Image Source: Domino’s Pizza Inc – 2022 ICR Conference Presentation

By Callum Turcan

Domino’s Pizza Inc (DPZ) is contending with serious inflationary pressures and headwinds from changing consumer spending habits as the worst of the coronavirus (‘COVID-19’) pandemic fades. We continue to view the firm’s longer term outlook quite favorably and appreciate its franchise-heavy business model (~98% of its stores are franchised), which enables Domino’s to generate substantial free cash flows in almost any operating environment.

Our fair value estimate for Domino’s sits at $517 per share, and we include shares of DPZ as an idea in the Best Ideas Newsletter portfolio. Shares of DPZ yield ~1.3% as of this writing, offering incremental income generation upside potential to its favorable capital appreciation risk-reward scenario, in our view.

In this note, we’ll also talk about another one of our favorite restaurants, Chipotle Mexican Grill Inc (CMG), which reported second quarter results a couple weeks ago. We continue to like Chipotle as an idea in the Best Ideas Newsletter portfolio, too, and value its shares north of $1,750 each (they are trading at ~$1,300 at the time of this writing).

Domino’s Long Term Outlook Is Bright

On April 28, Domino’s reported first quarter earnings for fiscal 2022 (period ended March 27, 2022) that missed both consensus top- and bottom-line estimates as various headwinds are beginning to take a toll. The company noted in its earnings press release that staffing shortages and “unprecedented inflation” along with headwinds from the Omicron variant of the coronavirus pressured its results last fiscal quarter. Looking ahead, Domino’s forecasts that “some of these headwinds are likely to persist further into 2022,” with an eye towards inflationary pressures in particular.

There were some bright spots in Domino’s latest earnings report. Its international same-store sales grew 1.2% year-over-year in the fiscal first quarter, marking the 113th consecutive quarter that Domino’s has grown its international same-store sales. After a banner fiscal 2020 and fiscal 2021, due in part to dynamics created by the pandemic, Domino’s reported that its US same-store sales declined by 3.6% year-over-year last fiscal quarter. Please note that this is off a high base as the firm’s US same-store sales rose by 11.5% in fiscal 2020 and 3.5% in fiscal 2021.

Domino’s reported 3% year-over-year GAAP revenue growth last fiscal quarter as it benefited from opening up 213 net new stores in the fiscal first quarter. As of March 27, Domino’s had over 19,060 stores operating across the world. Its GAAP operating income declined 5% year-over-year last fiscal quarter due primarily to headwinds from inflationary pressures. Looking ahead, Domino’s aims to offset those hurdles through pricing increases such as raising the cost of its “Mix and Match” deal by $1 per item to $6.99 and changes to the propositions of its offerings (such as reducing the number of its carryout chicken wings to eight from ten).

The company’s carryout business is performing quite well. During DPZ’s latest earnings call, management noted that carryout same-store sales in the US were up over 11% year-over-year last fiscal quarter and up 24% versus levels seen in the first quarter of fiscal 2019. Growth in its ticket size and the number of orders supported the firm’s performance on the carryout front according to recent management commentary.

However, its delivery business was facing headwinds from consumers changing their dining habits as other venues opened their doors in the wake of COVID-related lockdown measures easing up. Though Domino’s noted that its delivery ticket size grew, its order count fell last fiscal quarter.

Domino’s is benefiting from its relentless focus on encouraging consumers to order online for both delivery and carryout orders. Management had this to say on the firm’s digital strategy during its latest earnings call (emphasis added):

“As of January 31, our $7.99 national carryout offer is now available online only. This supports a balanced approach of bringing value and a great experience to our customers online and is aligned with our goals of growing the digital carryout business and enhancing the profitability of our carryout orders.

Online carryout orders generate a higher ticket and require a lower cost to serve than phone carryout orders, in addition to driving digital engagement and the opportunity to add members to our loyalty program.Thus far, we are very pleased with the initial results in our carryout business with positive impacts on order counts, ticket, store-level margins, and in particular digital penetration.

During the quarter, we began a strategic campaign to support a transition to online carryout for our customers by offering a $3 tip for each online carryout order.This approach also aims to drive repeat purchases as the tip comes in the form of a coupon that the customer can use on their next order, which must be used the week after the initial purchase.” — Ritch Allison, CEO of Domino’s

Due to its franchise-heavy business model, Domino’s is a stellar free cash flow generator, one of the reasons why we are big fans of its business. The firm generated $66 million in free cash flow during the fiscal first quarter while spending an insignificant amount covering its dividend obligations and $48 million buying back its stock.

