Image Source: Cisco

Let’s cover some ground on Cisco’s (CSCO) calendar third-quarter report, its first quarter of fiscal 2017.

By Brian Nelson, CFA

What management said:

“We had a good quarter despite a challenging global business environment and we performed well in our priority areas,” said Chuck Robbins, CEO, Cisco. “We are leading our customers in their digital transition by providing them with highly secure, automated, and intelligent solutions in the ways they want to consume them. Our innovation pipeline is robust and we are well positioned for the future.”

“We executed well in Q1 delivering profitable growth, and saw strong adoption of our subscription-based and software offerings as we transition our business to a more recurring revenue model,” said Kelly Kramer, CFO, Cisco. “We will invest in key growth areas and continue to focus on delivering shareholder value.”

The scoop:

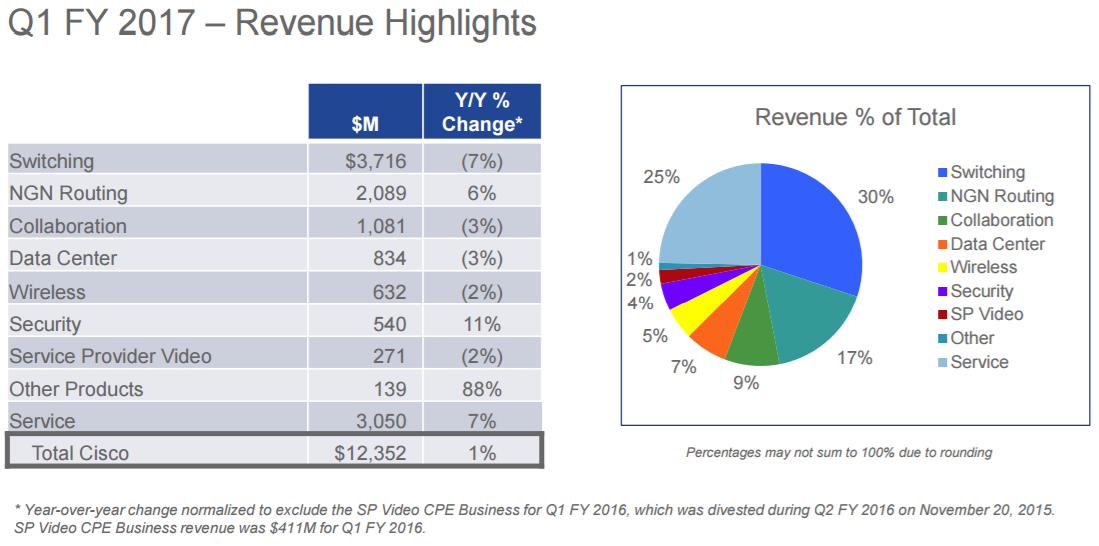

Cisco’s first-quarter 2017 results, released November 16, were mixed. The pace of revenue growth came in in-line with management’s guidance for the period, but it wasn’t robust by any stretch at ~1% expansion year-over-year. ‘Security’ and NGN Routing’ were areas of strength, but weakness across the rest of its portfolio, including ‘Switching’ and ‘Data Center’ proved to be stiff headwinds to top-line growth. A pause in enterprise spending due to macroeconomic uncertainty and a market shift from “Blade to Rack” were the culprits, respectively.

Cisco’s gross profit trends were encouraging as productivity improvements and its divestiture of its SP Video CPE Business drove product gross margin 250 basis points higher in the period (non-GAAP gross margins also increased). The better levels of gross profitability, however, didn’t translate into significant bottom-line growth, however, as net income dropped 4%, a rate that matched the decline in GAAP diluted earnings per share. On a non-GAAP basis, excluding its SP Video CPE Business, net income did advance 3% as GAAP operating measures were weighed down by lofty restructuring charges, including headcount reductions.

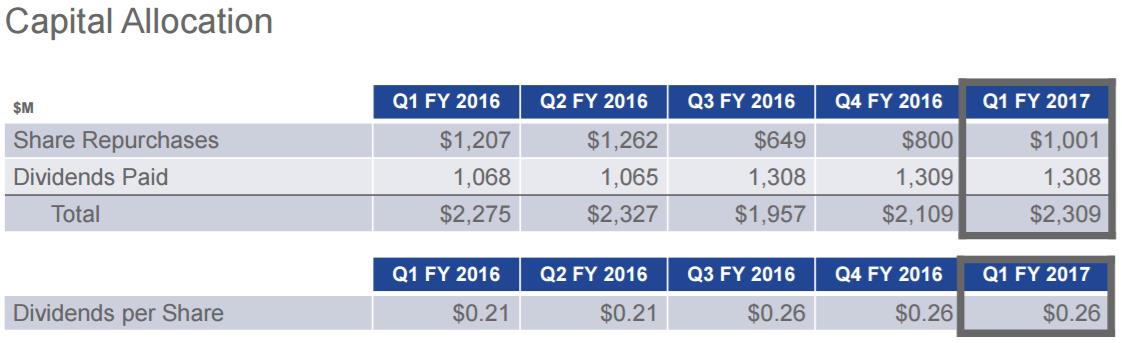

The networking giant’s cash flow from operations remained robust at $2.7 billion during the quarter, and it ended the period with $71 billion in cash and cash equivalents on hand, speaking to its incredible financial strength and dividend-paying power. Cisco’s shares faced selling pressure following the quarterly release, however, as a result of a rather muted outlook for the current quarter. Revenue for the second period of its fiscal 2017 is expected to fall at a 2%-4% annual pace, with non-GAAP earnings per share coming in at $0.55-$0.57, both modestly below consensus forecasts at the time.

Insight from the quarterly conference call:

“Let me review a few areas of our business where our innovation is driving momentum. First security; our security revenue grew 11% marking the 4th consecutive quarter of double-digit growth. We’re driving more subscription based recurring business resulting in deferred revenue growth of 39%. Our competitive position in security is growing stronger as our integrated architecture approach and best-of-breed portfolio resonates with our customers. In fact, we’re the only company with security product revenue exceeding $2 billion annualized run rate with double-digit growth.” – CEO Chuck Robbins

“Second, our next generation data center. Our goal is to build the best private and hybrid cloud solutions for our customers. We’re investing heavily in our data center portfolio to extend our market leadership. To do this, we’re delivering software, hardware and systems at all levels of the data center stack and across delivery models. Our customers widespread adoption of Cisco ASI family of data center networking products continued in Q1 with revenue growth of 33% to an annualized revenue run rate now of $3 billion.” – CEO Chuck Robbins

Are we changing our mind with our position?:

Image Source: Cisco

No. Cisco’s balance sheet remains incredibly robust, and policy changes with respect to the tax code on repatriated cash would only play into a better market price for Cisco as participants give it greater credit for its net cash position on the books. The company remains committed to growing the dividend, regardless of the interest rate environment, and while we weren’t happy with the modest outlook for the current quarter, management may be taking a more conservative approach in light of the election results, which have caught many by surprise. We’re comfortable collecting dividend checks on Cisco – it’s massive net cash position is extremely reassuring. Shares are currently yielding ~3.5%.