Image Source: Cisco Systems Inc – First Quarter of Fiscal 2022 IR Earnings Presentation

By Callum Turcan

On November 17, Cisco Systems Inc (CSCO) reported first quarter earnings for fiscal 2022 (period ended October 30, 2021) that missed consensus top-line estimates but beat consensus bottom-line estimates. Shares of CSCO fell initially after its latest earnings update was published due to its near term guidance coming in a tad softer than expected, though we caution that this is primarily due to supply chain headwinds negatively impacting Cisco Systems and the networking hardware industry more broadly.

As global health authorities work towards bringing the coronavirus (‘COVID-19’) pandemic to an end worldwide, the supply chain situation should improve going forward. We include Cisco Systems as an idea in both the Best Ideas Newsletter and Dividend Growth Newsletter portfolios. As of this writing, shares of CSCO yield ~2.6%.

Overview

Last fiscal quarter, Cisco Systems’ GAAP revenues rose 9% year-over-year, hitting $12.9 billion, supported by strong growth in its ‘Internet for the Future,’ ‘Optimized Application Experiences,’ and ‘Secure, Agile Networks’ segments. The company’s GAAP operating income rose 34% year-over-year last fiscal quarter, hitting $3.4 billion, aided by revenue growth and a sharp reduction in its ‘restructuring and other charges’ expense line-item. Cisco Systems’ GAAP diluted EPS came in at $0.70 last fiscal quarter, up 37% year-over-year. Its non-GAAP gross margins weakened year-over-year last fiscal quarter (its total non-GAAP gross margin hit 64.5% in the first quarter of fiscal 2022, down ~130 basis points year-over-year, with the non-GAAP gross margins of both its product and service offerings weakening somewhat during this period) as inflationary headwinds and logistical bottlenecks weighed negatively on its performance.

The guidance Cisco Systems provided for the second quarter of fiscal 2022 came in a bit lighter than what Wall Street wanted. Cisco Systems expects to post 4.5%-6.5% year-over-year revenue growth and $0.80-$0.82 in non-GAAP EPS in the current fiscal quarter. As noted previously, supply chain hurdles were cited as a key headwind. Its non-GAAP gross margin guidance for the current fiscal quarter stands in at 63.5%-64.5%, down sequentially at the midpoint of guidance though still a strong figure.

Cisco Systems maintained (compared to guidance put out during its fourth quarter of fiscal 2021 earnings update) its full-year revenue forecast for fiscal 2022 that calls for 5%-7% annual growth and $3.38-$3.45 in non-GAAP EPS. In fiscal 2021 (period ended July 31, 2021), Cisco Systems reported $3.22 in non-GAAP EPS. At the midpoint of its fiscal 2022 guidance, Cisco Systems expects its non-GAAP EPS will rebound by 6% this fiscal year versus fiscal 2021 levels.

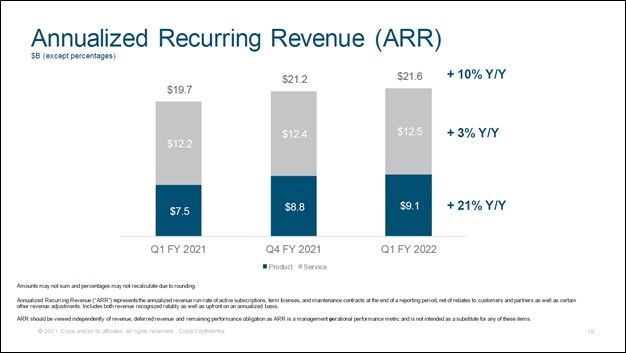

There were some bright spots in Cisco Systems’ latest earnings update as its management team noted that “remaining performance obligations and annualized recurring revenue [‘ARR’] both grew 10% year over year with product ARR growth of 21% providing more predictability and visibility to our long-term growth” within its latest earnings press release. Building up its recurring revenue streams is a major focus for Cisco Systems, and the firm laid out its strategy on this front during a big investor day event in September 2021.

