Let’s talk about our views on Amazon, Facebook, Honeywell, PayPal, and Visa. We think Facebook’s equity offers the biggest bargain, but Visa remains our top idea, as it has been for some time.

By Brian Nelson, CFA

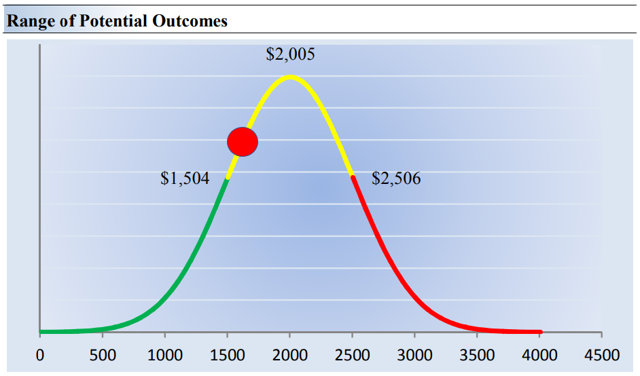

Amazon’s Shares Are Trading Below Our Fair Value Estimate But Sensitivity to Assumptions Is Great

Image shown: The probability distribution of our fair value estimate range for Amazon. The company is trading below our fair value estimate of ~$2,000, but above the low end of the fair value estimate range of ~$1,500. We think shares are fairly valued if they are trading on the yellow line. Amazon’s fair value estimate is very sensitive to its operating margin.

Here are the three things that you need to know about Amazon (AMZN). First, the company’s equity value is significantly sensitive to its mid-cycle operating margin. Only a very modest change in profitability can have a large impact on our estimate of its equity value. This is primarily why we don’t include the company in the simulated Best Ideas Newsletter portfolio. Even if we’re wrong by just a little bit, it could mean that we’re wrong by a lot when it comes to the fair value estimate. This is the nature of Amazon’s business model, for better or worse. The company has tremendous earnings leverage.

Second, despite the fair-value sensitivity of its equity, Amazon has become a veritable cash-flow-generating machine. In its fourth-quarter report, released January 27, the company’s free cash flow advanced to $19.4 billion for the trailing 12 months ended December 2018 compared to $8.3 billion for the trailing 12 months ended December 2017. This is extraordinary growth in a metric that matters considerably to intrinsic value. However, when it comes to valuation, it is not so much about growth as it is about growth in excess of expectations, that which causes valuation revisions. In that respect, Amazon is in-line with what we believe to be reasonable expectations.

Third, it’s important you’re aware of some of the news flow surrounding the name. You may have already heard about CEO Jeff Bezos’ divorce, but we don’t think shareholders have much to worry about from this personal event. Second, there appears to be some hiccups in Amazon’s expansion efforts in India, but as with many global companies, we would expect Amazon to work with local policymakers to find an amicable solution that benefits all parties. We’re focused on the long term, not on policy that may impact performance in the next few years. Finally, Amazon is making some in-roads with respect to its own advertising, and while Amazon Web Services (AWS) remains a cash-cow, the online advertising market remains robust amidst a strong economic backdrop.

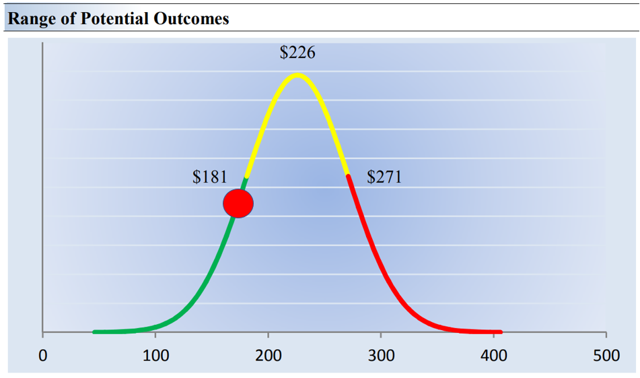

Facebook’s Shares Look Incredibly Cheap, Stock on the Move

Image shown: The probability distribution of our fair value estimate range for Facebook. Very few stocks are as cheap as Facebook is today. The company continues to be beaten down by negativity surrounding how it handles consumer data, but on a cash-basis, its shares offer long-term investors a bargain, in our view.

Not all is bad at Facebook (FB). Remember, a company’s value is not sentimental. Whether you love or hate what Facebook is doing, it is cash that forms the basis of intrinsic value, whether it is net cash on the balance sheet or future expectations of enterprise free cash flows. We know Facebook has made some mistakes, but when it comes to evaluating price versus estimated intrinsic value, very few companies offer this level of a disconnect. We think shares of Facebook are extremely cheap at the moment, and our fair value estimate stands at $226 per share.

The social media behemoth reported fourth-quarter results January 30, and they certainly weren’t bad by any stretch (in our opinion, they were actually quite good). Total revenue advanced 30% in the quarter on a year-over-year basis, while net income soared more than 60%. The company’s operating margin came in at 46%. We’re currently modeling in 20% compound annual growth on the top line and an average operating margin of ~37% over the next five years, and this is what we are using to arrive at our fair value estimate.

