Image Source: Exact Sciences Corporation – IR Presentation

By Callum Turcan

Exact Sciences (EXAS) operates as a molecular diagnostics company built around its Cologuard offering which was approved by the US FDA in August 2014. Cologuard is used to screen adults of any gender, particularly those that are 50 and older, who are at average risk for colorectal cancer by testing stool samples. The long-term aim of Exact Sciences is to increase the uptake of its Cologuard offering by encouraging more Americans to get colorectal cancer screenings, which in turn could make Exact Sciences profitable sometime in the future. Citing data from the American Cancer Society, Exact Sciences notes colorectal cancer is the second deadliest cancer in American after lung cancer and ahead of pancreatic cancer.

Furthermore, Exact Sciences notes may Americans don’t get screened for colorectal cancer, which is a major problem because when “colorectal cancer is detected in Stage I, about 90 percent of patients survive five years, and the removal of pre-cancerous lesions can further prevent the disease from progressing. Only about 11 percent of patients survive five years when the disease is detected in Stage IV” according to 2009 data from the Journal of the National Cancer Institute. Greater screenings would go a long way in catching colorectal cancer in patients early, at a time when treatment is wildly more effective.

The commercialization process is built around reimbursements. Patients send in stool samples to Exact Sciences’ 55,000 square foot facility in Madison, Wisconsin, which processes the Cologuard tests. Note that the Clinical Laboratory Fee Schedule for 2018 and 2019 sets Exact Sciences reimbursement rate from the CMS (Centers for Medicare and Medicaid Services) at $508.87 per test, keeping in mind that Medicare covers about half of potential Cologuard patients (those 50 and over who are at average risk of colorectal cancer). That reimbursement rate is regulated by PAMA (Protecting Access to Medicare Act of 2014) where “payment rates for clinical diagnostic laboratory tests are calculated based on the volume-weighted median of private payer rates for each clinical diagnostic laboratory test based on data submitted by certain applicable laboratories.” Reimbursement rates from private insurers are likely around $500 – $525 per test (based on Exact Sciences’ commentary regarding reimbursement rate estimates and the current PAMA-compliant reimbursement rate). Check out this key excerpt from Exact Sciences 2018 10-K:

“The current CMS reimbursement rate was set based on the volume-weighted median of private payer rates for Cologuard for the period from January 1, 2016 to June 30, 2016. Based on current PAMA regulations, we expect that the current CMS reimbursement rate for Cologuard will remain in place until January 2021, and then will be reset based on the volume-weighted median of private payer rates for Cologuard during the data collection period from January 1, 2019 to June 30, 2019.”

In theory, there could be room for upside here in the event Exact Sciences’ reimbursement rate per test goes up (following the trend of most other healthcare services). As Exact Sciences hopes to get patients on a cycle of getting tested every three years (Medicare B covers one Cologuard test every three years for patients that meet specific requirements), earning more per test on top of processing more tests per year (in the event a greater chunk of Americans start getting tested for colorectal cancer for the first time and patients begin getting tested somewhat regularly) could represent a very powerful growth catalyst for Exact Sciences.

We appreciate its growth story as Cologuard offers patients a non-invasive way of screening for cancer, particularly colorectal cancer (the company hopes to expand into other areas over time), and the market potential here is huge. Far too many Americans (and patients worldwide) don’t get screened for colorectal cancer, and Exact Sciences has set out on a quest to change that.

On the downside, note that federal budget sequestration impacts could reduce Exact Sciences’ CMS reimbursement rate due to automatic spending cuts (where CMS takes the baseline reimbursement rate and applies a certain discount, which under the Budget Control Act of 2011 equated to up to a 2% reduction in Exact Sciences CMS reimbursement rate). The federal budget sequester may come back into force in 2020 after the Bipartisan Budget Act of 2018 removed the spending restrictions for 2018 – 2019. We’ll see how the current make-up of Congress takes up budgetary issues.