One of our biggest concerns with Domino’s is its net debt load, which stood at $4.9 billion (inclusive of short-term debt, exclusive of restricted cash) as of March 27. Domino’s needs to retain access to capital markets to refinance that burden. Its net debt load is primarily a product of its past share repurchases.

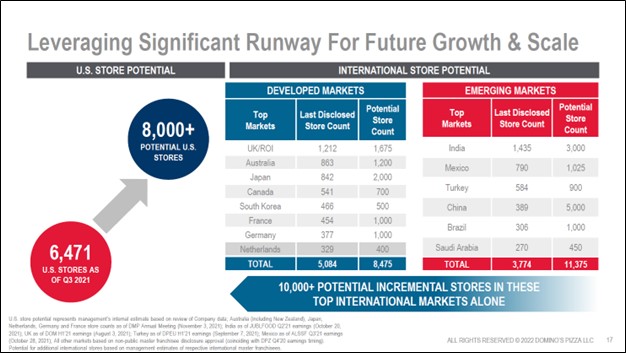

Though it was a difficult quarter for Domino’s, the company’s growth runway remains incredibly bright. The unit economics of Domino’s restaurants are quite appealing and its digital and delivery operations are top-notch, which encourages existing franchisees to expand and new franchisees to join the team. In turn, this underpins the company’s expectations that there is an enormous amount of room to further expand its unit store count in developed and emerging markets across the globe. Expected growth in its unit store count supports our expectations that Domino’s will steadily grow its free cash flows over the coming years and decades.

Domino’s sees room for over 10,000 net new incremental store locations across its 15 core markets!

Image Shown: Domino’s sees room for ample unit store count growth. Image Source: Domino’s – 2022 ICR Conference Presentation

Chipotle Expects Strong Second Quarter Same Store Sales Growth

Another one of our favorite restaurants, Chipotle Mexican Grill Inc, posted 9.0% year-over-year comparable restaurant sales growth in the first quarter of 2022, results released April 26. During Chipotle’s latest earnings call, management noted that in-store sales surged 33% due to the economy opening back up and consumers resuming “normal” dining activities. The firm’s digital sales held up relatively well and represented 42% of Chipotle’s total sales last quarter.

Image Shown: Chipotle’s cash flow statement. The restaurant’s traditional free cash flow generation remains robust. Image Source: Chipotle.

During the second quarter, Chipotle reported 16% year-over-year GAAP revenue growth and 18% year-over-year GAAP operating income growth as the firm effectively took advantage of its pricing power to get ahead of inflationary pressures. The burrito maker also hauled in ~$187 million in traditional free cash flow in the period (image above).

Looking to the second quarter of 2022, management expects comparable restaurant sales growth in the 10-12% range and to open between 235-250 new restaurants, a very strong pace. We continue to like Chipotle as an idea in the Best Ideas Newsletter portfolio and value shares north of $1,750 each (they are trading at ~$1,300 at the time of this writing).

Concluding Thoughts

Inflationary pressures are difficult to navigate but we have confidence that Domino’s and Chipotle are up to the task. Domino’s growth runway is still firmly intact, and the company continues to steadily grow its unit store count. Chipotle’s same store sales growth rate is expected to accelerate in the second quarter of 2022, and it continues to build out its restaurant base. We continue to like both Domino’s and Chipotle as ideas in the Best Ideas Newsletter portfolio.

—–

Tickerized for DPZ, CMG, QSR, PZZA, PZRIF, BPZZF, WING, EATZ, YUM, YUMC, BYND, WEN, SHAK

Discretionary Spending Industry – ATVI, BBY, CBRL, CMG, DIS, DG, DLTR, DPZ, EL, F, GM, HAS, HD, LOW, MCD, NFLX, NKE, SBUX, TSLA, YUM, DKS, TJX, ROST, WHR, KMX, AZO, RL, ULTA, LEG, GPC, VFC, CTAS, WSM

Related: VDC

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan owns shares of DIS, FB, GOOG, VRTX, and XLE and is long call options on DIS and FB. Chipotle Mexican Grill Inc (CMG), Dollar General Corporation (DG), Domino’s Pizza Inc (DPZ) and The Walt Disney Company (DIS) are all included in Valuentum’s simulated Best Ideas Newsletter portfolio. Dick’s Sporting Goods Inc (DKS) and Home Depot Inc (HD) are both included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Vanguard Consumer Staples ETF (VDC) is included in Valuentum’s simulated High Yield Dividend Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.