Image Source: Carvana Co. – IR Presentation

By Callum Turcan

Carvana Co. (CVNA) seeks to disrupt the used car and used light truck market in the United States as a leading e-commerce platform for used automobile sales. Perhaps best known for its “car vending machines” that are located in key metropolitan areas across the US, Carvana wants to fundamentally transform the way consumers buy, sell, and ultimately ascertain the proper value for used automobiles. Please note that Carvana does not pay out a common dividend at this time and is unlikely to do so in the foreseeable future given its negative free cash flows.

Industry Overview

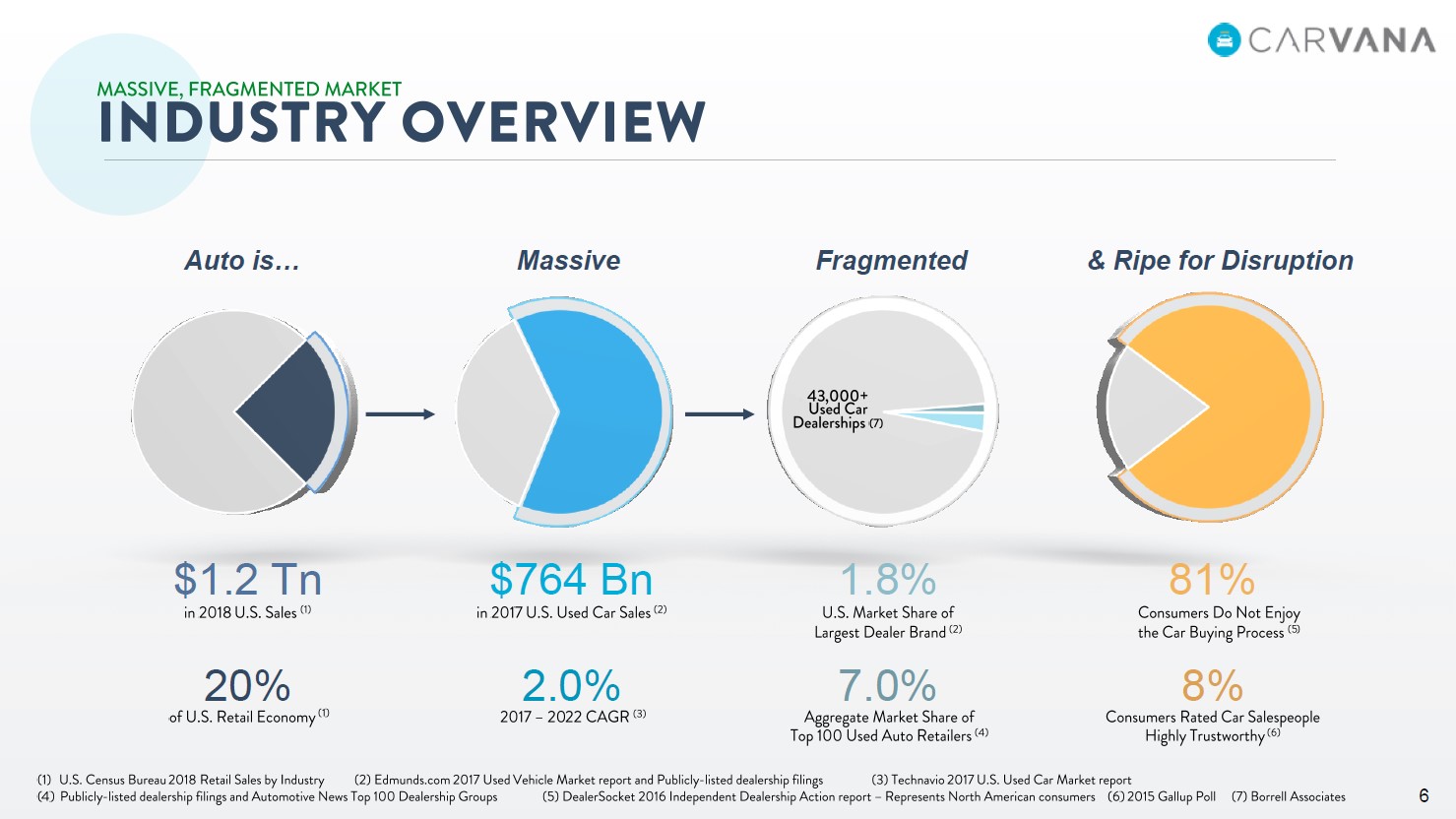

The company noted that the US used auto sales market clocked in at $764 billion in 2017 according to third-party auto market data research provider Edmunds.com Inc. This is a market that Carvana noted another third-party market research provider sees as growing by 2% CAGR from 2017-2022. There are over 43,000 used car dealerships in the US, making this a highly fragmented market and one ripe for disruption. Carvana further highlights how most consumers aren’t satisfied with the way the entire used automobile sales process is handled.

