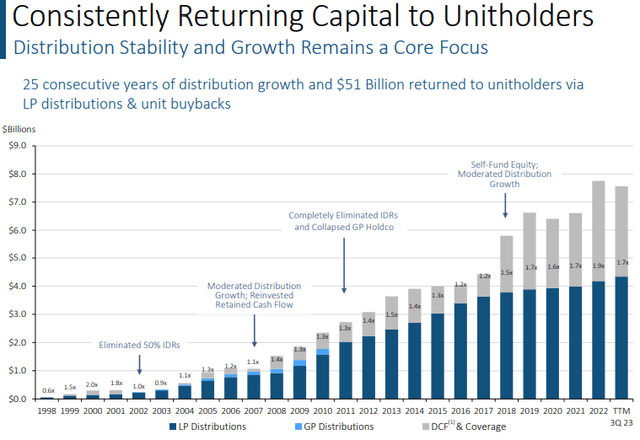

Image: Enterprise Products Partners continues to raise its distribution year after year. Source: Enterprise Products Partners.

By Brian Nelson, CFA

Enterprise Products Partners (EPD) represents rare exposure to the midstream energy pipeline space in the simulated High Yield Dividend Newsletter portfolio, a key feature of the monthly High Yield Dividend Newsletter, released by email to its subscribers on the first of each month. The master limited partnership is one of the largest providers of midstream energy services of natural gas, natural gas liquids (NGLs), crude oil and other refined products in North America. Units offer investors a distribution yield of ~7.6% at the time of this writing, one that is covered nicely by the firm’s distributable cash flow [DCF], not to be confused with free cash flow. Enterprise Products Partners last raised its payout 2% in July and has raised its payout in each of the past 25 years.

Back on October 31, Enterprise Products Partners reported decent third-quarter results. The company is currently experiencing revenue pressure, but Enterprise Products Partners is doing a good job controlling costs, where operating income and net income declined only marginally in the quarter on a year-over-year basis. Fully diluted earnings per common unit declined to $0.60 in the quarter ending September 30 from $0.62 in last year’s period, but adjusted EBITDA expanded to $2.327 billion from $2.258 billion in the year-ago period. To rectify the stagnation in its operating performance, Enterprise Products Partners is investing heavily in new growth projects. Here is what co-CEO Jim Teague had to say about the company’s growth initiatives in the press release:

“…we announced $3.1 billion of new growth capital projects in our NGL Pipelines & Services segment, our largest business. In addition to these projects directly integrating with and complementing our entire NGL value chain, these investments also facilitate continued crude oil and natural gas production growth in the basin that will provide benefits to our crude oil and natural gas businesses. In total, we now have $6.8 billion of organic growth projects under construction. Once in service, these assets will provide new sources of cash flow that will support additional returns of capital to our partners.”

No longer are the vast majority of energy pipeline players not covering their dividends/distributions with traditional free cash flow, as measured by cash flow from operations less all capital spending. Enterprise Products Partners is on the cusp of doing so in this regard. Through the first nine months of the year, the company generated free cash flow of $2.95 billion, consisting of operating cash flow of $5.2 billion and total capital expenditures of $2.25 billion. Free cash flow through the first nine months of 2023 was modestly lower than what it paid in cash distributions to common unitholders and noncontrolling interests ($3.33 billion). Distributable cash flow of $5.54 billion easily covered distribution payments over this time period, however, with sustaining capital expenditures coming in at $284 million during the first nine months of the year.

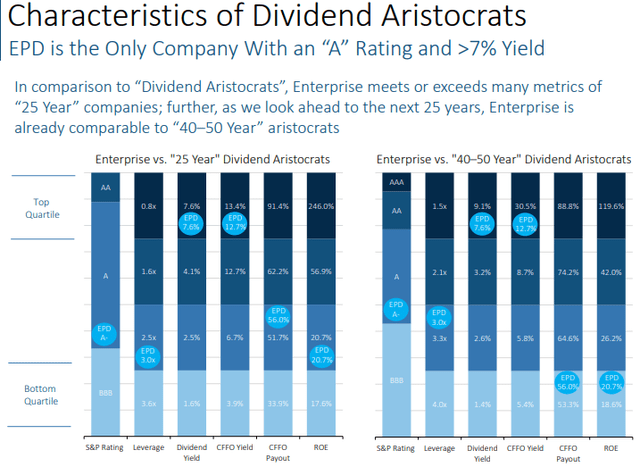

Image: Enterprise Products Partners offers a strong combination of investment-grade marks and a high dividend yield. Source: Enterprise Products Partners.

Though, in general, we’re not too excited by the midstream pipeline space given their capital-intensive nature and hefty net debt positions, Enterprise Products Partners has a lot of things going for it. The company boasts investment-grade credit ratings (A-/A-/A3), has strong and consistent returns on invested capital, and has put up 25 years of consecutive distribution increases. In addition to growing its payout in each year for more than two decades, management has done a great job reducing its leverage ratio (net debt adjusted for equity credit in its junior subordinated notes divided by adjusted EBITDA). For the trailing twelve months ended in the third quarter, its leverage ratio has fallen to 3.0x from 4.1x in 2017. All told, we think Enterprise Products Partners’ growth initiatives will help to solve revenue pressures, and we expect the company to continue to drive distribution growth in the coming years as it keeps its leverage in check.

———-

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.