Image: Dick’s Sporting Goods’ guidance pleased investors. Image Source: Dick’s Sporting Goods.

By Brian Nelson, CFA

On May 29, Dick’s Sporting Goods (DKS) reported excellent first quarter results that beat expectations on both the top and bottom lines. Net sales in the quarter advanced 6.2% on a year-over-year basis, while the company put up 5.2% in comparable store sales expansion (well above consensus expectations). Dick’s Sporting Goods delivered strong profitability in the quarter with a double-digit EBT (income before taxes) margin of 11.3%, as well as reported earnings per share of $3.30 on 4% EBT growth (above the Street forecast).

The executive team was upbeat with their commentary in the press release:

Our strong first quarter results continue to prove that DICK’S is the go-to destination for sport and sport culture in the US. The product pipeline from our key brand partners and our vertical brand portfolio has never been better. For example, Nike’s recent Paris innovation summit highlighted a number of breakthrough products across apparel and footwear that we look forward to bringing to our athletes. We have significant momentum and are excited about the differentiated product and compelling experience we are providing.

We are incredibly proud of our first quarter results. With our comps increasing 5.3% and double-digit EBT margin of over 11%, we drove continued momentum in our business. Our core strategies and execution are delivering strong results, and we are continuing to gain market share as consumers prioritize DICK’S Sporting Goods to meet their needs. Because of our strong Q1 performance, our expectations for continued robust demand from athletes and the confidence we have in our business, we are raising our full year outlook.

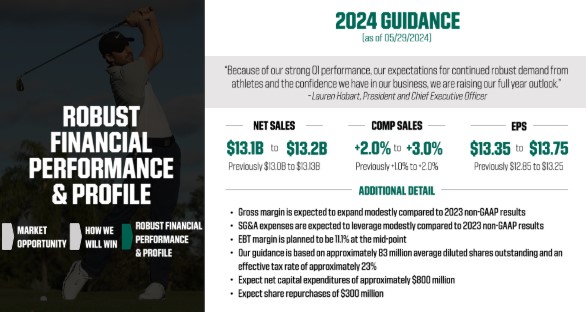

Looking to the remainder of 2024, Dick’s Sporting Goods upped its 2024 guidance for comparable store sales growth to the range of 2%-3% (was 1%-2% previously). The strength in comps will trickle down to the bottom line, too, as Dick’s upped its 2024 earnings per diluted share guidance to the range of $13.35-$13.75 per share, up from $12.85-$13.25 previously. The midpoint of the bottom-line revision came in higher than what the Street had been expecting.

The company ended its fiscal first quarter with $1.65 billion in cash and total debt of $1.48 billion, good for a nice net cash position, though we note the firm has sizable long-term operating lease liabilities. We continue to like Dick’s Sporting Goods as an idea in the Dividend Growth Newsletter portfolio. The company was recently highlighted as top dividend growth stock for the long run. Shares yield ~2.26% on a forward estimated basis.

—–

NOW READ: 12 Reasons to Stay Aggressive in 2024

NOW READ: 2023 Was a Fantastic Year! Are You Ready for 2024?

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.