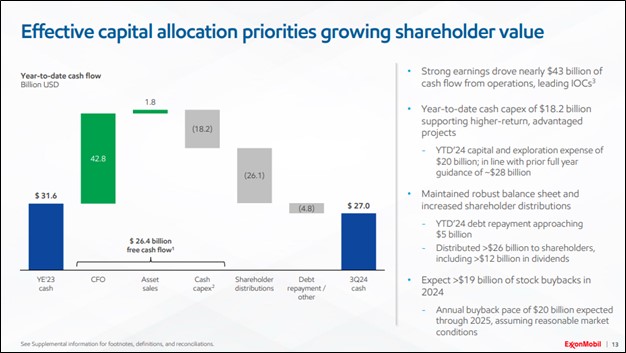

Year-to-date, Exxon Mobil’s GAAP cash flow from operations expanded to $42.8 billion, up from $41.7 billion in the same period of 2023. Non-GAAP free cash flow fell to $26.4 billion year-to-date from $28.1 billion in the year-ago period, but it was well more than total dividends paid on common stock of $12.3 billion for the nine months ended September 30. The company bought back $13.8 billion in stock over the same time period. Exxon Mobil ended the third quarter with $27 billion in cash and cash equivalents, with total debt, notes and loans payable totaling $42.6 billion.

We like Exxon Mobil’s strong advantaged volume growth from Guyana and Permian assets, including Pioneer Natural Resources, and we view Exxon Mobil as one of our favorite ideas to gain energy exposure, given its strong dividend track record and excellent free cash flow generation. Exxon Mobil is also aggressively pursuing structural cost savings and is on track to deliver cumulative savings of $15 billion through the end of 2027 versus 2019. Our fair value estimate stands at $126 per share. Exxon Mobil yields 3.4% at the time of this writing.

—–

Tickerized for holdings in the XLE.

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.