By Brian Nelson, CFA

Campbell Soup (CPB) recently reported fourth quarter fiscal 2024 results that were mixed. Revenue came in slightly lower than forecast, while non-GAAP earnings per share was a bit higher than the consensus estimate. Net sales increased 11% thanks to its acquisition of Sovos Brands, but they fell 1% on an organic basis due to weaker net price realization. Adjusted earnings before interest and taxes [EBIT] increased 36%, to $329 million, which includes its acquisition of Sovos. Adjusted earnings per share increased 26%, to $0.63.

Management had the following to say about the quarter:

We finished fiscal 2024 with solid fourth-quarter performance including sequential volume improvement and margin expansion versus prior year and delivered significant progress against our longer-term strategic plan despite an evolving consumer landscape. I’d like to thank the entire Campbell’s team for finding ways to deliver solid results in this dynamic environment. The strength of the Meals & Beverages recovery, including Soup, was a standout in the quarter as was the competitive advantage of our supply chain. The integration of Sovos Brands is progressing ahead of our expectations, marking a transformative shift in our Meals & Beverages growth trajectory. We’ve also advanced our Snacks margin journey, while delivering significant innovation and improved sales and marketing capabilities. All of this provides continued confidence in our ability to deliver sequential progress in fiscal 2025 as we continue to navigate the steady and ongoing recovery in the industry. More importantly, as we look ahead, we are strengthening our conviction in our longer-term outlook driven by our advantaged market-leading brands, capabilities and execution.

Campbell Soup’s adjusted gross profit increased to $719 million from $632 million in the quarter, while its adjusted gross profit margin advanced 80 basis points, to 31.4%, thanks in part to supply chain improvements. Adjusted marketing and selling expenses fell 4% in the period thanks to easier comps, while administrative expenses increased 1% on an adjusted basis. Excluding items impacting comparability, Campbell Soup’s fiscal fourth quarter results were solid.

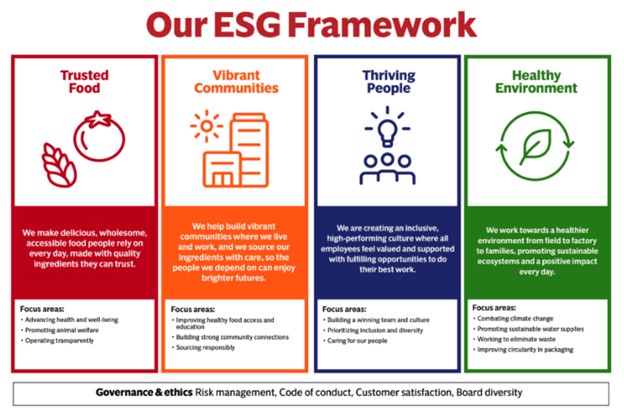

ESG Matters

Image Source: Campbell Soup

Campbell Soup has a 81-page Corporate Responsibility Report. Campbell’s efforts with respect to ESG have been notable. Some of the highlights from the report include commencing “a 12-year virtual renewable power purchase agreement that will reduce (its) reported Scope 2 greenhouse gas emissions,” lowering “the amount of waste to landfill…reversing a previous trend,” and increasing “the amount of post-consumer recycled content used in (its) beverage bottles.”

Campbell also “exceeded (its) goal to source 50% of (its) tomatoes, potatoes, cashews, and almonds from suppliers engaged in sustainable agricultural programs, two years early.” It’s working hard to enhance the sustainability of its supply chain, converting it to “gestation-crate-free pork and broiler chickens raised in improved environments, and increasing (its) use of cage-free eggs.” During fiscal 2023, the firm “supported community organizations with over $2 million in giving from The Campbell’s Foundation.”

Concluding Thoughts

Looking to fiscal 2025, Campbell’s net sales are expected to expand 9%-11% thanks to a twelve-month contribution of Sovos Brands, offset in part by the divestiture of Pop Secret. Organic net sales are expected to be flat to up 2%, which reflects positive volume/mix compared to last year. Adjusted EBIT growth is targeted at 9%-11%, including Sovos and the impact of the divestiture of Pop Secret. Adjusted earnings per share growth is expected in the range of 1%-4%, inclusive of Sovos acquisition and Pop Secret divestiture, to $3.12-$3.22 (versus $3.23 consensus).

—–

NOW READ: What to Do During This Market Selloff

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.