Image Shown: Dividend growth idea Qualcomm Inc put up strong performance last fiscal quarter. Image Source: Qualcomm Inc – Third Quarter of Fiscal 2022 Earnings Press Release

By Callum Turcan

Qualcomm Inc (QCOM) recently reported third quarter earnings for fiscal 2022 (period ended June 26, 2022) that beat both consensus top- and bottom-line estimates. The company provided guidance for the fiscal fourth quarter that was a tad lighter than what Wall Street was looking for, though its near term forecasts still call for substantial revenue and earnings growth on a year-over-year basis. We like Qualcomm as an idea in the Dividend Growth Newsletter portfolio given its stellar free cash flow generating abilities, healthy balance sheet, pricing power, bright growth outlook, and margin expansion potential. Shares of QCOM yield ~2.2% as of this writing.

Earnings Update

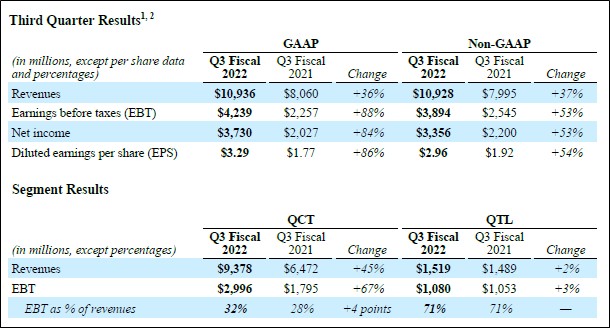

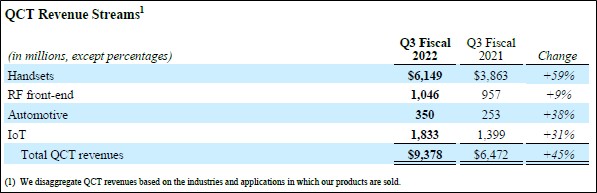

Qualcomm generated $10.9 billion in GAAP revenues in the fiscal third quarter, up 36% year-over-year. This performance was driven by 45% sales growth at its Qualcomm CDMA Technologies (‘QCT’) segment, which designs and supplies semiconductor components and related software, along with 2% growth at its Qualcomm Technology Licensing (‘QTL’) segment. Revenue growth at its QCT segment was widespread with sales of its handset (up 59% year-over-year), radio frequently front-end (up 9%), automotive (up 38%), and Internet of Things (up 31%) offerings all performing well last fiscal quarter.

While its QCT segment generates the bulk of its revenues (~86% of its total fiscal third quarter revenues), its QTL segment is incredibly lucrative with segment-level operating margins of 71.1% as of the fiscal third quarter. For reference, its QCT unit had segment-level operating margins of 31.9% last fiscal quarter. Strength at both segments last fiscal quarter saw Qualcomm’s GAAP operating income more than double year-over-year to reach $4.5 billion. Please note that some of Qualcomm’s revenues and expenses are not allocated to either its QCT or QTL segments. The company’s GAAP diluted EPS rose by 86% year-over-year to reach $3.29, and its non-GAAP diluted EPS rose by 54% to hit $2.96 in the fiscal third quarter.

Image Shown: Qualcomm experienced widespread sales growth at its QCT segment for its various semiconductor and related software offerings last fiscal quarter. Image Source: Qualcomm – Third Quarter of Fiscal 2022 Earnings Press Release

