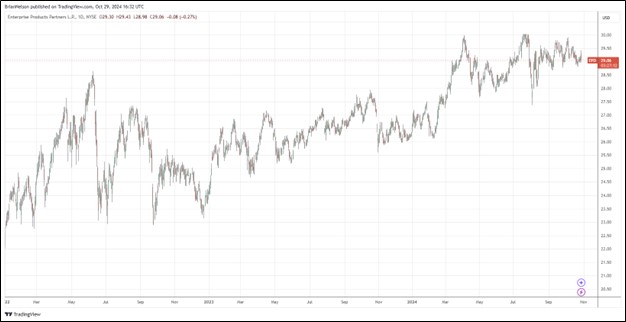

Image: Enterprise Products Partners’ units have done well the past couple years.

By Brian Nelson, CFA

On October 29, Enterprise Products Partners (EPD) reported third quarter results that came in slightly lower than expected. The midstream energy company reported net income attributable to common unitholders of $1.43 billion, or $0.65 per diluted unit, reflecting an 8% increase versus the $1.35 billion ($0.60 per diluted unit) it recorded in the third quarter of last year. Management had the following to say about the quarter:

Enterprise reported another strong quarter as recently completed organic growth assets generated new sources of earnings and cash flow. Operationally, we set 5 volumetric records including 7.5 billion cubic feet per day of inlet natural gas processing volumes and 12.8 million BPD of total equivalent pipeline volumes. This activity contributed to an 8 percent increase in earnings per common unit and a 5 percent increase in distributable cash flow, which supported a 5 percent increase in the partnership’s cash distribution declared for the third quarter compared to a year ago.

Enterprise bought back $76 million of its common units during the third quarter, bringing the total to $156 million during the first nine months of the year. It still has roughly $0.9 billion remaining on its authorized $2.0 billion common unit share repurchase program. Adjusted cash flow from operations came in at $2.1 billion, up from $2 billion in the year-ago period, while adjusted free cash flow came in at $943 million, down from $1.2 billion in last year’s quarter.

Enterprise’s distributable cash flow [DCF] was $1.96 billion for the third quarter, up 5% from the $1.87 billion it registered in the same period a year ago. Distributions during the third quarter increased 5% to $0.525 per common unit, with DCF providing 1.7x coverage of the distribution declared for the third quarter. The midstream energy company expects organic growth capital investment for 2025 in the range of $3.5-$4 billion to reflect opportunities in the Permian Basin and with its acquisition of Piñon Midstream. Our fair value estimate of Enterprise Products Partners stands at $30 per share. Units yield 7.2% at the time of this writing.

—–

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.