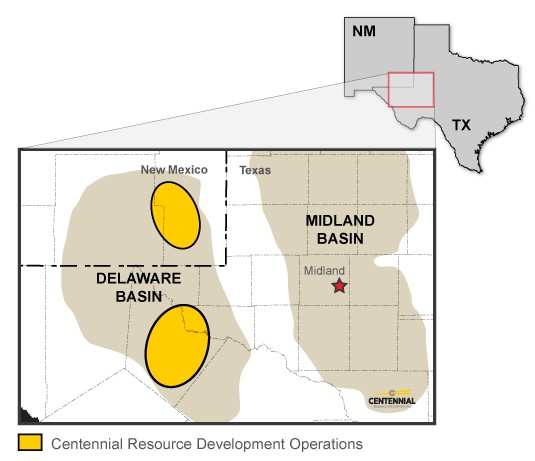

Image Source: Centennial Resource Website

Centennial Resource Development is an upstream oil & gas company that is solely focused on developing the Delaware Basin, located in West Texas and Southeastern New Mexico. The company was created through the business combination of Centennial Resources Production LLC, Riverstone Holdings LLC, and Silver Run Acquisition Corporation back in 2016. What makes Centennial Resource Development interesting is that is it run by the founder of upstream giant EOG Resources Inc, Mark Papa, who acts as CEO and Chairman of this up-and-coming company. At the end of the second quarter of 2018, Centennial Resource Development had an economic interest in 80,100 net acres (90% operated) within the Delaware Basin.

By Callum Turcan

The goal of capital appreciation is in part to find undervalued companies with promising growth trajectories that are run by quality management teams. Within the oil & gas space, under-covered Centennial Resource Development fits this bill. As a pure-play on the Delaware Basin that is run by the founder of EOG Resources (EOG), Centennial Resource (CDEV) may be a good way to play both the recovery in the oil markets (in particular, rising West Texas Intermediate prices) and the American energy renaissance.

Evaluating Centennial requires a forward-looking approach. The company is sitting on 2,400 potential well locations in Reeves County, Texas, and Lea County, New Mexico, putting those opportunities squarely in the Tier 1 category when it comes to upstream upside. Centennial is targeting oil-rich well locations within the Wolfcamp and Bone Spring formations, locations that when hydraulically fractured can produce wells with a 60% oil cut (meaning that over the lifetime of one of these wells, 60% of its hydrocarbon production will be crude oil). Other opportunities will come from developing the Avalon/Leonard formation, the deeper Wolfcamp horizons, and the third bench of the Bone Springs formation (developments that are already underway).

These are extremely profitable wells, even when factoring in the ongoing differential issues out of the Permian Basin. In short, oil produced in the Permian Basin (West Texas & Southeast New Mexico) is selling at a discount to oil deliveries to the Cushing oil hub in Oklahoma due to limited pipeline takeaway capacity relative to exiting production streams. This issue is expected to be alleviated by late 2019 or early 2020 as many new pipelines are brought online, which will be able to route larger oil volumes across Texas to the Gulf Coast and up to Cushing. The Midland-to-WTI futures curve indicates the differential may evaporate by December 2019.

In the meantime, crude-by-rail options and expansions of existing pipeline systems (i.e. Midland-to-Sealy and Sunrise) will keep the Midland-to-WTI differential contained. As of this writing, the differential stands at ~$6.50 per barrel through the rest of 2018. During the second quarter of 2018, Centennial Resource sported a net profit margin of 29.18%, up materially from the 22.80% net profit margin it sported during the second quarter of 2017. On a half-year basis, Centennial Resource’s net profit margin rose to 29.89% in first half of 2018 from 20.10% in the first half of 2017. Higher realizations for its oil production and economies of scale were key to realizing this improvement.

Impressive Growth Expected to Continue

Centennial Resource posted $129.6 million in net income during the first half of this year on $433.7 million in revenue, versus $30.6 million in net income on $152.2 million in revenue during the first half of last year. We expect this impressive growth trajectory to continue as Centennial Resource has launched an aggressive growth program that utilizes a moderate outspend (capital expenditures are set to exceed operating cash flow) to take advantage of a $70s WTI world.

