Image Source: Visa Corporation – IR Presentation

By Callum Turcan

One of our favorite companies out there and a top holding in the Best Ideas Newsletter portfolio, Visa Corporation (V) reported fiscal third quarter FY2019 earnings on July 23 that were overall a net positive. Shares initially sold off on July 24 before recovering throughout the trading session and ended up over 1%. At the upper end of our fair value estimate range, we value Visa at $184 per share, and while Visa has performed tremendously since we added it to our Best Ideas Newsletter portfolio, we remain confident that shares have room to climb higher. Please note that Visa’s fiscal third quarter for fiscal year 2019 ended on June 30.

Key Updates

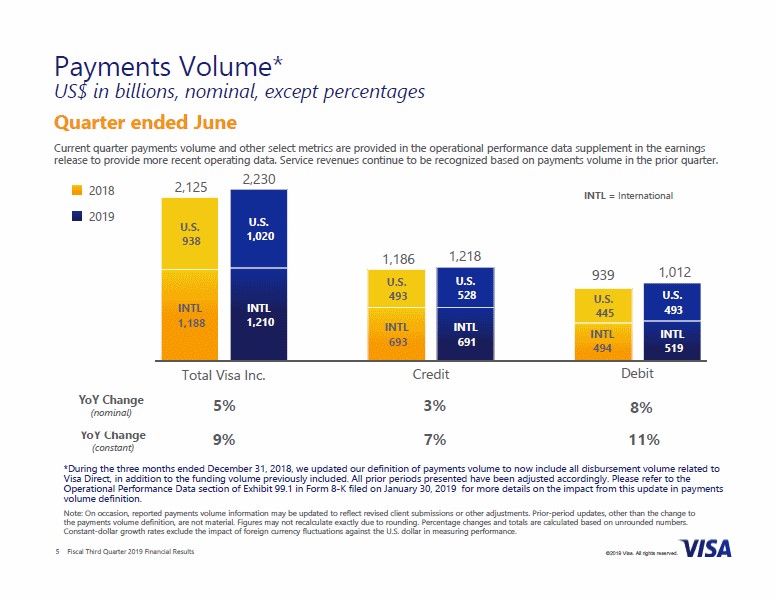

Payment volumes were up 5% year-over-year on a nominal basis to over $2.2 trillion with stronger growth seen at its debit segment. Excluding foreign currency movements, payment volumes grew by 9% year-over-year, while processed transactions climbed 12% to over 35.4 billion. Cross-border volumes rose 7% on a constant-currency basis. A strong US dollar held back Visa’s performance during the quarter, but the company continued to post strong results anyway.

Visa does not issue credit cards, so it doesn’t take on any credit risk, and instead makes its money from offering payment processing solutions. The virtuous cycle of increased debit/credit card use worldwide is an integral part to our thesis. As card payment and transaction volumes continue to increase, so does Visa’s addressable market and ultimately, its ability to keep growing. There remains an enormous room for upside not just in developed markets, but in developing markets as well where cash payments are usually much more common. As you can see below, Visa experienced year-over-year payment volume growth in both domestic and international markets.

Image Shown: Visa continues to see its payments volume steadily climb higher, aided by the paradigm shift away from cash towards card payment methods around the globe. Image Source: Visa – IR Presentation

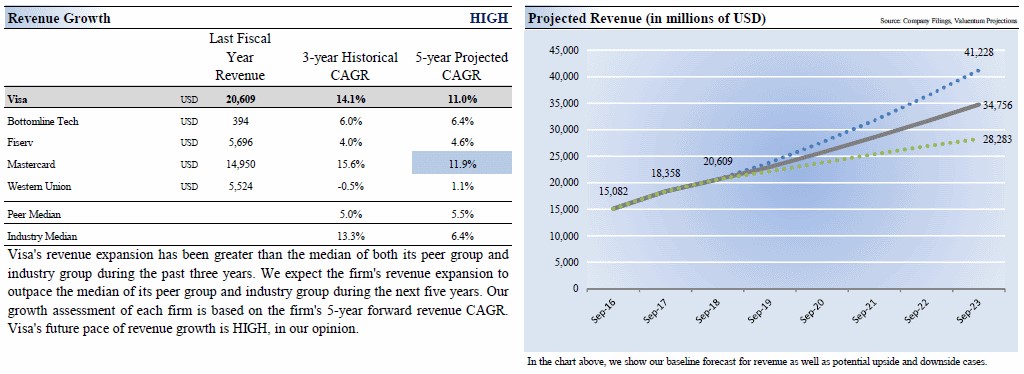

Revenue guidance for the full fiscal year stayed in the low double-digits, with larger than expected foreign currency headwinds offset by a larger revenue gain than expected from a recent revenue accounting rule change (ASC 606). We remain confident that Visa will continue to expand its revenue by a decent clip going forward, with the midpoint of our forecast calling for 11% CAGR sales growth over the next five fiscal years as you can see below (from our 16-page Stock Report covering Visa which can be accessed here).

