Image Source: Encana third-quarter presentation

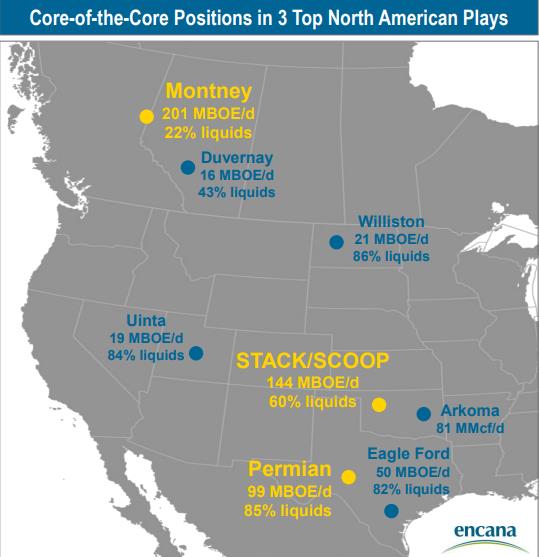

Encana already holds a nice presence in some of the most attractive oil-producing regions in North America, and its merger agreement with Newfield Exploration should only add to its appealing portfolio of unconventional plays.

By Callum Turcan

Encana Corporation (ECA) is a growing upstream oil & gas producer with operations in Canada and the United States. The firm’s two biggest targets in Canada are the Duvernay and Montney shale plays, and in the US, Encana is primarily focused on developing the Permian Basin and Eagle Ford plays. What all four of these regions have in common is they yield wells with a high-liquids production mix, allowing Encana to directly capitalize on the uneven and wobbly recovery in the West Texas Intermediate benchmark.

The Eagle Ford and the Permian Basin are arguably the two most economical unconventional upstream plays in North America, and possibly the world, according to McKinsey Energy Insights. While the Duvernay and Montney are receiving increasing amounts of interest from upstream players big and small, they aren’t on par with their American peers just yet. The only other unconventional upstream play that truly competes with the Eagle Ford and the Permian Basin on an economical basis is the STACK play in Oklahoma, and Encana only recently decided to make a move in the region.

Encana Purchases Newfield

Encana recently agreed to acquire Newfield Exploration Co (NFX) in an all-stock deal valued at roughly $5.5 billion that will result in Encana exchanging ~2.7 of its own shares for each outstanding share of Newfield Exploration. Encana will also assume Newfield’s $2.2 billion in net debt.

Listed in order of importance, Newfield Exploration’s area of operations include the Anadarko Basin in Oklahoma, the Williston Basin (home to the Bakken shale play) in North Dakota, the Uinta Basin in Utah, the Arkoma Basin in Oklahoma, and the Pearl development in the South China Sea. In its most important position in the Anadarko Basin, Newfield owns the lease on ~360,000 net acres in the area, plenty of which is prospective for the prolific Meramec and Woodford oil plays. The majority of Newfield’s Anadarko Basin acreage is located in the STACK (Sooner Trend, Anadarko Basin, Canadian County & Kingfisher County) region, with the remainder located in the Tier 2 SCOOP play.

Tier 1 STACK acreage, meaning acreage that is home to the most prolific and economical Meramec and Woodford well locations, is centered around Oklahoma’s Kingfisher, Blaine, and Canadian counties. Tier 2 opportunities are located in nearby Dewey and Major counties. What makes this acreage important is that it can offer some of the strongest returns in the shale patch. According to McKinsey Energy Insights, the breakeven oil price (measured by the West Texas Intermediate benchmark) required for wells in the STACK region ranges from $28-$39 per barrel. Where that acreage is located and what formation is being targeted is the key differentiator.

It isn’t entirely clear how many rigs Newfield Exploration is running in the Anadarko Basin, as that wasn’t disclosed during its brief third-quarter conference call. Based on past updates, it appears Newfield is currently running close to 11 rigs in the Anadarko Basin. This represents the bulk of its total drilling activity as the Anadarko basin accounted for just over 72% of Newfield’s domestic production in the third quarter.

As oilfield services and labor costs rise, that puts upwards pressure on LOE (lease operating expenses, the cost of producing oil & gas from a well) and DD&A expenses (the cost of drilling and completing a well). Transportation and processing expenses per barrel of oil equivalent (BOE) tend to move lower as an upstream player grows its production base. As additional pipeline takeaway capacity is added to the STACK region and the Permian Basin, additional pressure should be applied to Encana’s pro forma transportation and processing per BOE expenses.

When it comes to general and administrative expenses per BOE, two key factors are at play in the case of Encana. Corporate-level synergies from the merging of the two companies will be created from redundancies, among other integration-related simplifications, and a rising production base tends to put downward pressure of G&A spend per BOE as output rises at a faster pace than expenses. The scalability of corporate-level spending is an easy concept to grasp, especially compared to other expenses such as the labor necessary to discover and extract resources and transportation costs needed to take resources to market, both of which can be influenced by a number of factors.

Though expenses can also be volatile in the E&P space, perhaps the most difficult aspect in evaluating upstream entities is the inherent uncertainty surrounding price realizations, which is a function of both macro market forces and regional pricing differentials. While the former can be influenced by any number of factors that impact global energy resource pricing, the latter is often a product of the supply/demand profile of local or regional pipeline takeaway activity.

The Encana-Newfield merger will result in modest corporate-overhead and operational cost savings via synergies and economies of scale–the to-be-combined entity expects $250 million in annual synergies through greater scale, cube development, and overhead savings–but the real prize is having so many Tier 1 unconventional plays under one roof. Encana Corporation has an enormous growth runway in the most prolific and economical unconventional plays in America: the Permian Basin, the Eagle Ford, and now the STACK.

In addition, we like the operating flexibility having such attractive positions in a number of regions provides Encana. If pricing differentials in one play widens due to pipeline constraints (meaning oil & gas produced in a certain area starts selling for materially less than the WTI/Henry Hub benchmarks unless that output can reach out-basin markets), as has been the case in the Permian Basin, Encana Corporation can allocate capital elsewhere to ensure it is receiving the best realizations possible.

What We’re Thinking

We liked Newfield a lot and we were just about ready to highlight the company as an idea for consideration a few days before the Encana deal was announced. Almost by default, Encana is on our radar. We currently have exposure to the energy sector through the Energy Select Sector SPDR (XLE), and we’re comfortable with that for now. The volatility of energy resource prices has stepped up in recent weeks, and if we see something that stands out, we’ll get that in front of you right away. In any case, Encana is one for the radar.

Oil & Gas – Independent: APA, APC, CHK, CLR, COG, DNR, DVN, EOG, EQNR, MRO, NBL, OXY, PXD, RRC, SWN

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.