Image Source: Cisco

By Brian Nelson, CFA

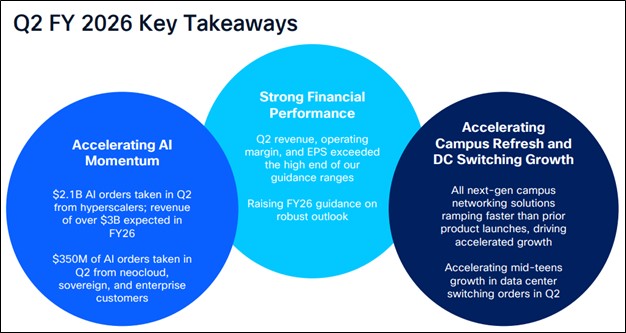

On February 11, Cisco (CSCO) reported better than expected results for the second quarter of fiscal 2026. Quarterly revenue of $15.3 billion increased 10% year-over-year, beating the consensus forecast of $15.11 billion, while non-GAAP earnings per share for the quarter came in at $1.04, up 11% year-over-year, and better than the consensus estimate of $1.02. The double-digit top and bottom-line growth exceeded Cisco’s guidance, and it was encouraging to see earnings advance faster than revenue in the quarter. Non-GAAP gross margin came in at 67.5%, down from 68.7% in last year’s quarter, while its non-GAAP operating margin was 34.6% in the quarter.

Management had the following to say about the results:

Cisco’s strong second quarter and first half of fiscal 2026 demonstrate both the power of our portfolio and the fundamental role we continue to play in connecting and protecting customers in a rapidly evolving landscape. With over 40 years of customer trust, global scale, and a relentless focus on innovation, we believe Cisco is uniquely positioned to deliver the trusted infrastructure needed to securely and confidently power the AI-era.

In Q2, we delivered double-digit growth on both the top and bottom lines which exceeded the high end of our guidance and puts us on track to deliver our strongest revenue year yet in fiscal 2026. Operating margin was also above the high end of guidance, as we continue to drive profitability by exercising financial discipline. We see strong, broad-based demand for our technology solutions and remain focused on capturing the significant opportunities we see ahead.

Cisco noted that it experienced “accelerating, double-digit growth in product orders across all geographies and robust growth across all customer markets. AI infrastructure orders taken from hyperscalers totaled $2.1 billion, reflecting a significant acceleration in growth.” Remaining Performance Obligations came in at $43.4 billion at the end of the quarter, up 5% in total; deferred revenue was up 2% in total. In the quarter, it returned $3.0 billion to stockholders via $1.6 billion in dividends and $1.4 billion in buybacks. The remaining authorized amount for stock repurchases stands at $10.8 billion. Cisco ended the quarter with $15.8 billion in cash and investments and $30.1 billion in short- and long-term debt.

Looking to the third quarter of fiscal 2026, revenue is targeted in the range of $15.4-$15.6 billion, above the consensus estimate of $15.2 billion, while non-GAAP earnings per share is targeted in the range of $1.02-$1.04, in-line with the consensus forecast of $1.03. Its non-GAAP gross margin is expected in the range of 65.5%-66.5%, down sequentially due in part to higher memory prices, with its non-GAAP operating margin targeted to be between 33.5%-34.5% in the quarter.

For fiscal 2026, revenue is expected to be between $61.2-$61.7 billion, above the consensus estimate of $60.76 billion, while non-GAAP earnings per share is expected in the range of $4.13-$4.17, the midpoint of the range above the consensus forecast of $4.13. Cisco raised its quarterly dividend by a penny to $0.42, representing a 2% increase. Though memory costs are expected to hurt margins at Cisco in coming periods, we continue to like shares in the newsletter portfolios. Shares yield 2.2% at the time of this writing.

—–

Brian Nelson owns shares in SPY, SCHG, QQQ, QQQM, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, QQQM, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, QQQM, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.