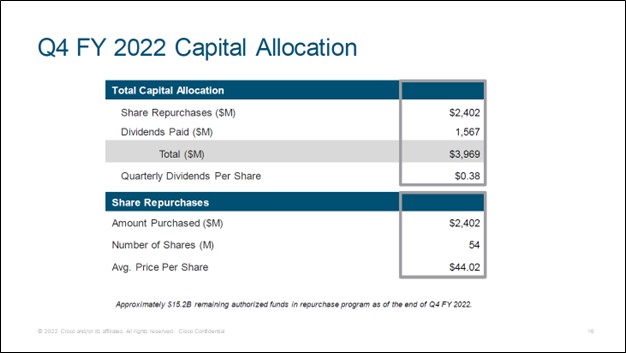

Image Shown: Cisco Systems Inc is incredibly shareholder friendly. Image Source: Cisco Systems Inc – Fourth Quarter of Fiscal 2022 IR Earnings Presentation

By Callum Turcan

Cisco Systems Inc (CSCO) reported fourth quarter earnings for fiscal 2022 (period ended July 30, 2022) that beat both consensus top- and bottom-line estimates. The networking hardware and software provider also issued promising guidance for fiscal 2023 that Wall Street appreciated. Cisco Systems is steadily putting supply chain hurdles (with an eye towards a shortage of semiconductor components and transportation bottlenecks) behind it and its growth outlook is starting to improve as a result. We continue to like shares of CSCO as an idea in both the Best Ideas Newsletter and Dividend Growth Newsletter portfolios. Shares of CSCO yield ~3.2% as of this writing.

Earnings and Guidance Update

In the fiscal fourth quarter, Cisco Systems’ GAAP revenues were broadly flat year-over-year and its GAAP operating income fell 4% due to its GAAP gross margin falling by ~230 basis points during this period to hit 61.3%. A decline in Cisco Systems’ operating expenses offset the decline in its gross margin, to a degree, as its GAAP operating margin fell by ~105 basis points year-over-year last fiscal quarter. Its revenues were supported by 20% growth in sales at its ‘end-to-end security’ offerings, 8% growth at its ‘optimized application experiences’ offerings, and 2% growth at its ‘collaboration’ offerings on a year-over-year basis in the fiscal fourth quarter. However, inflationary pressures and elevated freight and logistics costs are taking a toll on the company’s financial performance.

Cisco Systems remained a stellar cash flow generator in fiscal 2022 and posted $12.7 billion in free cash flow during this period while spending $6.2 billion covering its dividend obligations along with $7.7 billion buying back its stock. Furthermore, Cisco Systems exited fiscal 2022 with $9.8 billion in net cash on the books (inclusive of short-term debt).

We are huge fans of its rock-solid cash flow profile and pristine balance sheet. Cisco Systems is working on growing its recurring revenue streams, which provides for stronger cash flow profiles given the highly visible nature of those future cash flows.

During Cisco Systems’ latest earnings call, management noted that the firm’s “total subscription revenue was $22.4 billion, an increase of 2% and total subscription revenue represented 43% of [Cisco Systems’] total revenue” last fiscal year. As over 80% of its software revenue is derived by subscription sales, growing its software sales going forward is a key priority for Cisco Systems, though software sales were broadly flat in fiscal 2022 over fiscal 2021 levels.

Looking ahead, the company expects to grow its revenues by 4%-6% in fiscal 2023 while posting $2.77-$2.88 in GAAP EPS (broadly flat on a year-over-year basis at the midpoint) and $3.49-$3.56 in non-GAAP EPS (up 5% year-over-year at the midpoint). Here is what management had to say regarding Cisco Systems’ near and long-term outlook during the firm’s latest earnings call (emphasis added):

“Now, I want to be clear on our outlook for fiscal 2023. We expect strong performance across our portfolio, driven by our continued focus on innovation and easing of supply constraints to drive solid top line growth and profitability. While we anticipated some moderation from the unprecedented product order growth of last [fiscal] year, demand signals remain solid.

We do expect to continue to experience higher costs in the short term, driven primarily by higher component, freight and logistics costs, which is reflected in our Q1 guide. However, as you’ll see in our annual guidance, we expect this margin pressure to begin to ease as the year progresses.

Long term, there are many multi-year growth opportunities ahead of us, that gives me confidence in our future.There are currently more technology transitions occurring concurrently than I’ve seen in 20 years. Long-term megatrends like hybrid cloud, hybrid work, security, IoT, 400 gig and beyond, 5G and Wi-Fi 6 as well as the move towards application observability will likely provide tailwinds to our growth. With our portfolio in such a strong position to help our customers, I’m quite optimistic about what’s ahead…

After a challenging April due to the COVID-related shutdowns in Shanghai, and the impact on semiconductor and power supplies, overall supply constraints began to ease slightly at the back half of the fourth quarter and continuing into the start of Q1. While the component supply headwinds remain, they have begun to show early signs of easing.” — Chuck Robbins, Chairman and CEO of Cisco Systems

Targeted pricing increases across Cisco Systems’ portfolio are also expected to improve its financial performance going forward. We appreciate that management is confident Cisco Systems’ growth trajectory will resume in earnest this fiscal year. The firm is turning a corner, and we expect Cisco Systems will see its free cash flows swell higher over the coming fiscal years.

Concluding Thoughts

Cisco Systems has a fortress-like balance sheet, is a stellar free cash flow generator, and its bright longer term growth outlook is underpinned by several powerful secular tailwinds. Sizable near-term headwinds remain, though as the worst of the COVID-19 pandemic fades and the COVID-related lockdowns in China eventually come to an end, Cisco Systems should be able to resume steady revenue and ultimately cash flow growth over the long haul. We continue to like Cisco Systems as an idea in the newsletter portfolios.

—–

Technology Giants Industry – META (formerly FB), AAPL, GOOG, AMZN, MSFT, CSCO, V, MA, PYPL, INTC, ORCL, QCOM, TWTR, IBM, ADBE, NVDA, CRM, AMD, AVGO, BABA, BKNG, BIDU, TSM, FFIV, TXN, EBAY, ADP, PAYX, MU, KFY, MAN, KLAC, LRCX, AMAT, ADI

Tickerized for CSCO, ANET, JNPR

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan owns shares of DIS, META, GOOG, VRTX, and XLE and is long VRTX call options. Apple Inc (AAPL), Cisco Systems Inc (CSCO) and Microsoft Corporation (MSFT) are all included in both Valuentum’s simulated Best Ideas Newsletter portfolio and simulated Dividend Growth Newsletter portfolio. Alphabet Inc (GOOG) Class C shares, Meta Platforms Inc (META), Korn Ferry (KFY), and Visa Inc (V) are all included in Valuentum’s simulated Best Ideas Newsletter portfolio. Oracle Corporation (ORCL) and Qualcomm Inc (QCOM) are both included in Valuentum’s simulated Dividend Growth Newsletter portfolio. ASML Holding NV (ASML), Meta Platforms, Oracle, and Taiwan Semiconductor Manufacturing Company Limited (TSM) are all included in Valuentum’s simulated ESG Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.