On average, Centennial Resource produced 29,664 barrels of oil equivalent per day net during the second quarter of 2017. By the second quarter of 2018, that had grown to 57,528 BOE/d net. According to management’s guidance, Centennial is on track to produce around 64,000-65,000 BOE/d net by the fourth quarter of 2018.

During the 12 months ending in the second quarter of 2018, Centennial Resource’s oil mix shifted lower to 54.4% from 58.8%. The reason for this decrease was due to Centennial being able to market its ethane production as a liquids product, instead of being forced to put that ethane back into the natural gas production stream. Management expects that Centennial’s production mix will shift back towards 58-60% crude by the end of 2018.

Centennial Resource’s noted that the shift in its production mix was “entirely due to the ethane recovery and was not caused by any fundamental change in the GOR from any of our wells.” For this reason, management “expect(s) its percentage oil mix to end the year in the high 50% area.” Marketing larger amounts of its ethane volumes as a liquid means Centennial is getting more for its hydrocarbon output, a big plus going forward.

Access to Credit Appears Sound

To fund its outspending, Centennial can utilize its revolving credit line and growing cash flow generation. At the end of June 2018, Centennial had only drawn $30 million of its $600 million revolving credit line, leaving $569.1 million in credit capacity after taking into account $0.9 million in letters of credit posted against the facility. The revolving credit line runs through May 2023. Last year, Centennial issued out $400 million in 5.375% senior notes due 2026 to raise funds, which is its only other source of interest-bearing debt. With a debt-to-capital ratio of just 11%, Centennial may be able to easily tap its credit line to raise liquidity without raising concerns about being over-levered.

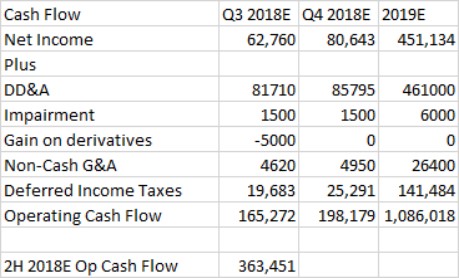

Centennial Resource generated $311.4 million in adjusted operating cash flow during the first half of 2018, which doesn’t take into account working capital changes (which were positive during that period). Note that Centennial Resource plans on spending roughly $970 million this year on capital expenditures. Exhibit C highlights our operating cash flow assumptions for the second half of 2018 and for 2019. Under the assumptions given in Exhibit B and the income statement shown in Exhibit A, we assume Centennial Resource generates $363.5 million in operating cash flow during the second half of 2018. That still indicates Centennial Resource would need to utilize roughly $300 million in outside funding to cover its probable outstand. The goal of this outspend is to ramp up its production base to levels where the company can be entirely self-funded, an event which should trigger significant capital appreciation.

By 2019, Centennial Resource appears ready to generate almost $1.1 billion in operating cash flow, under the assumptions laid out in Exhibit B. The capital expenditure budget required to generate our production growth assumptions would probably come in slightly above that level, which is why having a strong balance sheet is key. Centennial Resource’s biggest obstacle is the Midland-to-WTI differential and the massive Waha Hub differential to Henry Hub. To combat this issue, management has entered into several firm transportation commitments to ensure Centennial will be able to properly market its upstream output.

“We’ve recently entered into a 6-year firm sales agreement with a large diversified crude oil purchaser. Beginning in January of 2019, this contract allows for firm gross sales of 20,000 barrels oil per day, increasing to 30,000 barrels of oil per day in 2020, and for the remainder of the agreement. By utilizing the buyers existing FT, this agreement will provide Centennial with firm physical take away capacity out of the Permian Basin. The agreement will initially be based of Midland pricing and switch to Brent-based pricing beginning in 2020. Due to confidentiality agreements as well as for competitive reasons, we cannot discuss the specific pricing terms of this contract, but believe the commercial terms are attractive in today’s market.” – Centennial Resource Inc Q2 2018 Conference Call

What is most important about this statement is that by 2020, Centennial will begin realizing Brent-based pricing for 30,000 barrels per day of its oil production, less the cost of transportation. Brent trades at a $8-10/barrel premium to West Texas Intermediate, and WTI trades at a premium to Midland WTI. Realizing this uplift is why we think Centennial Resource is set to post tremendous growth in its bottom line during the 2020s. Gauging the cash flow generation of Centennial Resource is a difficult task without more formal 2019 guidance, but our financial assessment showcases the power a rising production base and higher oil realizations will have on this growth opportunity.

