Image shown: BioMarin’s stock price has had a choppy ride these past couple years.

BioMarin continues its impressive string of hits in the rare drug market. We continue to be impressed with the depth of the scientific advances brought forth by the company. An in-depth discussion of BioMarin’s pipeline is warranted, in our view, particularly in light of the potential for an expected, upcoming FDA approval.

By Alexander J. Poulos

Company Overview

BioMarin Pharmaceuticals (BMRN) is far from a household name even though the company has an impressive string of approved treatments in the field of rare and ultra-rare disease. Unlike traditional pharma or larger more well-known biotech firms whose primary focus is bringing forth treatments for the broad population such as diabetes and cancer, BioMarin’s intense focus on rare disease tends to pay off through the granting of orphan drug status that eliminates competition in the field for ten years in the US. The absence of competition coupled with an enormous price tag per treatment allows BioMarin to generate hefty sales even with a tiny pool of potential patients.

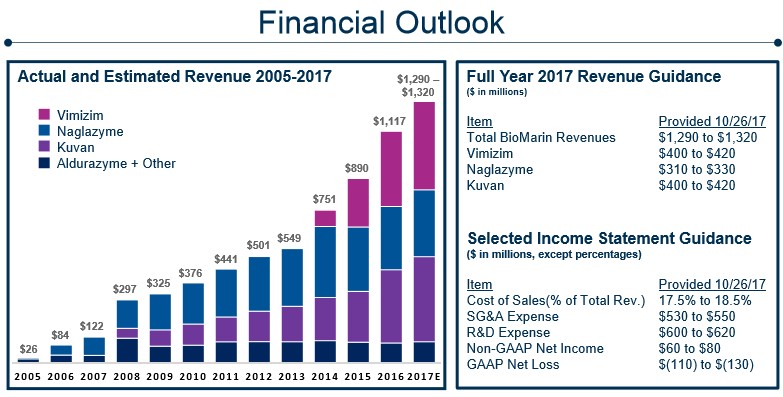

Image Source: BioMarin Pharmaceuticals 3Q17 Factsheet

Vimizin

Vimizin has grown into BioMarin’s top-selling product since its introduction in 2014. Vimizin is utilized for the treatment of Morquio A syndrome, an inherited autosomal recessive (both parents carry the defective gene) disorder where the patient will lack an adequate amount of the enzyme required for the body to break down sugar chains (glycosaminoglycans) during metabolism. Those afflicted with Morquio A may produce an adequate supply of enzyme but it may not work as expected.

Morquio A syndrome can lead to a host of medical problems with a few of the more prominent including a short stature, severe curvature of the spine, heart and vision problems including a murmur.

Kuvan

Kuvan is BioMarin’s revolutionary treatment for those afflicted with Phenylketonuria (PKU). PKU neatly falls into BioMarin’s expertise in rare disorders as PKU is an inherited condition that is estimated to affect less than 20,000 patients in the US. PKU is a condition where the enzyme required to process the amino acid phenylalanine (Phe) is missing or defective, thereby causing a build-up of Phe especially if the patient consumes foods that contain protein.

PKU can cause a host of side effects that will last the entirety of the patient’s life; some of the most common are forgetfulness, anxiety, and depression. The adherence to a strict diet that limits the intake of protein remains the hallmark for treatment of PKU, but additional therapy may be essential. Kuvan works by mimicking the effects of tetrahydrobiopterin (BH4), a substance that aids the PAH enzyme to lower the impact of Phe levels in the blood to an acceptable level.

Kuvan remains one of the oldest products in BioMarin’s product portfolio after initial marketing approval was granted in 2007. Kuvan is entering into its final phase of exclusivity, thus necessitating the need for BioMarin to bring forth additional products to offset the expected loss in revenue. We have identified three molecules from BioMarin’s near-term pipeline that have the potential to more than offset the loss of Kuvan.

Pegvaliase

In a clever bit of lifecycle management, BioMarin is widely expected to gain marketing approval in the first half of 2018 for its next-generation treatment for PKU. The newest molecule Pegvaliase (Pegylated recombinant phenylalanine ammonia lyase) is intended to improve on the dosing regimen of Kuvan. PEG-Pal in recent phase 3 trials reached its primary endpoint of reducing Phe levels, but failed to show a statistically significant increase in cognitive score.

