This article originally appeared on our website December 8, 2021.

Image Source: Exxon Mobil Corporation – December 2021 IR Presentation

By Callum Turcan

At the start of December 2021, Exxon Mobil Corporation (XOM) laid out its longer term strategy for the 2020s decade. We are going to cover that outlook, the state of the global energy complex, Exxon Mobil’s stellar and improving financial position, and what to expect going forward. Exxon Mobil is a tremendous enterprise and one of our favorite energy names out there.

Outlook Overview

The company noted in its early-December update that its capital expenditures would come in around ~$20-$25 billion from 2022-2027. Its investments are focused on its operations in the Permian Basin, Guyana, Brazil, its liquefied natural gas (‘LNG’) business, and its petrochemical businesses. While up from ~$16-$19 billion versus expected 2021 capital expenditure levels (during Exxon Mobil’s third quarter of 2021 update, the firm noted that it would spend at the lower end of that range), please note that its 2022-2027 capital expenditure target is well below levels seen during previous periods of strong raw energy resources pricing. From 2010-2014, ExxonMobil’s annual capital expenditures averaged ~$33 billion (I, II).

Predicting the exact trajectory that raw energy resources pricing will take over the coming years is an impossible task. However, operating under the assumption that raw energy resources pricing will remain at “comfortable” levels in the coming years (meaning at levels in which energy majors like Exxon Mobil can generate sizable net operating cash flows and ultimately free cash flows when keeping a lid on capital expenditures) is reasonable, in our view, as the longer term outlook for global energy complex is quite favorable.

After raw energy resources pricing tanked starting in late 2014, and largely remained subdued through 2020, investment in upstream developments (those focused on extracting oil & gas from the ground) shifted materially lower according to data from the International Energy Agency (‘IEA’). In nominal terms, the IEA notes that upstream oil & gas investment levels fell from $779 billion in 2014 to $483 billion in 2019 and further still to $328 billion in 2020 in the wake of the coronavirus (‘COVID-19’) pandemic. During the 2014-2019 period, demand for raw energy resources largely continued to grow.

The IEA notes that in 2014, global crude oil demand stood at 4.2 billion metric tons which rose to 4.5 billion metric tons by 2019 before dropping to 4.1 billion metric tons in the wake of the COVID-19 pandemic. Data provided by BP plc’s (BP) 2021 edition of its Statical Review of World Energy backs this up. From 2014 to 2019, global crude oil demand rose from 90.7 million barrels per day to 97.6 million barrels per day, before dropping to 88.5 million barrels per day in 2020.

Please note that these figures are different than global “liquids” consumption, which according to BP’s calculations also includes such items as biogasoline, biodiesel, and derivatives of coal and natural gas. Broadly speaking, whether one includes items such as biofuels, natural gas liquids (such as propane and butane), and condensate in the consumption mix can change these figures, though the demand growth trajectory generally remains the same. Additionally, whether one is looking at the input consumption levels (the raw energy resources) or the consumption levels of refined petroleum products (such as gasoline, diesel, marine bunker fuel, and aviation fuel) could change these figures somewhat, though again, the demand growth trajectory remains the same.

As of early November 2021, the US Energy Information Administration (‘EIA’) noted that global petroleum and liquids fuels consumption rose by 4.5 million barrels per day in October 2021 versus October 2020 levels, though were still down 1.9 million barrels per day from October 2019 levels. Please note that the EIA updates its Short-Term Energy Outlook webpage and related data roughly once a month. The privately held consulting firm McKinsey expects global oil demand will steadily recover in the coming years according to its February 2021 outlook, and should recover its 2019 levels by late-2021 or early-2022 according to the company’s forecasts.