“Given our bullish macro view, we see no need to change our targeted organic growth trajectory towards 65,000 barrels of oil a day in 2020.” – Centennial Resource Inc Q2 2018 Conference Call

As an aside, at first glace, it appears that Centennial Resource is becoming less profitable in the third quarter of 2018 versus the prior quarter as its net income generation is expected to move mildly lower sequentially. It is important to note that this is due to a large mark-to-market gain in the value of Centennial Resource’s hedging instruments and isn’t a reflection of underlying weakness in its business. While we assume operating costs on a barrel of oil equivalent basis will move higher due to cost reinflation in the oil patch, that is more than offset by improving realizations due to a shrinking Midland-to-WTI differential, and economies of scale realized elsewhere.

What Are the Risks?

Centennial Resource has its risks, the company’s growth trajectory is largely determined by the price of oil and the ability to move its upstream production streams out of the Permian Basin. On the crude front, the futures curve along with Centennial Resource’s ability to secure firm transportation commitments along pipelines indicates the worst is behind the company. On the natural gas front:

“…through a series of firm transportation of firm sales agreements, we have contracted capacity on multiple pipelines for 100% of Centennial’s gross residue gas. Notably, these contracts cover Centennial’s gas both to the WAHA Hub and out of the Permian Basin through the end of 2021. As a result, we did not envision a scenario whereby Centennial will be required to flare or shut-in production, during the time period when we anticipate Permian Basin-wide production will be significantly exceed available take away capacity. In turn, these agreements will also allow us to recognize the economic value of both natural gas and NGL’s, which represent approximately 20% of our total revenue.” – Centennial Resource Inc Q2 2018 Conference Call

As Venezuela’s economy becomes consumed by political and economic turmoil, as US-led sanctions on Iran cripple the nation’s ability to export oil and condensate, and in light of OPEC having limited spare capacity in case turmoil arises in Libya or Nigeria, it appears top tier oil plays offers asymmetrical upside to investors willing to take the long-term view. Management has secured the necessary takeaway capacity to ensure Centennial Resource can continue onwards with its growth story, the question now is what will WTI do in the meantime. We’re watching this idea very closely.

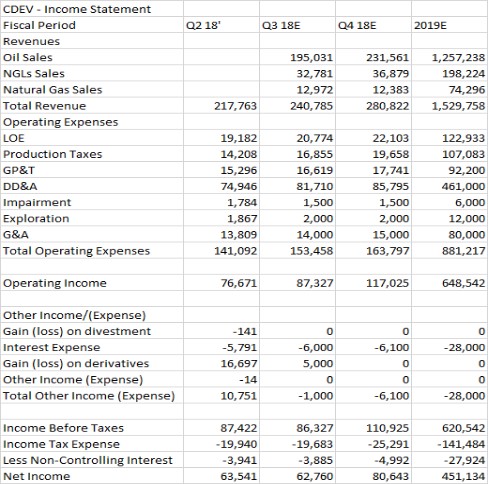

Exhibit A – (thousands of USD)

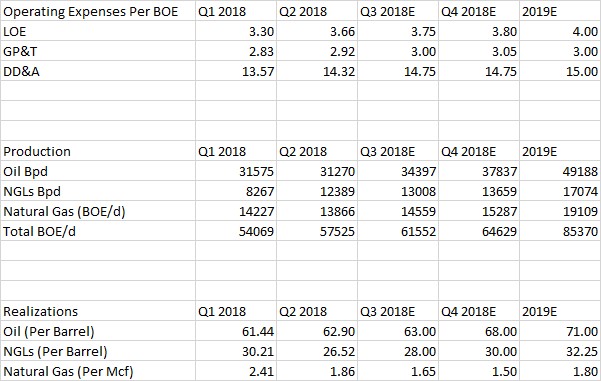

Exhibit B (thousands of USD)

Exhibit C – (thousands of USD)

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Independent energy contributor Callum Turcan does not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.