By Brian Nelson, CFA

Netflix (NFLX) Lands WWE Raw and Puts Up Huge Streaming Paid Member Number

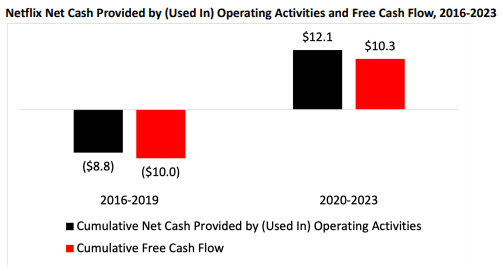

Image: Netflix’s substantially improved free cash flow has made it a clear winner in the streaming wars. Image Source: Netflix.

On January 23, Netflix reported mixed fourth-quarter results that showed a beat on the top line, but a bottom-line miss. The mixed performance, however, was overshadowed by a huge growth number in new global streaming paid memberships of 13.12 million during the quarter and a landmark $5 billion deal with TKO Group (TKO) to begin streaming WWE Raw exclusively on Netflix beginning in January 2025. 2023 was a banner year for Netflix. The company grew revenue 12% (up from 6% last year), pushed its operating margin to 21% (roughly 3 percentage points higher on a year-over-year basis and above its 18%-20% target), while it hauled in free cash flow of $6.9 billion on the year. Looking out to all of 2024, Netflix expects double-digit revenue growth on the year thanks to continued membership growth and improvement in its advertising business. Management expects its 2024 operating margin to be 24% (up from its 22%-23% prior guidance), and we think there is more room for expansion in the coming years as it scales its content costs. Free cash flow is targeted at ~$6 billion in 2024. Netflix is the clear winner in the streaming wars, distancing itself from Disney (DIS) and Paramount+ (PARA), and the company has a long runway of future growth through new members, advertising, games, and further pricing optimization. Netflix’s stock, however, is a bit too risky for the Best Ideas Newsletter portfolio, but we like shares, especially its improved free cash flow generation in recent years.

ASML Holding N.V. (ASML) Hits New 52-Week High on Strong Order Numbers

ASML Holding N.V. is one of the most prolific innovators in the semiconductor industry. The firm provides chipmakers with hardware, software and services to make patterns on silicon with lithography, a vital system in the chip-manufacturing process that increases chip value while lowering costs. The resolution of ASML’s lithography systems contributes to the ever-shrinking nature of transistors and microchips needed for ongoing industry innovation. Smaller and smaller chips save energy, cost and time, and the wavelength of the light used by ASML’s lithography systems can print smaller and smaller features to accommodate required shrink. The company reported fourth quarter results on January 24 that capped off a 2023 that showed 30% top-line growth and GAAP earnings per share of €5.20. The big news in the period was the firm’s fourth-quarter net bookings number, which came in at €9.2 billion, up significantly from the €2.6 billion in the third quarter of 2023. Though sales are expected to be flat during 2024 from 2023 levels, ASML Holding’s backlog of €39 billion (1.4x annual revenue) at the end of the year should translate to continued growth in the years ahead. Management spoke of improved industry end-market inventory conditions and better litho tool utilization levels, as well as significant growth expected in 2025. We liked the quarterly report from ASML, especially its net bookings number, and the company remains one of our favorite ideas in the semiconductor space.

AT&T (T) Issues Disappointing Profit Outlook for 2024; Capital Spending to Be Higher Than Expected

AT&T reported mixed fourth-quarter results January 24 that showed a modest beat on the top line, but a miss versus the consensus forecast on non-GAAP earnings per share. Operating revenue during the fourth quarter expanded 2.2% from the fourth quarter of 2022 due to improvement in its Mobility and Consumer Wireline business, offset in part by weakness in its Business Wireline division. AT&T pointed to Mexico (EWW) as a source of strength. As with Verizon (VZ), AT&T has a huge net debt position due to the capital intensity of its operations in building out infrastructure, making a laser-focus on free cash flow key to any investment proposition. For 2023, the company generated cash flow from operations of $38.3 billion (up $2.5 billion from last year), while capital spending came in at $17.9 billion, exclusive of vendor financing, resulting in free cash flow of ~$20.5 billion on the year, materially higher than what it paid in dividends on the year (~$8.14 billion). Looking to 2024, AT&T guided adjusted earnings per share in the range of $2.15-$2.25, below the consensus forecast of $2.47 at the time, and for free cash flow to decline to the range of $17-$18 billion, as capital spending is expected to increase to the range of $21-$22 billion. We think AT&T’s challenges are far from over, given the earnings weakness and elevated capital outlays, and we think investors should remain cautious. Shares yield ~6.5% at the time of this writing.

Abbott Laboratories (ABT) Strong Pipeline Suggests More Annual Payout Increases for this Dividend King

Dividend King Abbott Laboratories reported decent fourth quarter results on January 24, where modest revenue growth came in better than expectations, while non-GAAP earnings per share came in roughly in-line with the consensus forecast. The company continues to work through declines in COVID-19 testing-related sales, but its underlying base business, which excludes COVID-19 related revenue, advanced 11% in the quarter on a year-over-year basis. Recent performance highlights include Abbott reclaiming its market-leading position in U.S. infant formula, the FDA approval of its new laboratory automation system (GLP systems Track), and “that Tandem Diabetes Care’s (TNDM) t:slim X2 insulin pump is the first automated insulin delivery system in the U.S. to integrate with Abbott’s new FreeStyle Libre 2 Plus sensor.” Management noted that it is excited about the positive momentum behind its productive pipeline and that investors should expect continued growth in 2024 and beyond. In particular, Abbott is targeting full-year 2024 organic sales expansion, excluding COVID-related revenue, of 8%-10%, while full-year adjusted diluted EPS is targeted in the range of $4.50-$4.70, about in-line with the consensus forecast. We like Abbott Labs’ long track record of consecutive dividend increases, and while we generally prefer the Health Care Select Sector SPDR (XLV) for health care exposure (as it offers more “shots on goal” with respect to the sector’s broad based pipelines), Abbott Labs is a strong consideration for the Dividend Growth Newsletter portfolio.

—–

NOW READ: 12 Reasons to Stay Aggressive in 2024

NOW READ: 2023 Was a Fantastic Year! Are You Ready for 2024?

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.