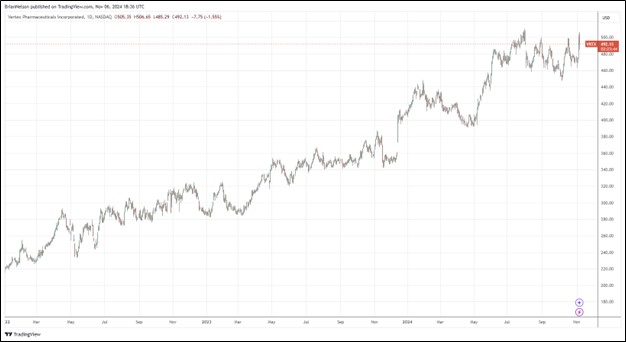

Image: Vertex Pharma’s shares have done quite well the past couple years.

By Brian Nelson, CFA

Vertex Pharma (VRTX) reported better than expected third quarter results November 4 with revenue and non-GAAP earnings per share coming in ahead of the consensus forecasts. Product revenue advanced 12% in the quarter on a year-over-year basis thanks to strong performance of its cystic fibrosis (CF) therapy TRIKAFTA/KAFTRIA. GAAP and non-GAAP net income were $1.0 billion and $1.1 billion, respectively, for both the third quarter of 2024 and the third quarter of 2023.

Management was upbeat with its commentary in the press release:

The third quarter marked another period of strong progress, with continued revenue growth and outstanding execution across the business, and we are again increasing our full-year product revenue guidance. Launch preparedness is well underway as we look forward to the potential approvals of the vanzacaftor triple for cystic fibrosis and suzetrigine, a new class of medicine for moderate-to-severe acute pain. With a broad and deep pipeline and three additional programs advancing to Phase 3 development in the last quarter alone, Vertex is well positioned for continued long-term growth.

Vertex’s cash and marketable securities were $11.2 billion at the end of the quarter compared to $13.7 billion at the end of last year, the decline driven by its acquisition of Alpine Immune Sciences and the repurchase of common stock, partially offset by cash-flow generation. The company ended the quarter with no traditional debt. Looking to full-year 2024, Vertex raised its product revenue guidance to $10.8-$10.9 billion from $10.65-$10.85 billion thanks to continued growth in its CF business and the launch of CASGEVY in approved indications (sickle cell disease and transfusion-dependent beta thalassemia) and geographies.

We continue to like Vertex’s established position in cystic fibrosis and its opportunity in gene-editing therapies as well as a new class of medicine for acute pain (VX-548) that’s without the limitations of opioids. The company’s pipeline is also progressing nicely with three additional programs advancing to Phase 3 – suzetrigine in painful diabetic peripheral neuropathy (DPN), povetacicept in immunoglobulin A nephropathy (IgAN), and VX-880 in Type 1 diabetes (T1D). The high end of our fair value estimate range for Vertex stands at $640 per share.

—–

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.