Image Source: Cisco

By Brian Nelson, CFA

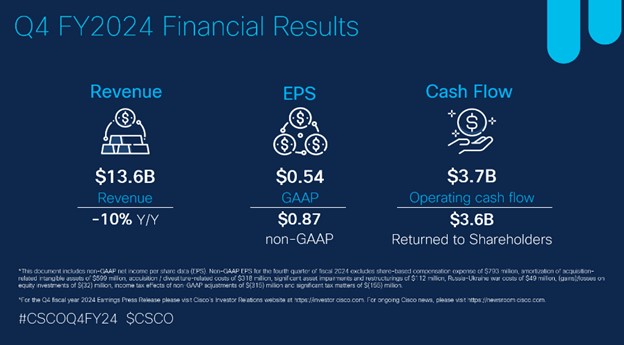

On August 14, Cisco Systems (CSCO) reported better than expected fiscal fourth quarter results with both revenue and non-GAAP earnings per share coming in higher than the consensus forecasts. Revenue fell 10% on a year-over-year basis, while non-GAAP earnings per share dropped 24% from the same period last year. Fiscal fourth quarter non-GAAP gross margin was 67.9%, and the company now has total annualized recurring revenue of $29.6 billion, up 22% year-over-year inclusive of its acquisition of Splunk. The company’s product order growth was 14% in the quarter. Management’s commentary in the press release was positive:

We delivered a strong close to fiscal 2024. In our fourth quarter, we saw steady customer demand with order growth across the business as customers rely on Cisco to connect and protect all aspects of their organizations in the era of AI.

Revenue, gross margin and EPS in Q4 were at the high end or above our guidance range, demonstrating our operating discipline. As we look to build on our performance, we remain laser focused on growth and consistent execution as we invest to win in AI, cloud and cybersecurity, while maintaining capital returns.

Looking to Cisco’s fiscal 2025 outlook, for the first fiscal quarter, revenue is expected in the range of $13.65-$13.85 billion (versus consensus of $13.76 billion), with non-GAAP earnings per share targeted in the range of $0.86-$0.88 (versus consensus of $0.85 per share). For all of fiscal 2025, management is targeting revenue in the range of $55-$56.2 billion (versus consensus of $55.68 billion) and non-GAAP earnings per share in the range of $3.52-$3.58 (versus consensus of $3.55 per share).

Cisco ended its fiscal year with $31 billion in short- and long-term debt and $17.9 billion in cash and investments. Free cash flow of $10.2 billion during fiscal 2024 easily covered its cash dividends paid of $6.4 billion. We continue to like Cisco as an idea in the newsletter portfolios. Though it has a net debt position and revenue has been under pressure, it trades at a below-market multiple, pays a nice dividend, and is working aggressively to transform its business model into one that is more recurring in nature. Shares yield 3.5% at the time of this writing.

—–

NOW READ: What to Do During This Market Selloff

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.