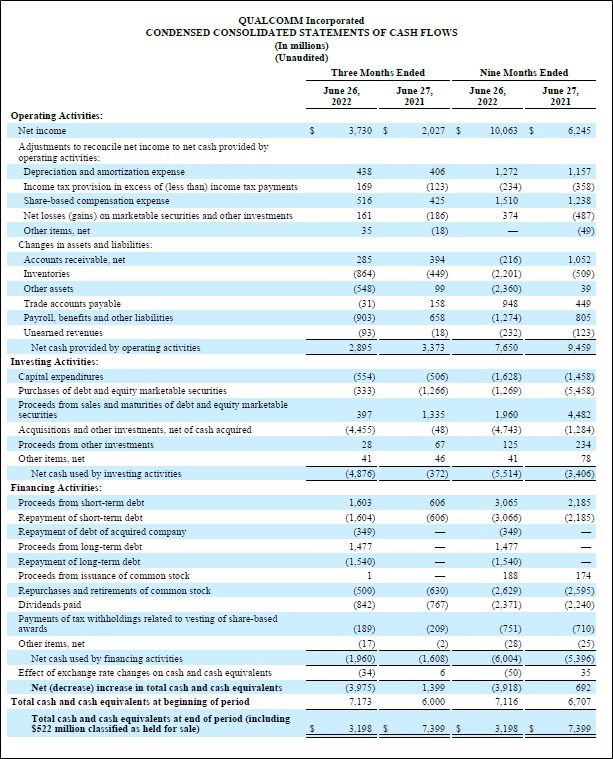

Qualcomm generated $6.0 billion in free cash flow during the first three quarters of fiscal 2022 while spending $2.4 billion covering its dividend obligations and another $2.6 billion buying back its stock. The firm exited the fiscal third quarter with a net debt load of $8.7 billion (inclusive of current marketable securities and short-term debt), though its $6.8 billion in cash-like assets on hand at the end of this period provides Qualcomm with ample liquidity to meet its near-term funding needs.

Image Shown: Qualcomm is a tremendous free cash flow generator, aided by its relatively asset-light business model. Image Source: Qualcomm – Third Quarter of Fiscal 2022 Earnings Press Release

Guidance Update

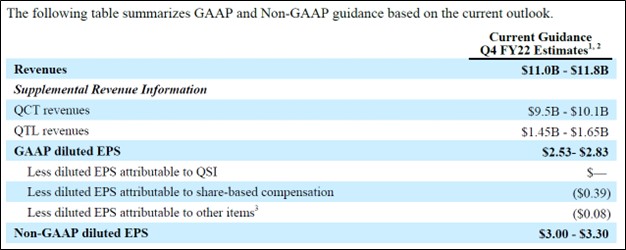

In the fourth quarter of fiscal 2022, Qualcomm expects to generate $11.0-$11.8 billion in revenue, which at the midpoint represents 22% year-over-year growth. That revenue guidance assumes forecasted 27% year-over-year growth at its QCT segment will offset a 1% year-over-year decline at its QTL segment, at the midpoint of its forecasts. Qualcomm also expects to generate $2.53-$2.83 in GAAP diluted EPS (up 9% year-over-year at the midpoint) and $3.00-$3.30 in non-GAAP diluted EPS (up 24% year-over-year at the midpoint) in the fiscal fourth quarter.

Image Shown: Qualcomm’s near term guidance for the current fiscal quarter was a tad lighter than what Wall Street was expecting, though that guidance still calls for substantial revenue and earnings growth on a year-over-year basis. Image Source: Qualcomm – Third Quarter of Fiscal 2022 Earnings Press Release

Please note that Qualcomm intends to remove the one-quarter lag in the reporting of the financial performance of some of its recently acquired assets from Veoneer (the deal closed in the third quarter of fiscal 2022). Going forward, the performance of the Veoneer’s former Arriver operations (retained by Qualcomm) will be reflected in Qualcomm’s financials going forward without the one-quarter lag (a change that will be reflected in Qualcomm’s fiscal fourth quarter earnings results). There will still be a one-quarter lag in the financial reporting of Veoneer’s former non-Arriver business (which is getting sold off, at least that’s the goal) as it concerns Qualcomm’s financials. We will cover this acquisition and accounting significance in greater detail.

Automotive Update

In April 2022, SSW Partners (an investment firm based in New York) acquired Veoneer through an all-cash deal with an equity value of ~$4.6 billion, though total cash considerations stood at ~$4.7 billion when including the $0.1 billion termination fee paid to Magna International Inc (MGA). SSW Partners subsequently sold Veoneer’s Arriver business unit to Qualcomm, the unit that focused on advanced driver assistance systems (‘ADAS’) and autonomous driving (‘AD’) solutions. This acquisition was a joint effort by both SSW Partners and Qualcomm, and the duo outbid Magna International for Veoneer.