We suspect the product will gain approval based on the long-established track record of Kuvan as we feel the reduction of Phe will significantly aid the overall patient population. Assuming PEG-PAL gains approval, we expect the product will more than offset the anticipated loss of Kuvan, but PEG-PAL itself will not assist BioMarin in growing the top-line or becoming a profitable biotech. For BioMarin to transition into a profitable biotech, in our view, it will need to produce a minimum of one additional product from its near-term-pipeline.

A win in either Vosoritide for Achondroplasia (Dwarfism), or BMN 270 for Hemophilia A would vault BioMarin into the pantheon of profitable biotech firms as either indication should lead to over a billion dollars in sales based on the overall patient population. A word of caution, however: while both molecules have posted impressive results thus far, until they are granted marketing approval the potential for a late-stage clinical failure or for an unwanted side effect to manifest itself remains. In either case, the commercial potential may become severely impaired or non-existent. These are some of the risks inherent in innovative biotechs such as BioMarin.

Vosoritide

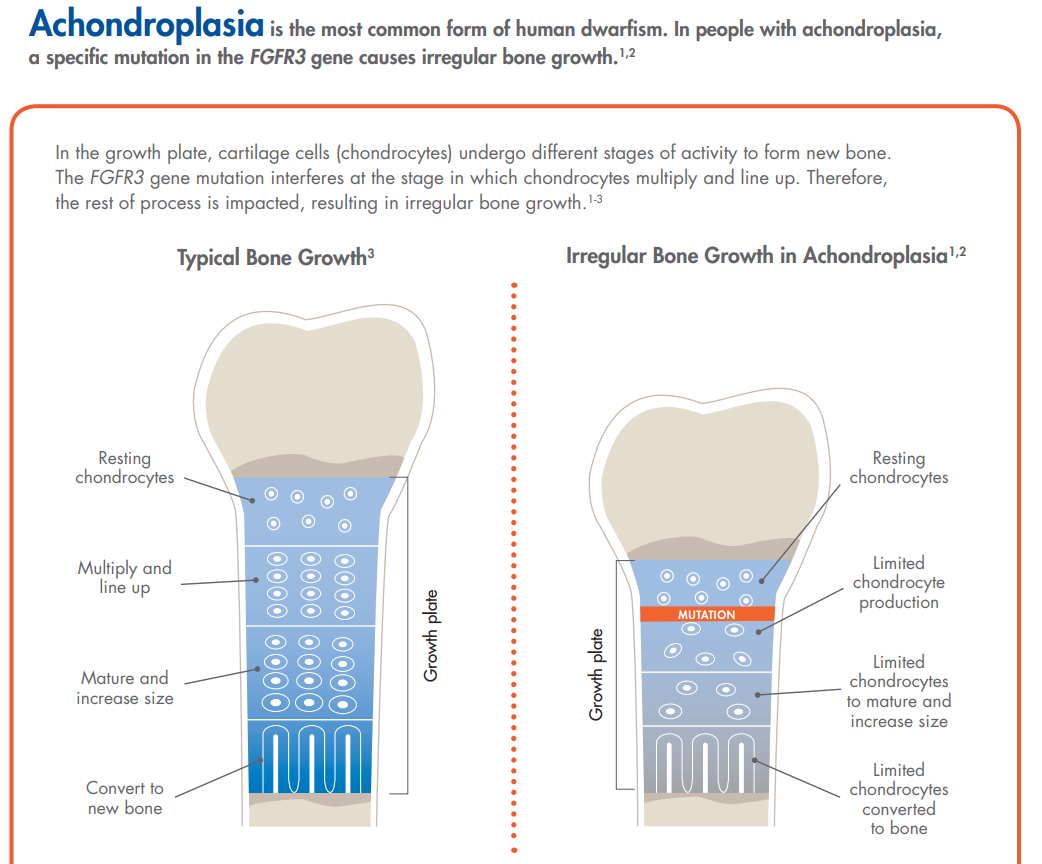

Image Source: BioMarin

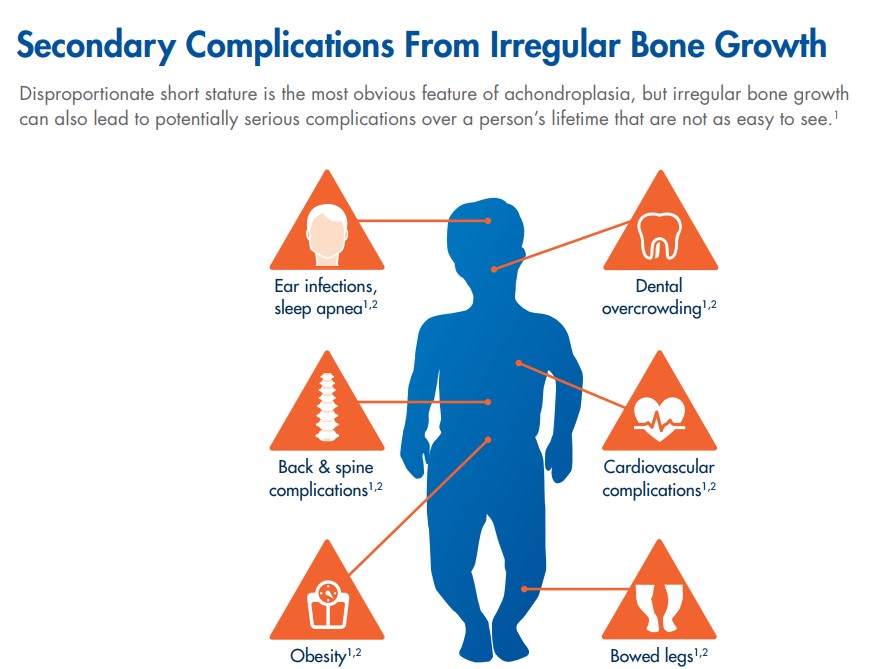

The FGFR3 gene mutation, as described in the image immediately preceding, leads to irregular bone growth that manifests itself into a wide range of ailments for those afflicted with Achondroplasia (outside of short stature). The most common side effects are back and spine problems as many will have a form of scoliosis (curvature of the spine). The shorter trunk commonly found in the patient class will also lead to organ issues as the organs will grow to full size while the short trunk will often lead to cardiac complications. Achondroplasia is the most common type of dwarfism.

Image Source: BioMarin

Thus far in phase 2 trials, the average child treated with Vosoritide experienced growth of 2 centimeters per year, a marked improvement. The side-effect profile is relatively clean with hypotension (low blood pressure) and injection site reactions as the most notable side effects. We are impressed with the results thus far, but we caution the sample size of eight and ten patients in different arms of the trial. We anxiously await for additional data as BioMarin has advanced the molecule in phase 3 testing with additional tests currently underway.

