Image Source: Symantec Corporation – Fall 2018 IR Presentation

By Callum Turcan

Reportedly, semiconductor Broadcom Inc (AVGO) is getting close to acquiring Symantec Corporation (SYMC) in a deal that could be worth ~$22.0 billion when including debt. Symantec offers cybersecurity services to more than 350,000 organizations and 50 million individuals around the world, and would mark Broadcom’s second big foray into the software space after acquiring CA Technologies for $18.9 billion in cash last year. We would like to take this time to highlight the value of using enterprise cash flow analysis, particularly as it relates to the see-saw trading action in shares of Symantec, and why Broadcom has reportedly shown such interest in acquiring the company.

Image Shown: Symantec shares has seen volatile trading action over the past several months.

Overview in Brief

The purchase of CA Technologies was Broadcom’s way of diversifying away from the semiconductor space. So far, that move has paid off, keeping in mind these are early days.

In June, we published a note (that can be viewed here) covering the downward revision in Broadcom’s guidance for its FY2019 that was announced on June 13 after the bell which sent shares of AVGO plummeting the next day. We could like to stress that based off management commentary and guidance, Broadcom’s pro forma revenue is now forecasted to decline in FY2019 versus FY2018 levels. On a positive note, Broadcom’s new CA Technologies asset continues to perform well due to strength in the infrastructure software space.

Back in May 2019, Symantec’s fortunes were looking a whole lot different as its CEO had just abruptly left while the company had also just issued a profit warning. Several other of Symantec’s top executives had already left within the past year, raising serious issues concerning the stability of the cybersecurity firm’s leadership team. Shares of SYMC fell from $24 per share at the end of April to $18 per share by June 3. Activist shareholders looking to turn things around were already closing in long before the Broadcom news broke (Starboard acquired almost a 6% stake in the company, a position disclosed last August).

Why Enterprise Valuation Matters

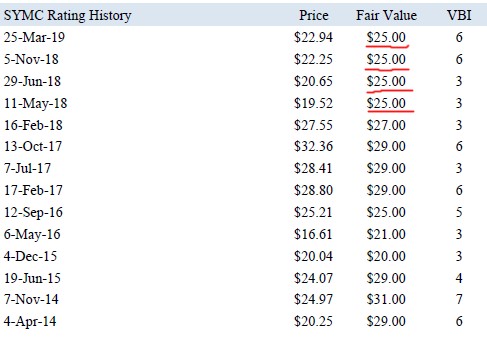

Our fair value estimate for shares of SYMC stands at $25.00, and that estimate hasn’t changed much over the past few years as you can see down below (from our 16-page Stock Report covering Symantec). Generally speaking, fair value estimates shouldn’t fluctuate much as the value of the discounted free-cash-flows-to-the-firm during the mid-cycle period and into perpetuity generally have the greatest influence on the fair value of the equity. Profit warnings are important, but more so as it relates to the trajectory of the company’s free cash flow generation. Transformative acquisitions, major structural shifts in the industry the company in question operates in, or other fundamental changes are all potential sources of meaningful changes in fair value.

Image Shown: Our Fair Value Estimate for shares of Symantec hasn’t changed much over the past several years.

Fair value estimates can change as new information becomes available, and the buying and selling activities of investors can be used as a gauge to get a reading on what the market thinks of a firm’s business trajectory, but panic is never a good strategy. Symantec has its problems, but fundamentally, this is a quality free cash flow generator with a promising growth runway as global cybersecurity needs continue to grow alongside growth in connected devices. It appears a lot of investors were in full blown panic mode May 2018 when they began unloading shares of SYMC under $20.

Symantec’s net debt load stood at $2.4 billion at the end of March 2019 (inclusive of short-term debt), with a total debt burden of $4.5 billion. The firm generated $1.5 billion in net operating cash flow in FY2019, up 56% from FY2018 levels, while spending just $0.2 billion on capital expenditures. As Symantec’s business model is capex-light, the company was able to generate $1.3 billion in free cash flow in FY2019. Please note Symantec’s fiscal year ends in March. Its net debt load is very tame by comparison, and we forecast Symantec will continue to be very free cash flow positive going forward. Here’s how we view the software industry, from our 16-page Stock Report;

“Participants in the software security industry focus on protecting important information wherever it resides—whether in servers, computers, mobile devices, or in the cloud. The space is intensely competitive, and some companies may offer their technology for free, engage in aggressive marketing, or pursue competitive partnerships. Firms also face indirect competition from application/operating system providers that may embed security solutions/functions in their own products. Participants must continuously develop new and enhanced services to meet changing customer demands. We’re neutral on the group.”

What Broadcom Gets

Bloomberg reported that Broadcom expects to realize $1.5 billion in annual synergies by acquiring Symantec. That’s likely due to G&A redundancies and possible overlap with its recent CA Technologies purchase, on top of other factors such as potential revenue upside via cross-selling. We caution that this is a rumored synergy figure, but let’s use that as a baseline to highlight why Broadcom would be interest in acquiring Symantec after the recent tumble in its share price.

Let’s assume all of those synergies are realized by the end of year three and none are realized beforehand for simplicities sake. In this thought experiment, let’s add the discounted perpetuity of those $1.5 billion in annual synergies to the value of Symantec in the eyes of Broadcom. Using Broadcom’s estimated WACC of 9.8%, the discounted value of the synergy-related perpetuity comes out to $11.6 billion. However, that doesn’t include cash outlays as it relates to restructuring costs and interest expenses (interest expenses need to be factored in when gauging free cash flow to the firm, particularly as this is likely to be a debt fueled deal).

We value Symantec’s equity at $16.9 billion, so depending on the what price Broadcom pays if a deal does materialize, the semiconductor giant may come out ahead due to the positive impact synergies can have on future free cash flows to the firm.

Concluding Thoughts

Broadcom is a serial acquirer looking to break into the high-margin, high-growth software market to move away from the semiconductor market (a space we see as unfavorable to operate in). Symantec offers the company an effective way to do that, keeping in mind Broadcom’s balance sheet would take a hit if this materializes as a cash deal. We will be monitoring events closely as they unfold. Most importantly, always remember to use enterprise valuation when making big decisions; panic selling is a great way to ruin investment returns.

Related Tickers: Qualcomm Inc (QCOM), CrowdStrike Holdings Inc (CRWD), Intel Corporation (INTC)

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Intel Corporation (INTC) is included in Valuentum’s simulated Best Ideas Newsletter portfolio and the simulated Dividend Growth Newsletter portfolio. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.