Image Source: Intel third-quarter earnings presentation

Intel reported strong third quarter results and subsequently raised its full-year guidance for a number of metrics. The company continues to throw off gobs of free cash flow and boasts a solid combination of a competitive dividend yield and a strong Dividend Cushion ratio.

By Kris Rosemann

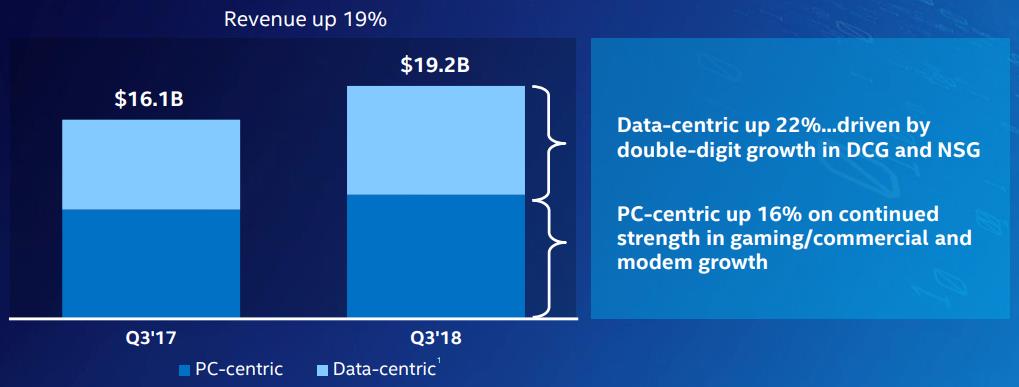

Simulated newsletter portfolio idea Intel (INTC) has found itself out of the market’s favor of late as a result of a delayed chip launch that some expect will allow rivals to take notable market share from the company, but shares gained nicely following its third quarter report, released after hours October 25. Intel’s top-line advanced 19% on a year-over-year basis to an all-time company record of $19.2 billion as its data-centric businesses turned in 22% growth and PC-centric business growth checked in at 16%. The company’s ‘Data Center Group’ led its data-centric businesses with 26% revenue growth from the year-ago period, and ongoing strength in commercial and gaming helped drive PC-centric revenue growth.

In addition to its impressive top-line growth, Intel reported tremendous operating leverage in the third quarter as its operating margin expanded by five percentage points and came in at the lowest spending as a percentage of revenue in over a decade. Operational efficiencies, volume, and average selling price all played a role in the company’s margin expanding to 39.7% in the third quarter, which drove non-GAAP earnings per share to $1.40 from $1.01 in the comparable period of 2017.

Free cash flow in the quarter leapt nearly 52% from the year-ago period to just under $5 billion, which was more than sufficient in covering cash dividends paid of ~$1.4 billion. Intel holds nearly $13.2 billion in cash and cash investments, in addition to $11.1 billion in long-term equity investments and other long-term investments, and nearly $27.9 billion in total debt on its balance sheet. The company’s Dividend Cushion ratio checks in at a strong 2.5, which pairs nicely with a ~2.6% dividend yield as of this writing.

Management raised its full-year 2018 guidance for a number of metrics after the strong third quarter, and it now expects non-GAAP revenue to be approximately $71.2 billion, up from previous guidance of ~$69.5 billion. Its non-GAAP operating margin guidance now sits at 34.5% compared to 32% previously, and non-GAAP earnings per share guidance was raised to $4.53 from $4.15. Free cash flow is now expected to be $15.5 billion, $500 million higher than its previous target.

Intel’s impressive third quarter report, particularly its return to satisfying market expectations with respect to robust data center growth, was a nice reminder of the chip giant’s momentum in its transformation to large and rapidly growing markets. Management noted that it remains on track and is making “good progress” with its 10-nm chip launch for the 2019 holiday season. Our fair value estimate currently sits at $56 per share, and we expect to continue highlighting the company in both simulated newsletter portfolios moving forward.

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Kris Rosemann does not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.