Image Source: Berkshire Hathaway Inc – 2018 Annual Report

By Callum Turcan

As a top holding in our Best Ideas Newsletter portfolio, Berkshire Hathaway Inc (BRK.A) (BRK.B) Class B shares have room to run in our view. Our fair value estimate for BRK.B stands at $229 per share, significantly higher than where shares are trading at as of this writing (~$204 per share). Please note Berkshire Hathaway does not pay out a common dividend at this time.

Covering a Tricky Balance Sheet

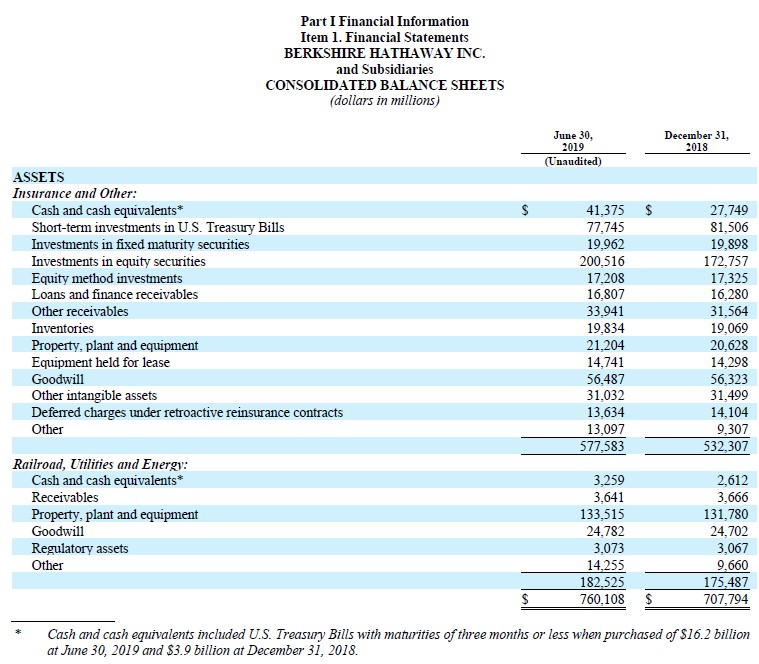

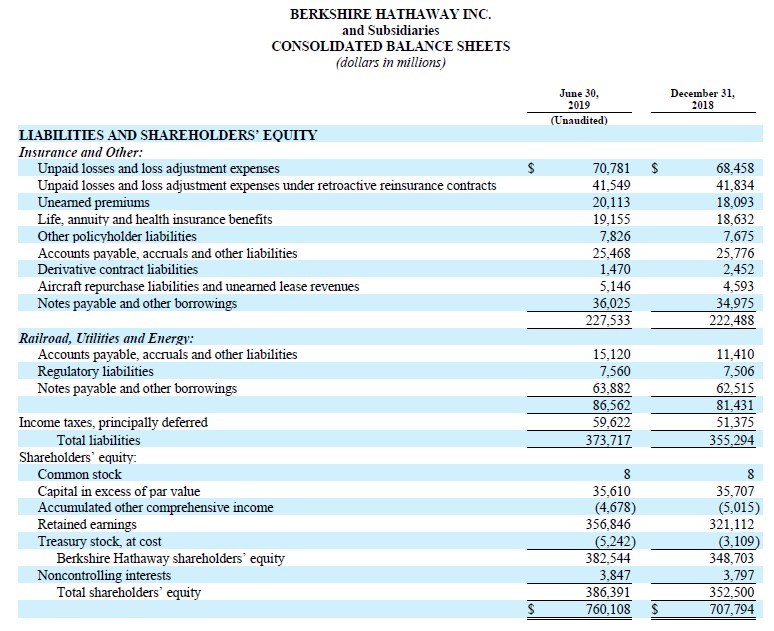

The conglomerate splits its operations into two; ‘Insurance and Other’ and ‘Railroad, Utilities, and Energy,’ with Berkshire Hathaway breaking down the financial performance of each segment when possible.

Berkshire Hathaway’s ‘Insurance and Other’ segment had a large net cash-like position of $356.8 billion at the end of June 2019 (when defined as cash, cash equivalents, short-term investments in US Treasuries, investments in fixed maturities, investments in equity securities, and equity method investments that included Berkshire Hathaway’s ~26.7% stake in Kraft Heinz Co’s (KHC) outstanding share count at the end of this period). That cash-like position was modestly offset by $36.0 billion in notes payable and other borrowings at the end of the second quarter.

However, this doesn’t tell the whole story. Berkshire Hathaway has numerous insurance business-related liabilities that require maintaining a large cash balance in order to pay out claims to policy holders, making the firm’s balance sheet a tricky read. Pivoting to its other operations, Berkshire Hathaway’s ‘Railroad, Utilities, and Energy’ segment had a net debt position of $60.6 billion ($3.3 billion in cash less $63.9 billion in total debt) at the end of the second quarter. Below is a look at Berkshire Hathaway’s financial status as of the end of June 2019.

Image Shown: Berkshire Hathaway had a lot of cash and cash equivalents on the books to cover future insurance payouts and potentially make large investments, as of the end of the second quarter of 2019. Image Source: Berkshire Hathaway – Second quarter 2019 10-Q filing

Image Shown: Berkshire Hathaway’s balance sheet can be a tricky read given its large insurance operations. Image Source: Berkshire Hathaway – Second quarter 2019 10-Q filing

Berkshire Hathaway invested $10.0 billion into a preferred equity issuance by Occidental Petroleum Corporation (OXY) that was contingent on Occidental Petroleum’s purchase of Anadarko Petroleum going through, which it did (we covered that in this article here). Now Berkshire Hathaway should be the proud owner of preferred shares in Occidental Petroleum that come with a hefty 8% coupon, quite the return given the size of the investment, and that’s on top of Berkshire Hathaway gaining warrants to acquire 80 million OXY shares at $62.50 per share. This investment was expected to close soon after the acquisition was completed, which occurred during the third quarter of 2019. We will be scanning through Berkshire Hathaway’s third quarter 2019 10-Q filing to find more information on this transaction when it becomes available.