Pivoting to natural gas demand, BP notes that global natural gas consumption stood at 3.4 trillion cubic meters in 2014 and rose to 3.9 trillion cubic meters in 2019, before dropping to 3.8 trillion cubic meters in 2020. Data provided by the IEA also indicates strong natural gas demand occurred from 2014-2019 across the globe, before global demand dipped modestly in 2020 versus 2019 levels. McKinsey expects global natural gas demand will grow by 0.8% CAGR from 2020-2029 according to its February 2021 outlook.

In our view, global energy demand is steadily recovering though headwinds from variants of the COVID-19 pandemic remain. Keeping near-term headwinds from COVID-19 variants, such as the new Omicron variant, in mind, we see global energy consumption steadily reaching pre-pandemic levels in the coming quarters. In turn, this supports the longer-term outlook for raw energy resources pricing.

Stellar Financials

Exxon Mobil’s stated strategy is to not chase raw energy resources pricing higher by perpetually raising its capital expenditure expectations. This strategy will better enable Exxon Mobil to generate substantial free cash flows going forward as it invests in its most promising assets while paying down debt, buying back its stock, and continuing to make good on its sizable dividend obligations going forward.

During its third-quarter 2021 earnings update, Exxon Mobil announced that starting in 2022, it would begin repurchasing sizable amounts its stock (buybacks were subdued during the 2018-2020 period). Its new stock buyback program will see the firm repurchase up to $10.0 billion of its shares over the 12-24 months starting in 2022. The company continued to make good on its dividend obligations during the pandemic which we appreciate.

Recently, Exxon Mobil has been taking advantage of its stellar free cash flows during the first three quarters of 2021 to pare back its net debt load. Inclusive of short-term debt, Exxon Mobil’s net debt load dropped by $11.4 billion from the end of December 2020 to the end of September 2021. During the first nine months of 2021, Exxon Mobil generated $23.0 billion in free cash flow and spent $11.3 billion covering its total dividend obligations. Cash raised via asset sales and its “excess” free cash flows (after paying out its total dividends) enabled the firm to improve its balance sheet strength. Exxon Mobil has a lot going for it.

Green Energy Considerations

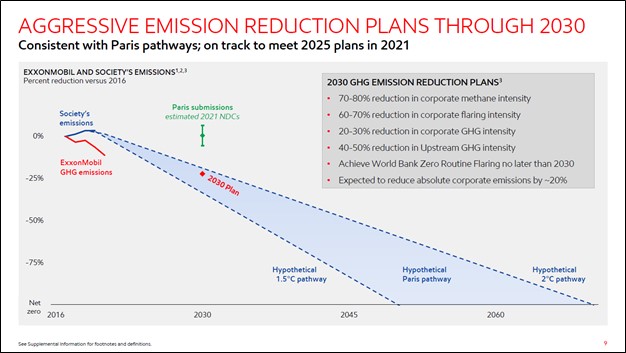

From 2022-2027, Exxon Mobil intends to spend ~$15 billion on “lower emission investments” including carbon capture and storage, hydrogen, and biofuel ventures according to guidance put forward during its December 2021 update. The company is committed to reducing the greenhouse gas (‘GHG’) intensity of its operations substantially, meaning its GHG emissions on a per unit basis. While there will be plenty of individuals and institutions that stay this does not go far enough, please note that Exxon Mobil is now making a serious effort on this front, particularly after the activist fund Engine No 1 secured three of its board seats in 2021 (two in May and another in June).

Image Shown: Exxon Mobil is reacting to changing regulatory environments, investor concerns, and societal changes by focusing on reducing its emissions on a per unit basis. Image Source: Exxon Mobil – December 2021 IR Presentation

