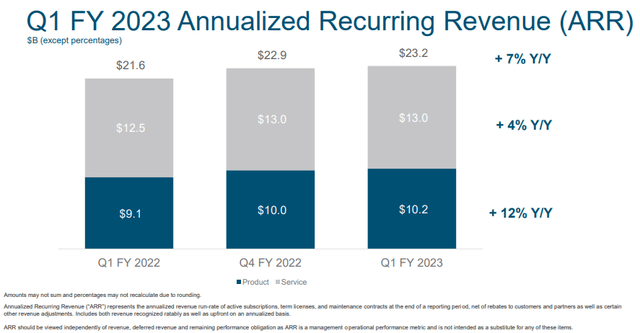

Image: Cisco’s annualized recurring revenue (ARR) continues to advance nicely. Image Source: Cisco

By Brian Nelson, CFA

On November 16, Cisco Systems, Inc. (CSCO) reported better than expected first-quarter fiscal 2023 results (for the period ending October 29, 2022) that beat expectations on both the top and bottom lines. The networking giant raised its revenue and adjusted earnings forecast for the fiscal year, indicating strong momentum behind its business amid a very uncertain economic backdrop for both consumers and businesses alike. We’re sticking with our fair value estimate of $50 per share for Cisco at this time.

The headlines for Cisco’s first-quarter fiscal 2023 results were fantastic. For starters, the company delivered the largest quarterly revenue in its history, while it put up the second-highest quarterly non-GAAP earnings per share since it was founded. Annualized recurring revenue (ARR) is now running at $23.2 billion (as shown in the image above), while software revenue and software subscription revenue advanced 5% and 11% on a year-over-year basis, respectively. Product ARR is up 12%.

We think the Street is still getting a handle on the firm’s business transformation, but we liked the momentum behind its ARR. We note, however, that product orders continue to be lumpy, falling 14% on a year-over-year basis during the period, but this growth rate comped a very strong 34% growth rate in the same period last year.

The firm raised its fiscal 2023 revenue guidance to the range of 4.5%-6.5% growth on a year-over-year basis, up from its prior target range of 4%-6%. Cisco also upped its fiscal year adjusted earnings outlook, with the networking company now expecting adjusted earnings per share between $3.51-$3.58 per share for the year, compared to management’s prior expectations of $3.49-$3.56.

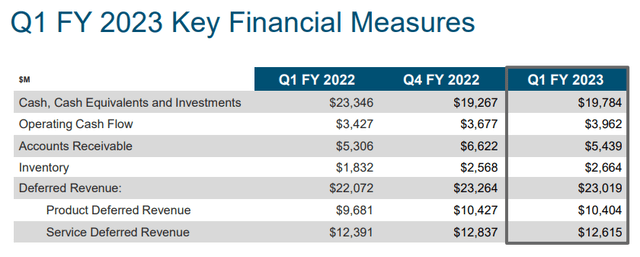

Image: Cisco continues to be a strong free cash flow generator and holds a tremendous net cash position. Image Source: Cisco

Cisco’s cash flow from operating activities came in at ~$3.96 billion during its fiscal first quarter, which was an increase of 16% compared with the ~$3.43 billion registered in the prior-year period. Free cash flow was ~$3.8 billion in the period, up materially from $3.3 billion in last year’s quarter. The firm ended October with ~$19.8 billion in cash and cash equivalents (against short- and long-term debt of ~$8.9 billion), offering a nice net cash position and a key source of cash-based intrinsic value. During the quarter, Cisco bought back ~$500 million in shares as it continued to pay a very nice dividend. The firm has ~$14.7 billion remaining on its share repurchase program.

Concluding Thoughts

Cisco’s first-quarter results for fiscal 2023, released November 16, were solid, and the firm’s pace of annualized recurring revenue continues to advance nicely, giving it strong visibility into future performance. The networking giant raised its guidance for fiscal 2023 for both the top- and bottom-lines, though we note that product orders did fall meaningfully in the quarter on a year-over-year basis (but this was largely due to a tough comparison from last year’s period). Its free cash flow generation was solid in the quarter, and we continue to like the company’s net cash position. Cisco continues to buy back its own undervalued stock and yields an attractive ~3.4% at this time.

Tickerized for CSCO, ANET, JNPR, SPLK, IBM, HPE, NTNX, NEWR, IYZ, TRFK, IGN, CIBR, FDN

———————————————

About Our Name

But how, you will ask, does one decide what [stocks are] “attractive”? Most analysts feel they must choose between two approaches customarily thought to be in opposition: “value” and “growth,”…We view that as fuzzy thinking…Growth is always a component of value [and] the very term “value investing” is redundant.

— Warren Buffett, Berkshire Hathaway annual report, 1992

At Valuentum, we take Buffett’s thoughts one step further. We think the best opportunities arise from an understanding of a variety of investing disciplines in order to identify the most attractive stocks at any given time. Valuentum therefore analyzes each stock across a wide spectrum of philosophies, from deep value through momentum investing. And a combination of the two approaches found on each side of the spectrum (value/momentum) in a name couldn’t be more representative of what our analysts do here; hence, we’re called Valuentum.

———————————————

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, and RSP. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.