While Occidental Petroleum trades at just ~$41 per share as of this writing, the warrants Berkshire Hathaway is obtaining give the conglomerate exposure to a recovery in raw energy resource prices. The 8% coupon on the preferred issuance is arguably quite generous, but please keep seniority in mind if Occidental Petroleum faces financial distress. Occidental Petroleum is currently embarking on a wide-ranging divestment program to pay down debt taken on after acquiring Anadarko Petroleum, a strategy that should work in Berkshire Hathaway’s favor.

On the tenth year anniversary of the preferred issuance, Berkshire Hathaway can have the preferred equity redeemed at 105% of the liquidation preference (face value) plus any accrued but unpaid dividends. On the downside, Occidental Petroleum does have the option to pay Berkshire Hathaway in common stock (we think cash will be the preferred choice of payment given the high 7.7% yield shares of OXY currently carry).

Cash Flow Commentary

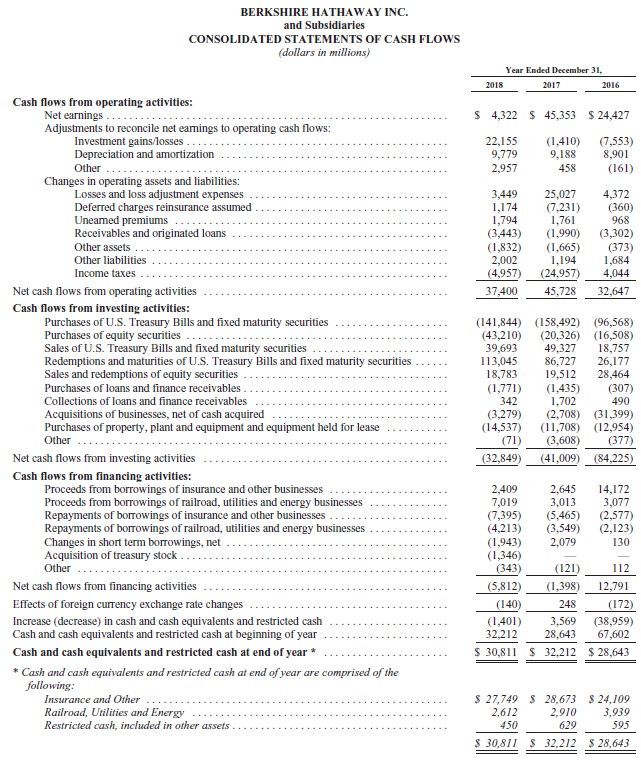

Berkshire Hathaway generated $38.6 billion in annual net operating cash flows on average from 2016-2018 while spending $13.1 billion on capital expenditures per year on average during this period. The cash generated from these strong free cash flows were largely added to Berkshire Hathaway’s balance sheet, with the conglomerate spending just $1.3 billon in 2018 (and nothing in 2016-2017) on share repurchases. That’s because Berkshire Hathaway’s current share buyback program was amended in 2018. Here’s more information on that from Berkshire Hathaway’s second quarter 2019 10-Q filing (emphasis added):

“For several years, Berkshire had a common stock repurchase program, which permitted Berkshire to repurchase its Class A and Class B shares at prices no higher than a 20% premium over the book value of the shares. On July 17, 2018, Berkshire’s Board of Directors authorized an amendment to the program, permitting Berkshire to repurchase shares any time that Warren Buffett, Berkshire’s Chairman of the Board and Chief Executive Officer, and Charles Munger, Vice Chairman of the Board, believe that the repurchase price is below Berkshire’s intrinsic value, conservatively determined. Repurchases may be in the open market or through privately negotiated transactions.”

As the company does not currently pay out a common dividend and is unlikely to do so for the foreseeable future, Berkshire Hathaway will likely continue to grow its cash-like hoard going forward. Please note Berkshire Hathaway did repurchase $2.1 billion of its stock during the first half of 2019, but that paled in comparison to the $10.0 billion in free cash flows the conglomerate generated over this period. Only major acquisitions have historically put a meaningful dent in Berkshire Hathaway’s cash pile, and CEO Warren Buffett has largely been on the sidelines over the past few years due to what he sees as lofty valuations for many investment opportunities (across the board). Down in the graphic below is a look at Berkshire Hathaway’s cash flows over the past few fiscal years.

Image Shown: Berkshire Hathaway is very free cash flow positive and we like the stability of its net operating cash flows. As the conglomerate has not historically repurchased a significant amount of its stock or paid out a common dividend, the firm has historically been able to quickly build up a large net cash-like position. Image Source: Berkshire Hathaway – 2018 Annual Report

Concluding Thoughts

There’s a lot to like about Berkshire Hathaway’s stable cash flow profile and future growth trajectory. We continue to like Berkshire Hathaway’s ability to navigate turbulent markets and think the firm is in a prime position to take advantage of any downturn in valuations at-large through very advantageous deals (whether that be outright acquisitions, preferred equity transactions, or investments in publicly traded equities).

Data Sheet on Stocks in the Insurance Industry

Tickerized for companies in the SPDR S&P Insurance ETF (KIE)

—-

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Berkshire Hathaway Inc (BRK.A) (BRK.B) Class B shares are included in Valuentum’s simulated Best Ideas Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.