Image Shown: Berkshire Hathaway Inc is a stellar cash flow generator in almost any operating environment. Image Source: Berkshire Hathaway Inc – 10-Q SEC filing covering the Second Quarter of 2022

By Callum Turcan

Berkshire Hathaway Inc (BRK.A) (BRK.B) reported second quarter 2022 earnings that saw its ‘operating earnings’ metric surge higher versus the year-ago level. This metric removes realized and unrealized gains/losses in its large equity portfolio from the picture to provide investors with a better understanding of the company’s underlying performance. Due to the downturn in equity markets seen during the first half of this year, Berkshire Hathaway’s GAAP net income swung to a large net loss last quarter. We include shares of Berkshire Hathaway Class B (ticker: BRK.B) in the Best Ideas Newsletter portfolio, and our fair value estimate sits at $320 per share with room for upside.

Earnings Update

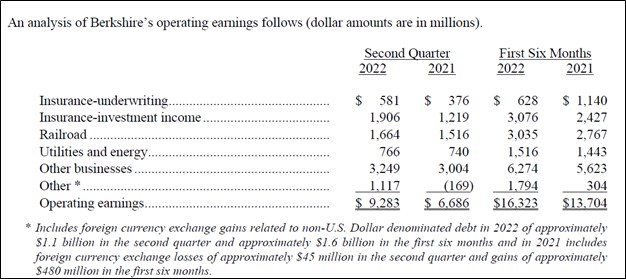

Berkshire Hathaway’s operating earnings rose 39% year-over-year in the second quarter of 2022 to reach $9.3 billion. All of its core business reporting segments reported nice operating earnings growth last quarter on a year-over-year basis including its ‘Insurance-underwriting’ (up 55%), ‘Investment-investment income’ (up 56%), ‘Railroad’ (up 10%), ‘Utilities and energy’ (up 4%), and ‘Other businesses’ (up 8%) segments. Its ‘Other’ business reporting segment swung from a loss in the same period last year to a gain in the second quarter of 2022 due largely to gains from non-US dollar-denominated debt as the US dollar has been quite strong of late. We appreciate the widespread strength seen across Berkshire Hathaway’s business portfolio last quarter.

Image Shown: Berkshire Hathaway reported year-over-year growth in the operating earnings across all of its core business reporting segments last quarter. Image Source: Berkshire Hathaway – Second Quarter of 2022 Earnings Press Release

On a GAAP basis, Berkshire Hathaway’s total revenues grew 10% year-over-year to reach $76.2 billion, though $66.9 billion in investment and derivative contract losses resulted in a $43.8 billion net loss last quarter. The performance of Berkshire Hathaway’s investment portfolio is significant given the portfolio represents a sizable chunk of its intrinsic value; however, it’s important to differentiate the performance of its operating businesses from its investment portfolio.

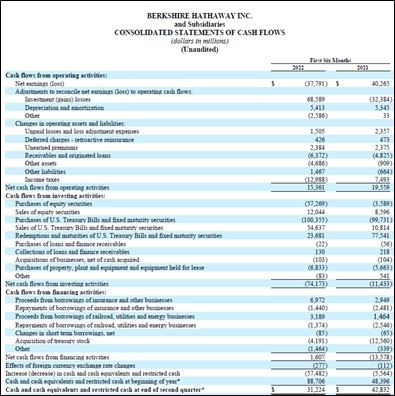

During the first half of 2022, Berkshire Hathaway generated $8.5 billion in free cash flow and spent $4.2 billion buying back its stock. We view Berkshire Hathaway’s share repurchases as a good strategy in moderation given that shares of BRK have been trading moderately below our estimate of their intrinsic value during most of the first half of this year. Furthermore, shares of BRK.B are trading meaningfully below our estimate of their fair value as of this writing. Berkshire Hathaway will likely continue buying back meaningful amounts of its stock going forward.

