Image Source: Caterpillar

By Brian Nelson, CFA

Caterpillar (CAT) recently reported third quarter results that missed on both the top and bottom lines. Performance declined across the board. Sales and revenues dropped 4% to $16.1 billion from $16.8 billion in the year-ago quarter (lower than what management had been anticipating), profit per share fell to $5.06 from $5.45 in the third quarter of 2023, while adjusted profit per share dropped to $5.17 from $5.52 in the same period a year ago. Weakness was driven by lower sales volume of $759 million, driven by lower sales equipment to end users. Changes in dealer inventories also negatively impacted sales.

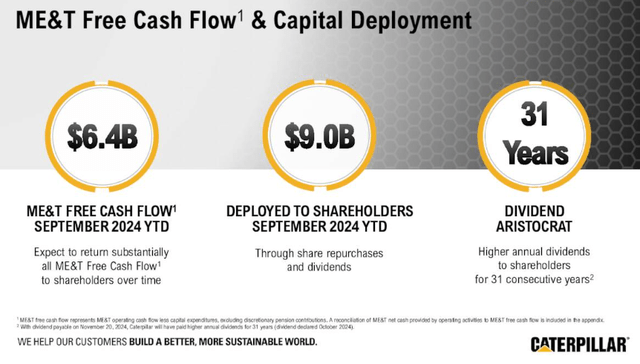

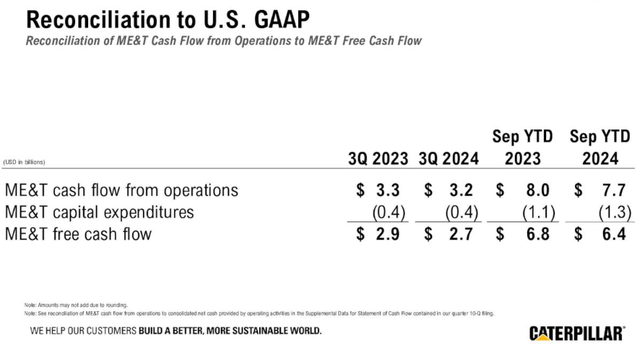

Caterpillar’s adjusted operating margin came in at 20.0% for the third quarter of 2024, which compared to 20.8% in the third quarter of 2023. Machinery, Energy & Transportation (ME&T) operating cash flow was $3.2 billion for the third quarter of 2024, down from $3.3 billion in the prior-year period. ME&T free cash flow of $2.7 billion was also lower than the prior-year quarter of $2.9 billion. Year-to-date ME&T free cash flow was $6.4 billion, down from $6.8 billion in the same period a year ago, but well in excess of the $1.97 billion it paid as dividends during the first nine months of the year. Management expects ME&T free cash flow to be at the top of its target range of $5-$10 billion for the year.

Image Source: Caterpillar

In the quarter, the heavy machinery and construction equipment giant reported declines in sales in its Construction Industries (-9%) and Resource Industries (-10%) segments, while sales in its Energy & Transportation segment increased 5%. ME&T revenue dropped 5% in the quarter on a year-over-year basis, while Financials Products revenue increased 6%, resulting in a 4% decline in consolidated sales and revenues.

Sales and revenues declined in all geographic areas, with the exception of Latin America, where sales and revenues increased 5% on a consolidated basis. Sales and revenues fell 4% in its largest geographic segment, North America. On an operating profit per segment basis, the firm experienced a 20% decline in profit in Construction Industries, a 15% decline in Resource Industries, while profit in its Energy & Transportation segment increased 21%. Financial Products profit improved 21%, resulting in consolidated operating profit dropping 9% in the quarter on a year-over-year basis, after accounting for corporate items and eliminations.

Caterpillar ended the third quarter with $5.6 billion of enterprise cash and $37.9 billion in ME&T and Financial Products short- and long-term debt. During the quarter, the company bought back $0.8 billion in common stock, while it shelled out $0.7 billion in cash as dividends. Though Caterpillar’s top line is under pressure “due to the impact of lower-than-expected sales to users in its Construction Industries segment and the timing of deliveries in its Resource Industries and Energy & Transportation segment,” Caterpillar’s lucrative services business and backlog remain healthy, and it covers its dividend nicely with ME&T free cash flow. Shares yield 1.6% at the time of this writing.

———-

Brian Nelson owns shares in SPY, SCHG, QQQ, QQQM, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, QQQM, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, QQQM, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.