A range of fair value outcomes considers a scenario with respect to contingent liabilities, too. Hypothetically, even if contigengent legal liabilities related to alleged data misuse amounted to a whopping $100 billion, shares of Facebook would still be cheap! The company remains 10-rated on the Valuentum Buying Index and among the top “weightings” in the simulated Best Ideas Newsletter portfolio. It’s going to stay that way for some time. We think Facebook may once again challenge new highs.

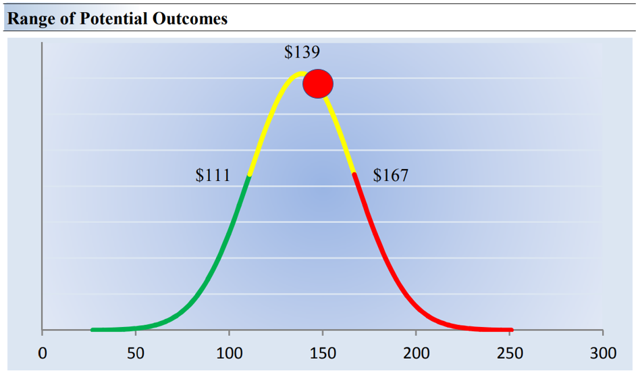

Honeywell Has Great Backdrop in Aerospace, Not Too Pricey and Strong Dividend

Image shown: The probability distribution of our fair value estimate range for Honeywell. Honeywell is one of our favorite industrials, now that GE has headed south. The company’s aerospace exposure is fantastic, but its shares are pricing in a lot of the good news.

There’s a whole bunch to like about Honeywell (HON). The company released fourth-quarter results February 1, and they had some noise in them due to spin-offs, but otherwise were quite solid. On an organic basis, revenue advanced 6%, while adjusted earnings per share leapt 12%, excluding spin-offs. For the full year, adjusted free cash flow advanced 2%, reflecting a conversion rate of 100% from net income, and management remained optimistic about sales, margin and cash flow growth in 2019 after its business transformation (it spun off Transportation Systems and its Homes and ADI Global Distribution businesses).

We continue to be huge fans of Honeywell, particularly its long-cycle commercial businesses, namely commercial aerospace, U.S. defense, and warehouse automation. The company’s commercial aerospace division is stacked with orders as the backlogs at the airframe makers Boeing (BA) and Airbus (EADSY) remain full. Honeywell’s management noted that its long-cycle orders and backlog advanced 15% during 2018. We fully expect the company to capitalize on the strength of order trends, and at higher levels of profitability. Segment margin expansion is running ahead of internal targets.

Here’s what the company had to say about its 2019 outlook:

Honeywell expects sales of $36.0 billion to $36.9 billion, representing organic sales growth of 2 to 5 percent; segment margin expansion of 110 to 140 basis points, or 30 to 60 basis points excluding the favorable impact of the 2018 spin-offs; earnings per share of $7.80 to $8.10; operating cash flow of $5.9 billion to $6.5 billion and adjusted free cash flow of $5.4 billion to $6.0 billion, representing conversion of approximately 100 percent.

We are strongly considering Honeywell for addition to the simulated Dividend Growth Newsletter portfolio. Though the simulated newsletter portfolio is currently “fully invested,” we could swap Honeywell with another equity should we grow even more excited about its commerical aerospace prospects, which have only grown stronger in years past. Honeywell’s Dividend Cushion ratio stands at 2.3, and the company yields ~2.3% at the time of this writing. Not bad at all.

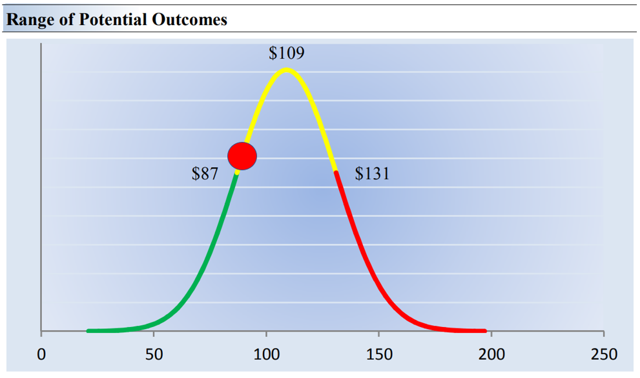

PayPal’s Shares Still Have Upside In Our View

Image shown: The probability distribution of our fair value estimate range for PayPal. We continue to like shares of PayPal and view it as a stealth way to play cryptocurrency, as well as the proliferation of e-commerce, which while growing fast, still remains in its infancy around the globe.

