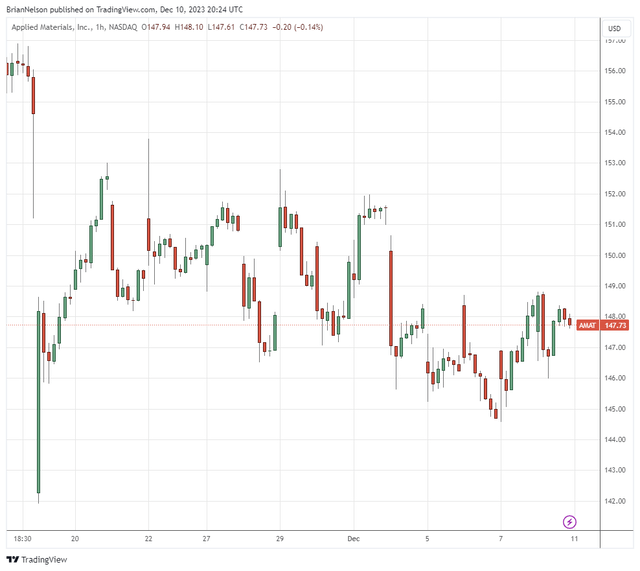

Image: Applied Materials’ shares faced considerable pressure November 17 as news that it had violated export restrictions to China came to light.

On November 16, Reuters reported that Applied Materials (AMAT) allegedly evaded export restrictions by shipping hundreds of millions of dollars of equipment to a subsidiary in South Korea before sending it to China’s biggest chipmaker SMIC. This alleged miscue falls under the Governance [G] category of ESG investing, and shares of Applied Materials have yet to recover from the aggressive sell-off it experienced during the trading session November 17. Though the results of the Department of Justice investigation are still pending, this is quite the black eye for Applied Materials, and we view this as a serious infraction given the U.S.’s stated efforts to keep advanced chips and chipmaking equipment out of China for national security reasons. We’re keeping a close eye on this story, as further news regarding the matter comes to light.

———-

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, QQQ, SCHG, and RSP. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.