George Akerlof’s famous 1970 paper “The Market for Lemons” highlighted the used auto market as an example of how asymmetrical distribution of information leads to distorted markets where clearly one party (the used car salesperson) has an advantage over the other. In short, used automobile dealerships are strongly incentivized to only put ‘lemons’ out on the lot and to reserve the best cars for different sales avenues as consumers will arbitrarily discount the value of the best cars while inflating the value of lemons (in theory). Carvana seeks to fundamentally change this paradigm for the benefit of consumers and its shareholders.

Image Shown: Carvana seeks to disrupt an enormous yet sleepy market that’s highly fragmented. Image Source: Carvana – IR Presentation

Carvana in many ways seeks to democratize the used automobile market by ensuring a standard level of ranking, quality and inspection services are provided across all different types of automobiles. The company leverages 21st century solutions to fix 20th century problems as consumers are able to “research and identify a vehicle, inspect it using interactive high definition photography, obtain financing and warranty coverage, value their trade-in, complete their purchase and schedule delivery or pick up, all from our online platform” with employees delivering those vehicles via “branded haulers as soon as the next day.” Additionally, please note that these sales are backed by a seven-day return policy, which is something many used auto dealerships wouldn’t want to offer.

Need Scale and Eventually Free Cash Flow

The opportunity is clearly there for those with scalable business models to cater to this need. As Carvana grew its used automobile inventory and invested in its expansion efforts, the firm has been unable to generate positive free cash flows or even positive net operating cash flows for that matter. Net operating cash flows were negative from 2016-2018. In 2018, Carvana’s free cash flows came in at negative ~$0.55 billion, and its balance sheet is already burdened with a meaningful amount of debt.

At the end of June 2019, Carvana had a total debt load of just over $0.8 billion while its cash, cash equivalents, and restricted cash on hand stood at less than $0.1 billion, giving the firm a significant amount of net debt. Please note that a large portion of Carvana’s assets are represented by vehicle inventory ($0.6 billion at the end of June 2019) and finance receivables held for sale ($0.2 billion at the end of June 2019).

On the one hand, Carvana’s GAAP revenues have surged from less than $0.4 billion in 2016 to almost $2.0 billion by 2018 while its GAAP gross margin almost doubled during this period to ~10.1%. That indicates its business model exhibits signs of scalability, as strong revenue and gross margin growth are required to cover rising operating expenses. On the other hand, from 2016-2018 Carvana’s GAAP operating expenses (represented by SG&A) grew four-fold to over $0.4 billion, consuming all of the firm’s incremental gross profit during this period. At some point, operating expense growth will need to level off in order to allow for incremental gross profits to filter down to Carvana’s bottom line and most importantly, to enable positive free cash flows in the future.