Image Shown: Cisco Systems continues to grow its recurring revenue streams, providing greater visibility as it concerns its future cash flow performance. Image Source: Cisco Systems – First Quarter of Fiscal 2022 IR Earnings Presentation

In our September 2021 article Cisco Systems’ Growth Outlook Continues to Improve (link here), we provided our thoughts on the company’s pivot to recurring revenues, while also noting in the piece that it would take time for recent pricing increases to filter through the firm’s financial statements.

Financials Remain Rock-Solid

During the first quarter of fiscal 2022, Cisco Systems generated $3.4 billion in net operating cash flow and spent $0.1 billion on its capital expenditures, resulting in $3.3 billion in free cash flow. The company spent $1.6 billion covering its dividend obligations and another $0.3 billion buying back its stock through its repurchase program last fiscal quarter (the firm also spent $0.1 billion towards ‘shares repurchased for tax withholdings on vesting of restricted stock units’ in the fiscal first quarter). Both of these activities were fully covered by Cisco Systems’ free cash flows.

At the end of the first quarter of fiscal 2022, Cisco Systems had $23.3 billion in cash, cash equivalents, and short-term investments on hand versus $0.5 billion in short-term debt and $9.0 billion in long-term debt. The company exited the fiscal first quarter with a fortress-like balance sheet as it had a net cash position of $13.8 billion (inclusive of short-term debt). Cisco Systems has ample financial firepower to continue growing its dividend, buying back its stock, investing in its business, and making strategic acquisitions (the firm spent $0.3 billion on ‘acquisitions, net of cash and cash equivalents acquired and divestitures’ last fiscal quarter).

Concluding Thoughts

We continue to like Cisco Systems in both the Best Ideas Newsletter and Dividend Growth Newsletter portfolios. The company’s near-term guidance came in a bit soft, though its longer-term growth outlook remains bright as it pivots towards recurring revenue streams. Its pristine balance sheet and stellar free cash flow generating abilities are still intact, and Cisco Systems is still guiding for decent revenue and non-GAAP EPS growth this fiscal year as enterprises, governments, and other entities resume major IT projects that were delayed by the COVID-19 pandemic. Secular growth tailwinds and ample financial firepower should enable Cisco Systems to navigate near-term supply chain hurdles.

We recently updated our cash flow valuation model covering Cisco Systems, and its updated fair value estimate sits at $62 per share. As shares of CSCO are trading at a discount to their fair value estimate as of this writing, we are supportive of management utilizing the company’s financial strength to buy back meaningful amounts of Cisco Systems’ stock. We also expect that Cisco Systems will push through sizable payout increases over the coming fiscal years as its updated Dividend Cushion ratio sits at a nice 2.9, earning the firm an “EXCELLENT” Dividend Safety rating and the company also has an “EXCELLENT” Dividend Growth rating.

Downloads

Cisco’s 16-page Stock Report (pdf) >>

Cisco’s Dividend Report (pdf) >>

—–

Technology Giants Industry – FB, AAPL, GOOG, AMZN, MSFT, CSCO, V, MA, PYPL, INTC, ORCL, QCOM, TWTR, IBM, ADBE, NVDA, CRM, AMD, AVGO, BABA, BKNG, BIDU, TSM, FFIV, TXN, EBAY, ADP, PAYX, MU, KFY, MAN, KLAC, LRCX, AMAT, ADI, SIMO

Tickerized for CSCO, QQQ, XLK, ANET, MCHP, NTGR, COMM, UI, DDOG, NEWR, CIEN, VRT, JNPR, APH, NTAP, FSLY, FFIV, DELL, PANW, EXTR, HPE, PSTG

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Apple Inc (AAPL), Cisco Systems Inc (CSCO), and Microsoft Corporation (MSFT) are all included in both Valuentum’s simulated Best Ideas Newsletter portfolio and simulated Dividend Growth Newsletter portfolio. Alphabet Inc (GOOG) Class C shares, Facebook Inc (FB), Korn Ferry (KFY), PayPal Holdings Inc (PYPL) and Visa Inc (V) are all included in Valuentum’s simulated Best Ideas Newsletter portfolio. Oracle Corporation (ORCL) and Qualcomm Inc (QCOM) are both included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Facebook Inc, Oracle Corporation, and Taiwan Semiconductor Manufacturing Company Limited (TSM) are all included in Valuentum’s simulated ESG Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.