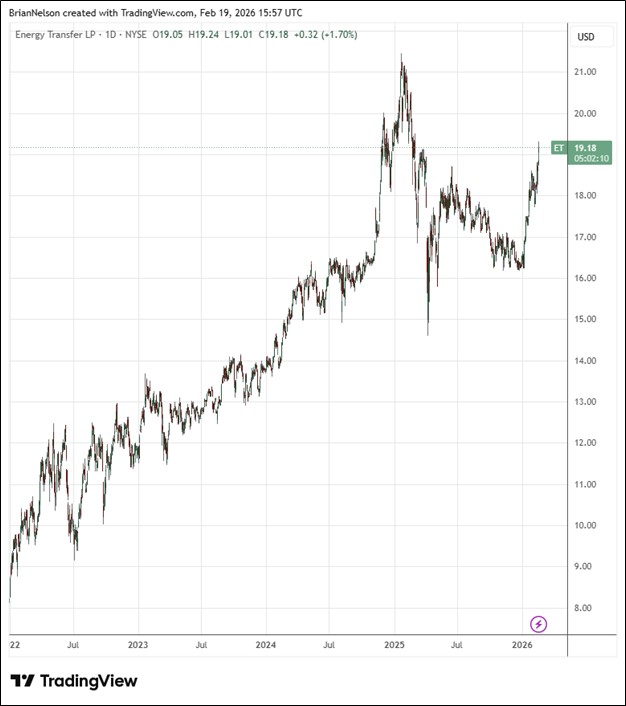

Image Source: TradingView

By Brian Nelson, CFA

On February 17, Energy Transfer (ET) reported mixed fourth quarter results with revenue beating expectations, but GAAP earnings missing the consensus forecast. Net income for the three months ended December 31, 2025, was $928 million, down from $1.08 billion for the same period last year. Adjusted EBITDA for the quarter was $4.18 billion, however, up 8% from the year-ago period. Distributable cash flow for the quarter was $2.04 billion compared to $1.98 billion for the same period last year. Growth capital spending in the fourth quarter was $1.4 billion, while maintenance capital spending was $355 million.

Energy Transfer’s volumes continued to expand in the fourth quarter. NGL and refined product terminals volumes were up 12%, NGL transportation volumes increased 5%, and NGL fractionation volumes set a new partnership record, up 3%. NGL exports were up 12%, crude oil transportation volumes set a new partnership record, up 6%, while midstream gathered volumes were up 4%. Interstate natural gas transportation volumes were up 4%, while intrastate natural gas transportation volumes were up 3%.

Energy Transfer benefits from a portfolio of assets with exceptional product and geographic diversity. The Partnership’s multiple segments generate high-quality, balanced earnings with no single business segment contributing more than one-third of the Partnership’s consolidated Adjusted EBITDA for the three months or full year ended December 31, 2025. In addition, Energy Transfer generates approximately 40% of its Adjusted EBITDA from natural gas-related assets. The vast majority of the Partnership’s segment margins are fee-based and therefore have limited commodity price sensitivity.

In January 2026, Energy Transfer announced a quarterly cash distribution of $0.335 per common unit, which is an increase of more than 3% from the fourth quarter of 2024. At the end of the year, the partnership had $2.12 billion of available borrowing capacity on its revolving credit facility. Energy Transfer raised its 2026 adjusted EBITDA guidance to the range of $17.45-$17.85 billion, compared to a previous range of between $17.3-$17.7 billion. The revision is solely attributable to USA Compression’s acquisition of J-W Power Company, which closed on January 12, but we like the trajectory. Growth investment of $5-$5.5 billion is expected for 2026. Units yield 7.1% at the time of this writing.

—–

Brian Nelson owns shares in SPY, SCHG, QQQ, QQQM, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, QQQM, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, QQQM, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.