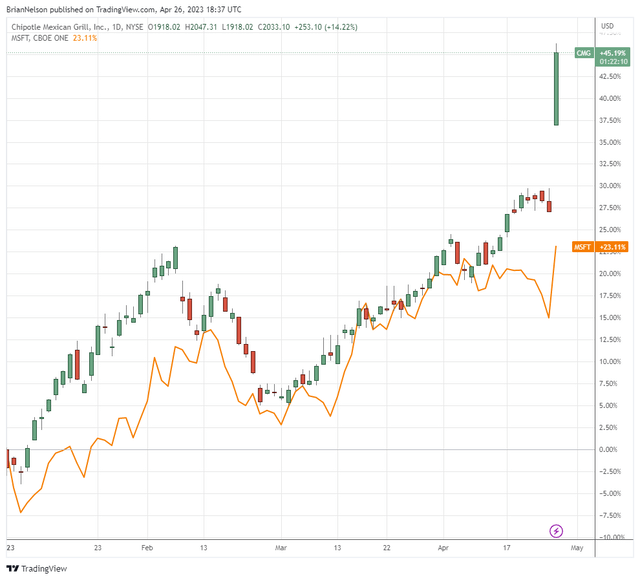

Image: Ideas in the Best Ideas Newsletter portfolio are doing great! Shares of Chipotle are up ~45% so far in 2023, while shares of large cap growth giant Microsoft (orange) are up more than 20% year-to-date.

By Brian Nelson, CFA

The UK Competition and Markets Authority (CMA) has decided to block Microsoft’s (MSFT) deal with Activision (ATVI). The CMA noted that the combination would “result in the most powerful operator in the fast-developing market for cloud gaming, with a current market share of 60%-70%, acquiring a portfolio of world-leading games with the incentive to withhold those games from competitors and substantially weaken competition in this important growing market.” Microsoft has been willing to work with regulators to get the deal done, but the executive team may be forced to move past the MSFT-ATVI potential tie-up.

We’re okay with the CMA decision given that it will ensure that Microsoft retains a large net cash position on its books, which is a key component of its cash-based sources of intrinsic value and dividend growth potential. In some respects, the failed proposal reduces merger integration risk and may allow Microsoft to focus more intensely on artificial intelligence [AI]. Microsoft’s shares soared during the trading session April 26 thanks to strong third-quarter fiscal 2023 performance for the period ending March 31 led by its Azure cloud business segment. We continue to be enthralled by Microsoft’s long-term growth potential in the cloud and with respect to artificial intelligence, and from what we can tell, Microsoft remains in the lead with AI given its big investment in ChatGPT.

Burrito maker Chipotle (CMG) blew the market’s socks off with its first-quarter 2023 earnings report, released after the market close April 25. During the period, total revenue advanced 17.2% thanks to strong double-digit (+10.9%) comparable restaurant sales expansion. Margins are also moving in the right direction, despite inflationary pressures. The company’s operating margin advanced to 15.5% in the quarter, up from 9.4% in last year’s period, while its restaurant level operating margin came in at 25.6%, which was up 490 basis points on a year-over-year basis. Chipotle’s diluted earnings per share came in at $10.50 in the quarter, which surged from the $5.70 mark it achieved in the year-ago period. Last week, we noted in an April 18 note that Chipotle’s chart looked awesome and that we plan to raise our fair value estimate for shares. Chipotle’s first-quarter 2023 report only provides more support for a higher intrinsic value estimate.

Valuentum’s April Best Ideas Newsletter (pdf) >>

———-

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, and RSP. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.