The Cologuard Growth Story

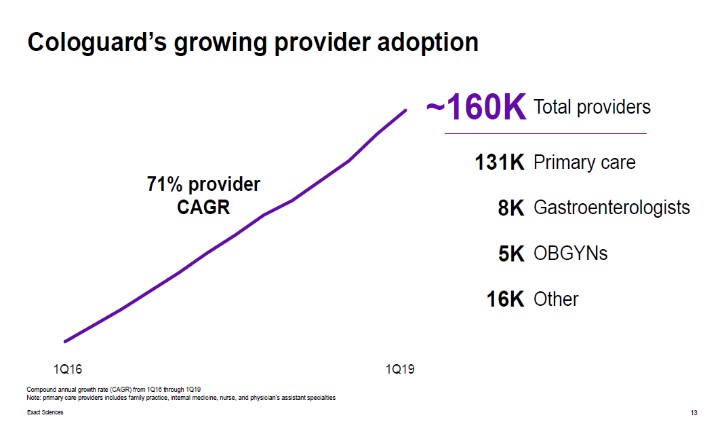

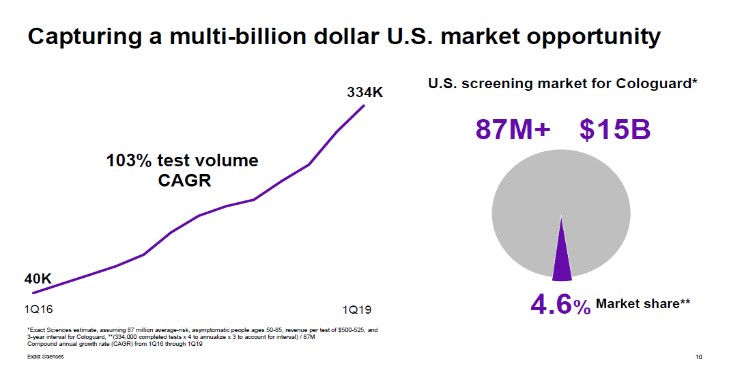

Since 2016, Exact Sciences has aggressively partnered up with healthcare providers to encourage greater usage of its Cologuard tests. Part of this involves encouraging its partners to push patients, particularly those 50 and older, to get colorectal cancer screens for the first time while also encouraging patients to get screened more regularly. For instance, of the 2.2 million patients who have been screened by Cologuard, nearly half of those may have been screening for colorectal cancer for the first time (based on a study conducted by Exact Sciences that surveyed Cologuard users), indicating Exact Sciences strategy is panning out favorably (at least to some degree). Exact Sciences went from performing 40,000 Cologuard tests in the first quarter of 2016 to over 330,000 tests in the first quarter of 2019, and there’s room to keep growing.

Image Shown: Exact Sciences has seen tremendous growth in the number of healthcare providers prescribing its stool tests, which has been increased usage of Cologuard. Image Source: Exact Sciences – IR Presentation

Exact Sciences’ growing network combined with the enormous market opportunity for Cologuard has led to a sharp increase in total tests performed by the company. That’s just the tip of the iceberg, as Exact Sciences sees 87 million Americans as being potential patients when measured as those between the ages of 50-85 who have an average risk of colorectal cancer. Assuming the healthcare company is reimbursed $500-$525 for each test, Exact Sciences sees Cologuard addressing what could be a $15.0 billion market. Rising test volume has directly translated into strong revenue growth and rising gross margins over the past three years, which we will cover later on.

Image Source: Cancer screening represents an enormous market for Exact Sciences’ Cologuard offering. Image Source: Exact Sciences – IR Presentation

When including the possibility that prospective patients between the ages of 45-49 start getting screened for colorectal cancer in significantly larger numbers, the size of this addressable market rises to $18.0 billion in Exact Sciences’ view. The company also has its eyes on the liver cancer screening business and reported promising results on that front in 2018, keeping in mind this is a long-term opportunity for Exact Sciences. Beyond liver and colorectal cancer screenings, Exact Sciences hopes to make headway in screening for other types of cancer as well. When dealing with cancer, catching it early on usually provides patients with a greater amount of treatment options and those options generally have much higher chances of success. Exact Sciences is working with the Mayo Clinic to advance and improve on these concepts.

In order to support this growth trajectory, Exact Sciences started building a second laboratory in Madison, Wisconsin, which should be operational by the middle of this year. While its first laboratory could process 3 million tests per year, both labs combined will be able to process up to 7 million tests per year. Reportedly, the company is seriously considering moving forward with a third laboratory. That laboratory may be used to support Exact Sciences’ future offerings and products that are currently under development.

To further bolster its sales growth and the Cologuard offering more broadly, Exact Sciences teamed up with Pfizer Inc (PFE) last year (from Exact Sciences’ 2018 10-K):

“We are focused on strengthening our Cologuard core business by increasing the size of our nationwide salesforce. We advanced this goal in August 2018 by entering into a Promotion Agreement with Pfizer. Under the terms of the Promotion Agreement, Pfizer will promote Cologuard and provide certain sales, marketing, analytical and other commercial operations support services. We and Pfizer committed in the Promotion Agreement to invest specified amounts in the advertising and promotion of Cologuard. We agreed to pay Pfizer a service fee based on incremental gross profits over specified baselines and pay Pfizer royalties for Cologuard related revenues for a specified period after the expiration or termination of the Promotion Agreement. The initial term of the Promotion Agreement runs through December 31, 2021, but may be terminated by either party at any time on or after February 21, 2020 upon six months’ written notice to the other party.”

