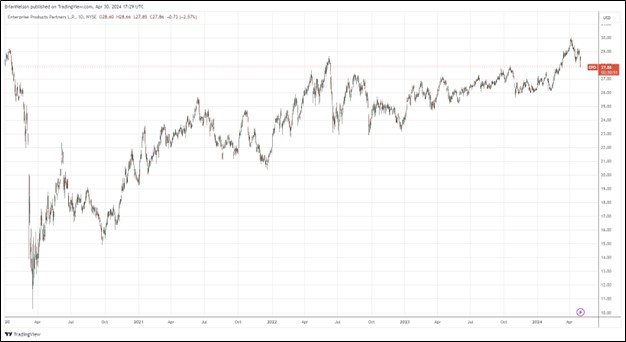

Image: Enterprise Products Partners has come back nicely since the doldrums of the COVID-19 meltdown.

By Brian Nelson, CFA

On April 30, Enterprise Products Partners (EPD) reported decent first-quarter 2024 results. Net income grew to $0.66 per diluted unit, up 5% compared to the $0.63 per diluted unit it put up during the first quarter of 2023. Distributable cash flow [DCF] came in at $1.9 billion for the first quarter of 2024, about the same as it was in last year’s quarter. The company’s DCF covered its distributions declared in the first quarter by 1.7x. The pipeline giant continues to buy back units, having used roughly half of its authorized $2 billion buyback program.

Management had a lot to say about the quarterly results:

Enterprise began 2024 with another strong quarter. Our integrated system of energy infrastructure transported 12.3 million equivalent barrels per day of NGLs, crude oil, petrochemicals, refined products and natural gas, while our marine terminals handled a record 2.3 million barrels per day of hydrocarbons in the first quarter of 2024. The partnership’s total gross operating margin for the first quarter of 2024 was $2.5 billion, a 7 percent increase compared to the first quarter of 2023. Our earnings growth in the first quarter of 2024 was primarily driven by contributions from new assets placed into service during the second half of 2023 in our NGL Pipeline & Services segment, a 17 percent increase in net marine terminal volumes attributable to growing international demand for U.S. energy, and higher sales volumes and margins in our octane enhancement business.

The partnership generated $1.9 billion in DCF during the quarter, which supported a 5 percent increase in cash distributions to partners compared to the same quarter last year. We reinvested $786 million of DCF to fund organic growth investments and buybacks.

We’ve never been huge fans of pipeline master limited partnerships [MLPs], but Enterprise Products Partners has been executing well. We also like the transparency it provides with respect to adjusted cash flow from operations and adjusted free cash flow, the latter coming in at $1.08 billion for the three months ended March 31. Units yield ~7.2% at the time of this writing and remain key exposure to the midstream space within the High Yield Dividend Newsletter portfolio.

—–

NOW READ: 12 Reasons to Stay Aggressive in 2024

NOW READ: 2023 Was a Fantastic Year! Are You Ready for 2024?

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.