Image Shown: We forecast Visa will continue to generate solid top-line growth through the mid-2020s.

Client incentives as a percent of gross revenue rose by 10 basis points year-over-year to 20.9% in the third quarter, however, management lowered full-year guidance for that item from 22.0%-23.0% of gross revenues to 21.5%-22.0%. We appreciate the move lower as that enhances Visa’s profitability. Management had this to say on the issue;

“Client incentives were better than expected due to lower incentives for some deals and programs than we had estimated, lower volumes in some markets and some deal delays. At this point, we have a very robust pipeline of significant renewals and new deals that we expect to get done by the end of our fiscal year.”

Expected growth in operating expenses was revised upwards to 10% for the full fiscal year during the third quarter, up from the mid-to-high single-digits previously, which is partially a product of a larger-than-expected impact from the new revenue accounting standard. Rising market expenses, one-time G&A expenses, and investments in technology were also at play. On the issue management noted:

“Operating expenses declined 18% on a GAAP basis due to the litigation provision last year associated with the interchange multi-district litigation. Excluding this special item, expenses grew 10%, primarily driven by marketing costs, a number of non-recurring expenses captured in G&A, and technology-related investment driving growth in network processing and depreciation expenses. Marketing expenses grew 18%, driven by investments related to the FIFA Women’s World Cup and the adoption of ASC 606. General and administrative expenses grew 37%, primarily due to several non-recurring items, ASC 606 impacts, and indirect taxes. The adoption of ASC 606 added approximately 2.5 points to expense growth.”

Financial Overview

Visa’s GAAP revenue climbed 11% year-over-year to over $5.8 billion during the fiscal third quarter, while its GAAP operating income jumped 35% to $3.9 billion. When removing special items that held down Visa’s fiscal third quarter performance in FY2018, it’s non-GAAP operating income climbed 12%. Adjusted EPS rose by 14% year-over-year to $1.37.

The firm exited June 2019 with $11.1 billion in cash, cash equivalents, and investment securities on hand. We aren’t including restricted cash in this calculation. Stacked against $16.7 billion in long-term debt, Visa’s net debt load of $5.5 billion is very manageable given its impressive free cash flows.

During the first nine months of FY2019, Visa generated $8.7 billion in net operating cash flow while allocating $0.5 billion towards capital expenditures, enabling $8.2 billion in free cash flow. That easily covered $1.7 billion in dividend payments during the period; however, Visa’s dividend payout is quite small as management prefers to allocate capital towards share buybacks. Visa spent $6.5 billion repurchasing stock during this period, which was also fully covered by free cash flows.

What We Think

Here is a concise summary of our thoughts on Visa from our 16-page Stock Report;

“Visa is the largest retail electronic payments network based on payments volume, total volume and number of transactions. The company benefits from one of the strongest competitive advantages out there – the network effect. As more consumers use credit/debit cards, more merchants accept them, thereby creating a virtuous cycle. Visa is not a bank and does not issue credit cards. The firm takes on no credit risk–unlike American Express (AXP) and Discover Financial (DFS)–but remains an integral part of the trend toward a cashless society. Sales are primarily generated from payments volume on Visa-branded cards.

The company acquired Visa Europe in a deal valued at $23+ billion, which unified the brand globally, and added $15+ billion debt to finance the deal, flipping its balance sheet to a net debt position. It owes another €1.1 billion in June 2019 per the deal terms. We’re not worried about the debt given Visa’s tremendous cash flow generation capacity. Concerns have cropped up more recently regarding cross-border volume growth. Visa acquired Earthport in May 2019 to revamp its cross-border business.

Visa, along with other US payment card companies, is reportedly preparing to request licenses to operating in China in the near future. However, it could take up to two years for the requests to clear Chinese regulators. The space, which is expected to grow to 9 billion cards in circulation by 2020, is currently dominated by state-backed China UnionPay. Any movement on this front is likely to be linked to ongoing US-China trade talks.

We include Visa in the Best Ideas portfolio because we think the company is one of the best operators in one of the strongest industries, the Financial Tech Services industry. The company’s fundamentals are rock-solid, in our view, and it continues to have an attractive runway for growth.”

Concluding Thoughts

We continue to like Visa and appreciate the company’s ability to navigate a difficult terrain as it relates to foreign currency headwinds. Shares of V yield just 0.6% as of this writing, making the total shareholder return largely dependent on capital appreciation, which is why we include it in our Best Ideas portfolio.

Financial Tech Services Industry – ACIW EPAY FDC FIS FISV FLT GPN MA MELI PYPL V VRSK WU WEX

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Visa Corporation (V) is included in Valuentum’s simulated Best Ideas Newsletter portfolio. PayPal Holdings Inc (PYPL) is included in Valuentum’s simulated Best Ideas Newsletter portfolio. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.