PayPal’s (PYPL) shares have come in a bit after releasing its fourth-quarter results January 30. On the whole, the performance during the quarter wasn’t bad. Quarterly GAAP revenue growth didn’t quite come in on par with its full-year run rate, but it still grew at a mid-teens clip (14% on a non-GAAP basis). Non-GAAP earnings per share also advanced nicely, a 26% year-over-year rate in the quarter, to $0.69. During the fourth quarter of 2018, PayPal added 13.8 million active accounts, which was significantly better than the 8.7 million it added in the same period a year ago. Payment transactions were up 28%, while total payment volume increased 25% on a foreign-exchange neutral basis, both year-over-year comparisons. 2018 was a solid year for PayPal.

Here’s what PayPal had to say about its outlook for 2019:

PayPal expects revenue to grow 16-17% at current spot rates and 16-17% on an FX-neutral basis, to a range of $17.85-$18.1 billion. As previously disclosed, full year 2019 revenue growth guidance includes an expected decline of approximately 3.5 percentage points for full year 2019 related to the sale of U.S. consumer credit receivables to Synchrony.

PayPal expects GAAP earnings per diluted share in the range of $1.83-$1.93 and non-GAAP earnings per diluted share in the range of $2.84 – $2.91.

Estimated non-GAAP amounts above for the twelve months ending December 31, 2019, reflect adjustments of approximately $1.30-$1.40 billion, primarily representing estimated stock-based compensation expense and related payroll taxes in the range of $1.05-$1.11 billion.

Estimated GAAP and non-GAAP results include approximately 1.5 points of revenue growth and $0.08 to $0.10 of dilution from the acquisitions that closed in 2018.

The stock traded off as a result of its outlook for 2019, but it wasn’t poor by any stretch. Revenue growth looks to be solid, and non-GAAP earnings growth is targeted at a 20% clip at the high end of the range from last year’s levels ($2.42). All appears to be healthy at PayPal, and we think the company offers a compelling proposition for those seeking e-commerce exposure. We have retained the company in the simulated Best Ideas Newsletter portfolio ever since its spin-off with eBay (EBAY) some years ago.

Visa Continues to Be a Top Performer

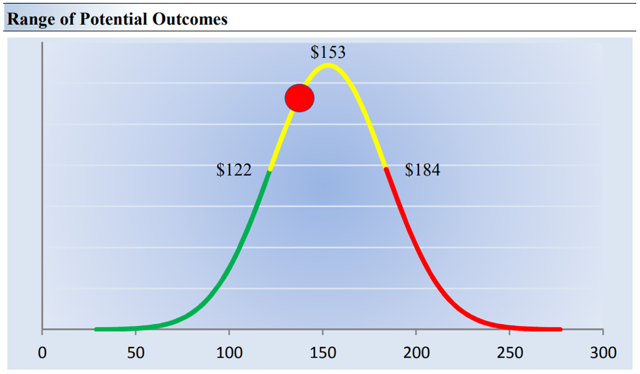

Image shown: The probability distribution of our fair value estimate range for Visa. We like Visa the most. It is our top idea, and we think 2019 is shaping up to be a fantastic year for the equity after a very strong 2018.

Visa (V), hands-down, is one of the best companies on the planet. It remains one of the “highest-weighted” equities in the simulated Best Ideas Newsletter portfolio, and its share-price performance during 2018 was simply awesome while most of the market swooned. The company offers a compelling way to play the secular trend toward a cashless society, and its operating margins are simply through the roof. If you asked us to name one company that we like the most, Visa would be it.

The credit card processing giant reported solid fiscal first-quarter results January 30 that reflected 13% top-line growth and 20% earnings-per-share expansion on a year-over-year basis, despite what management characterized as “an uncertain geopolitical environment.” Payments volume leapt 11%, cross-border volume increased 7%, while processed transactions advanced more than 10%. During the quarter, management returned $2.9 billion in capital in the form of share repurchases and dividends, while the board authorized a new $8.5 billion share-repurchase program.

Here’s what Visa had to say about its outlook for the remainder of fiscal 2019:

Annual net revenue growth: Low double-digits on a nominal basis, with approximately 1 percentage point of negative foreign currency impact and de minimus impact from the new revenue accounting standard

Client incentives as a percentage of gross revenues: 22% to 23% range

Annual operating expense growth: Mid-single digit decrease on a GAAP basis and mid-to-high single digit increase adjusted for special items in fiscal 2018 (see note below). GAAP and non-GAAP growth includes an approximately 1.5 to 2 percentage point increase from the new revenue accounting standard

Effective tax rate: 20.0% to 20.5% range

Annual diluted class A common stock earnings per share growth: High teens on a GAAP nominal dollar basis and midteens on an adjusted, non-GAAP nominal dollar basis (see note below). Both include approximately 1 percentage point of negative foreign currency impact

If you haven’t yet considered Visa as an idea, it is one of our favorites–and has been for years. Its business model is just too difficult to pass up, in our view. Visa gets paid every time someone swipes one of their cards, and it doesn’t take on the credit risk of its customers, unlike American Express (AXP) and Discover (DFS). We continue to see upside to Visa on the basis of our fair value estimate.

——————–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Brian Nelson does not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.