While Exact Sciences’ growth trajectory looks very promising in our view, that doesn’t mean this story isn’t without a great amount of risk. For starters, Exact Sciences is heavily dependent on reimbursements from the government (namely Medicare) and while stool tests are less invasive compared to other cancer screening options, there is always the chance better technology comes along and disrupts the space. How a fundamental change in America’s healthcare landscape (i.e. Medicare for All or even the completion socialization of most of the healthcare sector) would impact Exact Sciences is nearly impossible to pin down. Most importantly, the company isn’t profitable and is very free cash flow negative,indicating Exact Sciences will need to keep tapping capital markets for funds for the foreseeable future.

Covering the Financials

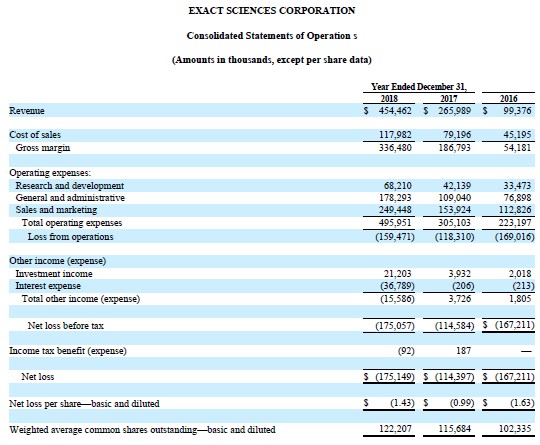

Below is a look at Exact Sciences income statement over the past three full years. As you can see, the company isn’t profitable even thought its revenue and gross margin have expand nicely during the observed period. From 2016 to 2018, Exact Sciences’ revenue climbed by 457% to $454 million while its GAAP gross margin soared from 54.5% to 74.0%, culminating into a 621% jump in its gross profit which hit $336 million last year. As that indicates Exact Sciences business model could be scalable, unlike an Uber Technologies Inc (UBER) or Lyft Inc (LYFT) where greater sales tend to lead to greater losses, the company’s growth story is one built on stronger foundations. This hasn’t translated into a material reduction in the firm’s operating losses as its R&D, G&A, and sales & marketing expenses all shot up during the observed period.

Image Shown: Exact Sciences’ business model is scalable but still not profitable. Image Source: Exact Sciences – 2018 10-K

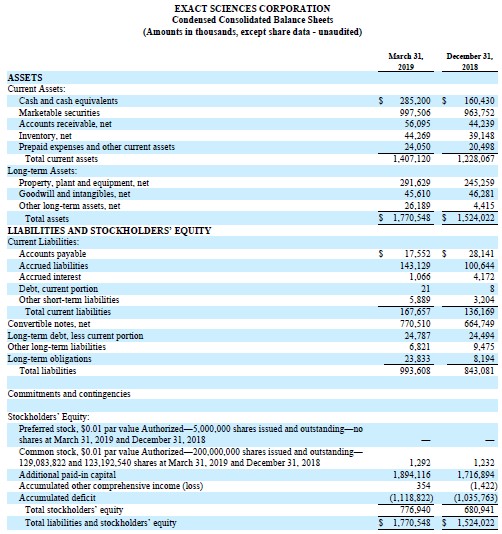

At the end of March 2019, Exact Sciences had ~$1.3 billion in cash & cash equivalents plus marketable securities. Stacked up against a negligible amount of long-term debt due within a year, $0.8 billion in convertible notes, and a very minor amount of long-term debt, Exact Sciences’ net cash position of ~$0.5 billion will help cover its probable outspend for several more years.

Image Shown: Exact Sciences had a nice net cash position of $0.5 billion at the end of March 31, 2019. Image Source: Exact Sciences – 10-Q for the first quarter 2019

From 2016 to 2018, Exact Sciences generated -$90 million (negative $90 million) in net operating cash flow. The company’s capital expenditures (defined as ‘purchases of property and equipment’) averaged $71 million during this period, however, note that Exact Sciences spent $150 million on capex in 2018 to fund its expansion programs (including construction on the second laboratory in Wisconsin). Using its average negative free cash flow generation (net operating cash flow less capex) of $161 million over the past three years as a guide, Exact Sciences’ net cash position at the end of the first quarter of 2019 would last for about three years. Equity issuance has been useful in keeping Exact Sciences afloat, which is why its diluted share count has steadily risen over the past few years. Additional debt issuance is also possible.

Concluding Thoughts

While we appreciate Exact Sciences growth story and appreciate that its business model appears very scalable, this isn’t the type of company we would normally like. Exact Sciences’ net cash balance and growth story are great, its negative free cash flow generation not so much, and that picture isn’t likely to change in the medium term. Any investment in Exact Sciences is highly speculative, and keep in mind that its entire business rests on one offering as things stand today. If anything adverse were to happen to Exact Sciences’ Cologuard business, that could potentially pose an existential threat to the firm’s ability to continue operating. Though EXAS stock has performed very well since 2016, the risk-reward trade off isn’t great as things stand today, with shares now having zoomed from the single-digits in 2016 to roughly $105 per share as of this writing.

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.