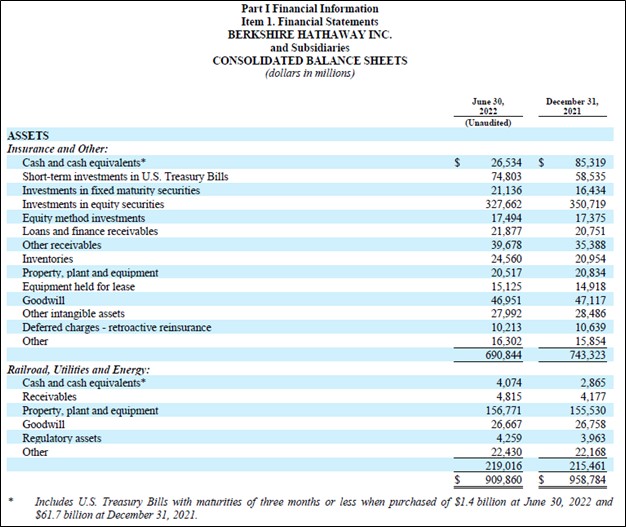

Given Berkshire Hathaway’s massive cash-like balance at the end of June 2022 ($106.1 billion when looking at its cash and cash equivalents and short-term investments in US Treasury bills, and that’s exclusive of $21.1 billion in its investments in fixed maturity securities), we are intrigued by the potential acquisition opportunities Berkshire Hathaway may pounce on in the current environment.

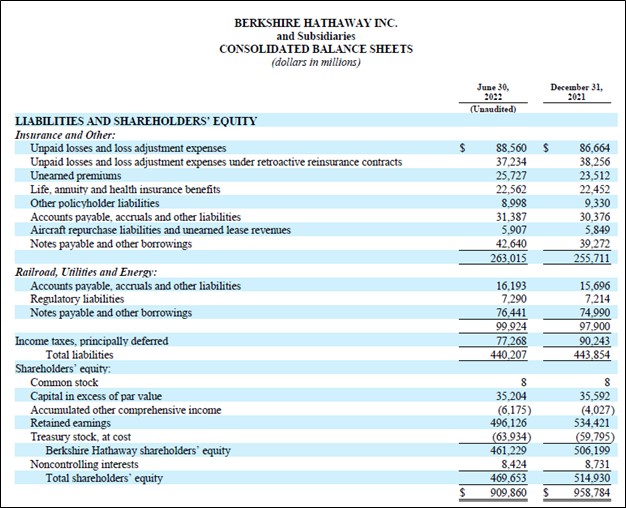

Berkshire Hathaway could capitalize on recent equity market weakness to acquire an undervalued enterprise outright or make a large strategic investment in one. For instance, Berkshire Hathaway has been steadily acquiring a large equity position in Occidental Petroleum Corporation (OXY) in recent months, a significant oil & gas producer with a sizable petrochemical and energy infrastructure footprint. Please note that Berkshire Hathaway also has substantial non-cancellable financial liabilities on hand as well, though it still has the funds to make a needle-moving deal. At the end of June 2022, Berkshire Hathaway’s insurance float stood at ~$147 billion.

Image Shown: We are intrigued by the potential acquisition opportunities Berkshire Hathaway may pursue in the current environment, given its large cash-like position on hand at the end of June 2022. Image Source: Berkshire Hathaway – 10-Q SEC filing covering the Second Quarter of 2022

Image Shown: Berkshire Hathaway had substantial non-cancellable financial liabilities on hand at the end of June 2022, including debt and insurance policy-related liabilities. Image Source: Berkshire Hathaway – 10-Q SEC filing covering the Second Quarter of 2022

Concluding Thoughts

Berkshire Hathaway is a stellar free cash flow generator whose core businesses have been doing great of late. The conglomerate’s industrial (energy, utilities, railroad) and insurance businesses have proven to be incredibly resilient. Looking ahead, Berkshire Hathaway has multiple levers to pull when it comes to generating shareholder value, from additional share buybacks to a potential needle-moving acquisition. We continue to like Berkshire Hathaway in the Best Ideas Newsletter portfolio.

—–

Banks & Money Centers – AXP, BAC, BK, C, DFS, FITB, GS, HBAN, HSBC, JPM, KEY, MS, MTB, NTRS, PNC, RF, TFC, USB, WFC

Tickerized for BRK.A, BRK.B, OXY, XLV, and holdings in the IAK.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan owns shares of DIS, META, GOOG, VRTX, and XLE and is long call options on DIS, GOOG, META, MSFT, V, and VRTX and is long put options on RDFN and RKT. Berkshire Hathaway Inc Class B shares (BRK.B), the Energy Select Sector SPDR Fund ETF (XLE), and the Financial Select Sector SPDR Fund ETF (XLV) are all included in Valuentum’s simulated Best Ideas Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.