Earnings Boost

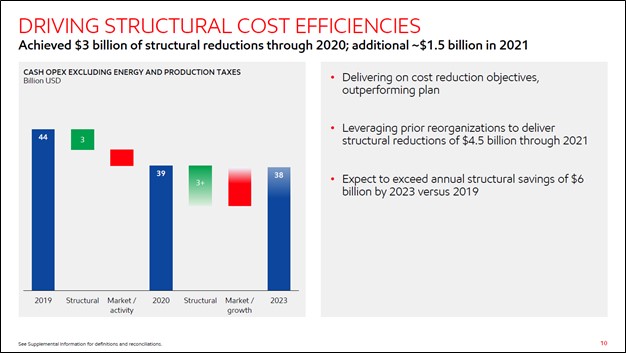

The company is also focused on improving its cost structure, a strategy that was accelerated by the COVID-19 pandemic. Specifically, Exxon Mobil is targeting “structural savings” or put another way, improvements in its cost structure that can be maintained for years to come. By 2023, Exxon Mobil aims to achieve ~$6 in annual cost structure improvements versus 2019 levels and had already achieved $4.5 billion of those savings by the end of the third quarter of 2021. These savings should go a long way towards improving Exxon Mobil’s future free cash flow generating abilities.

Image Shown: Exxon Mobil is steadily improving its cost structure which supports its free cash flow growth outlook. Image Source: Exxon Mobil – December 2021 IR Presentation

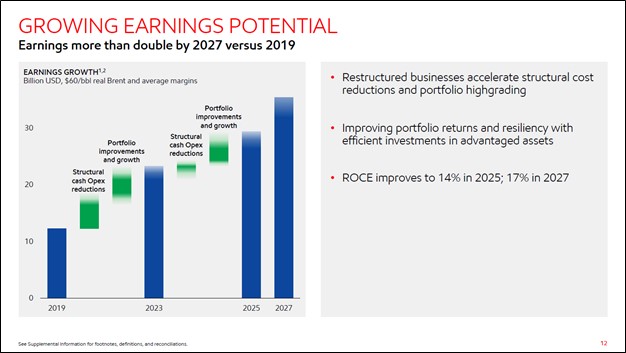

Put together, all of Exxon Mobil’s initiatives are forecasted to double its earnings by 2027 from 2019 levels. The company also aims to boost its return on capital employed (‘ROCE’) to 14% by 2025 and 17% by 2027. For reference, Exxon Mobil’s ROCE stood at 9.0% in 2017, 9.2% in 2018, and 6.5% in 2019 before hitting negative 9.3% in 2020. Furthermore, in 2019, Exxon Mobil generated $14.3 billion in GAAP net income attributed to common stockholders and $3.36 in GAAP diluted EPS.

Image Shown: Exxon Mobil aims to double its earnings by 2027 versus 2019 levels. Image Source: Exxon Mobil – December 2021 IR Presentation

Exxon Mobil also noted during its December 2021 update that it intends to double its operating cash flows by 2027 from 2019 levels. The state of the global energy complex will play an outsized role regarding whether this guidance is achieved or not, but we appreciate Exxon Mobil’s optimism. For reference, Exxon Mobil generated $29.7 billion in net operating cash flow in 2019.

Image Shown: Exxon Mobil aims to double its operating cash flows by 2027 versus 2019 levels. Image Source: Exxon Mobil – December 2021 IR Presentation

OPEC+

In April 2020, the OPEC+ oil cartel (includes OPEC member nations, such as Saudi Arabia and Iraq, and non-OPEC nations, such as Russia and Kazakhstan) decided to collectively remove 9.7 million barrels of crude oil production from the global market in a bid to stabilize prices by better matching supply and demand in the wake of the COVID-19 pandemic (which caused significant demand destruction for refined petroleum products and thus crude oil). A few months after the supply cuts came into force in June 2020, the OPEC+ group decided to slowly unwind those supply curtailments. Here is a timeline of these actions.

More recently, OPEC+ announced they would add another 0.4 million barrels of crude oil per day to global markets in January 2022. The group has been steadily unwinding its supply cuts by that amount each month in terms of the production cap over the past several months, though that cap is not always met as some nations are struggling to ramp their oil output back up according to S&P Platts, a unit of S&P Global Inc (SPGI).

The US and a few other nations announced in late November 2021 that they would release relativel