SSW Partners is operating Veoneer’s Tier-1 supplier business in the meantime until that asset can be sold off, though Qualcomm is still recording the financial performance of these non-Arriver operations under the variable interest model. Here is an important note from Qualcomm’s latest 10-Q SEC filing on the issue (emphasis added):

We have agreed to provide certain funding of approximately $300 million to the Non-Arriver businesses while SSW Partners seeks a buyer(s), of which approximately $150 million of funding remained available to the Non-Arriver businesses at June 26, 2022. Such amounts, along with cash retained in the Non-Arriver business, are expected to be used to fund working and other near-term capital needs, as well as certain costs incurred in connection with the close of the acquisition.

Although we do not own or operate the Non-Arriver businesses [namely the Tier 1 supplier business], we have determined that we are the primary beneficiary, within the meaning of the Financial Accounting Standards Board (‘FASB’) accounting guidance related to consolidation (ASC 810), of these businesses under the variable interest model.

We appreciate that Qualcomm brought in an outside firm to run the part of Veoneer’s business that clearly is outside of Qualcomm’s operational focus. Qualcomm has made scaling up its automotive business a top priority given the increased computing power demanded by modern automobiles along with lucrative opportunities available in the realm of self-driving and assisted driving technology.

In January 2020, Qualcomm unveiled its Snapdragon Ride automotive platform that enables self-driving activities and enhanced safety features. Vehicles equipped with its Snapdragon Ride platform are expected to be available in 2023. Qualcomm later launched Snapdragon Ride Vision System in January 2022, which is billed as a “new open, scalable, and modular computer vision software stack built on a four-nanometer process technology system-on-chip (‘SoC’) designed for an optimized implementation of front and surround cameras for ADAS and AD” activities. Vehicles equipped with its Snapdragon Ride Vision System are expected to be available in 2024. The company is betting big on this space via substantial R&D investments and recent M&A activity, a move we like.

Concluding Thoughts

Qualcomm is one of our favorite semiconductor companies. The semiconductor industry is supported by incredibly powerful secular tailwinds, and while there are substantial near term headwinds to keep in mind (inflationary pressures, supply chain hurdles, geopolitical tensions), Qualcomm’s longer term growth runway is immense. We appreciate Qualcomm’s ability to generate substantial cash flows in almost any operating environment, and its revenues and margins have trended in the right direction of late. Qualcomm possesses ample dividend growth potential, and we continue to like the company as an idea in the Dividend Growth Newsletter portfolio.

—–

Technology Giants Industry – FB, AAPL, GOOG, AMZN, MSFT, CSCO, V, MA, PYPL, INTC, ORCL, QCOM, TWTR, IBM, ADBE, NVDA, CRM, AMD, AVGO, BABA, BKNG, BIDU, TSM, FFIV, TXN, EBAY, ADP, PAYX, MU, KFY, MAN, KLAC, LRCX, AMAT, ADI

Tickerized for QCOM, SMH, SOXX, XSD, PSI, USD, FTXL, INTC, MU, TXN, NXPI, MCHP, AMAT, MGA

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan owns shares of DIS, META, GOOG, VRTX, and XLE and is long VRTX call options. Apple Inc (AAPL), Cisco Systems Inc (CSCO) and Microsoft Corporation (MSFT) are all included in both Valuentum’s simulated Best Ideas Newsletter portfolio and simulated Dividend Growth Newsletter portfolio. Alphabet Inc (GOOG) Class C shares, Meta Platforms Inc (FB), Korn Ferry (KFY), and Visa Inc (V) are all included in Valuentum’s simulated Best Ideas Newsletter portfolio. Oracle Corporation (ORCL) and Qualcomm Inc (QCOM) are both included in Valuentum’s simulated Dividend Growth Newsletter portfolio. ASML Holding NV (ASML), Meta Platforms, Oracle, and Taiwan Semiconductor Manufacturing Company Limited (TSM) are all included in Valuentum’s simulated ESG Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.