BMN 270

BioMarin has entered into the innovative field of gene modification therapy with a promising potential treatment for Hemophilia A. Hemophilia is an autosomal recessive disorder that may be inherited from the patient’s parents, but there are reported cases of a spontaneous formation of Hemophilia. In the case of Hemophilia A, the affected patient will have a deficiency in Factor VIII.

BioMarin is attempting to treat Hemophilia A through the use of a single-dose of AAV-factor VIII vector along with a dose of BMN 270. Thus far in phase 1/2 clinical trials, at the 52-week mark, all seven patients that were given the 6e13 vg/kg Dose of BMN 270 maintained a mean Factor VIII level in the normal range. Assuming the results can be duplicated in a more extensive study, the implications are profound for the Hemophilia community. If BMN 270 is approved, we believe it may become the standard of the industry, quickly disrupting the numerous weekly infusions that are the current norm of the Hemophilia community.

We continue to closely follow the clinical data for BMN 270 as we feel the treatment is BioMarin’s “crown jewel” of its clinical pipeline. A win in Hemophilia would transform BioMarin into a biotech powerhouse, but we caution the future remains uncertain as unexpected clinical side effects may manifest themselves. We are concerned with the elevation of ALT levels witnessed in the phase 1/2 trials—elevated ALT levels are typically an indication of liver disease such as acute hepatitis. All in, BioMarin should be viewed as a high-risk proposition as there is significant uncertainty as to the future path of its clinical pipeline. Valuentum’s fair value estimate range for BioMarin incorporates a full range of probabilities from a critical clinical failure ($45 per share) to clinical success of Vosoritide and BMN 270 ($134 per share).

Independent Healthcare and Biotech Contributor Alexander J. Poulos is long BioMarin.