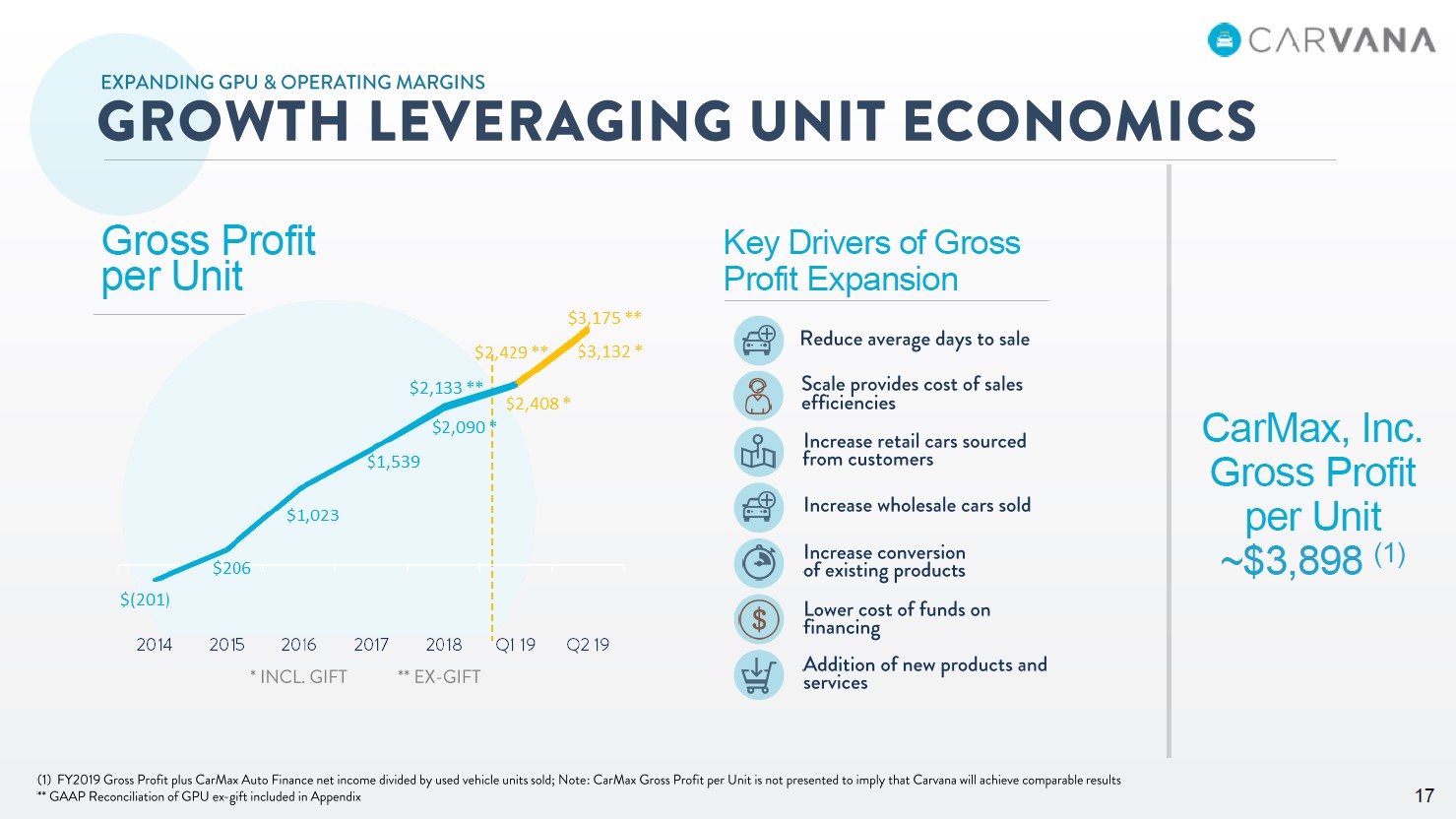

Carvana sees multiple avenues allowing for further gross margin expansion over time including reducing average days to sale and increasing its inventory turnover ratios, further growing its inventory to allow for a more expansive offering, adding new products and services to its business model, and leveraging economies of scale to drive down operating expenses on a relative basis.

Image Shown: Carvana is targeting meaningful gross margin expansion in the future as part of a years long march towards profitability. Image Source: Carvana – IR Presentation

We caution that Carvana is exposed to a cyclical market, even if management sees secular growth trends supporting the firm’s long-term growth trajectory. That being said, used car and used light trucks sales held up relatively well in the US during the Great Recession according to data provided by the Federal Reserve Bank of St. Louis. Personal consumption expenditures on used car and used light trucks by dollar value declined initially during the Great Recession before recovering, which ultimately culminated into an impressive surge in used car and used lights truck sales during the 2010s. Net purchases of used cars and used light trucks dropped from $113.6 billion in the fourth quarter of 2007 to $94.4 billion in the fourth quarter of 2008 before recovering to $109.1 billion by the fourth quarter of 2010. That figure hit $165.7 billion in the second quarter of 2019.

Concluding Thoughts

Carvana is supported by more than just its ambition or willingness to disrupt an enormous yet sleepy industry; the firm is capitalizing on strong secular growth trends as US consumers increasingly turn towards used car and used light truck offerings. We caution that as part of its desire to bulk up its inventory, Carvana is now heavily indebted and needs to retain access to capital markets to keep the momentum going. Since its IPO in 2017, shares of CVNA have climbed steadily upwards making equity issuance an easier task. Additionally, in a low interest rate environment Carvana should find it easier to tap debt markets for funds at relatively attractive rates, keeping in mind that there are limits to this strategy.

Unlike more recent IPOs of high flying companies with absolutely no chance of becoming profitable, Carvana appears to have a scalable business model. That being said, we aren’t interested in shares at current levels given the already impressive increase in CVNA and the lack of clarity of its medium-term trajectory given its negative free cash flows. The long-term outlook is bright but expect meaningful volatility beforehand. For the established companies in this arena, we caution that Carvana may one day represent a serious competitive threat.

Auto Making Industry – F GM HOG HMC TSLA TM

Auto Specialty Retailers Industry – AAP AN AZO CPRT GPC KMX KAR MNRO ORLY PAG

Related: CARZ, ADRA, RXI

—-

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. General Motors Company (GM) is included in Valuentum’s simulated Best Ideas Newsletter portfolio and simulated Dividend Growth Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.