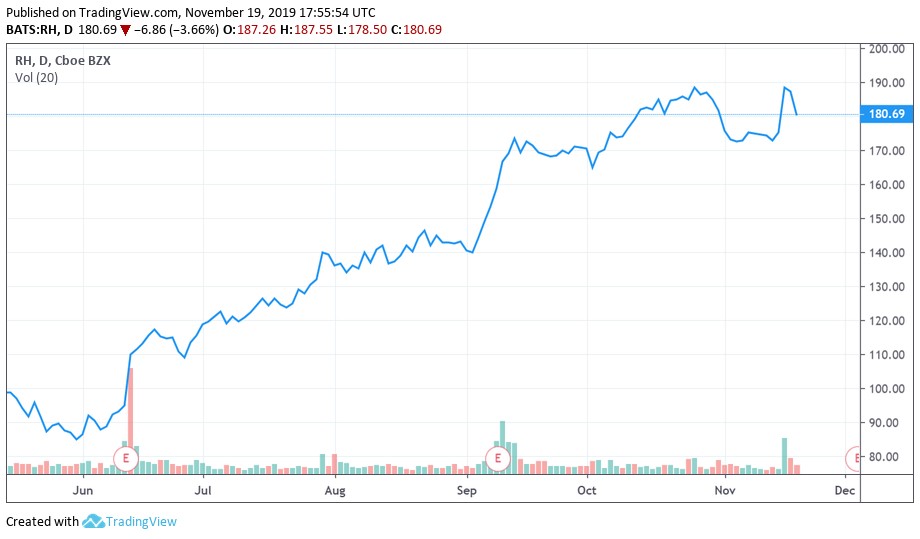

Image Shown: RH now counts Berkshire Hathaway Inc as a shareholder, which saw shares of RH initially spike up on the news.

By Callum Turcan

In a recent regulatory filing, Berkshire Hathaway Inc (BRK.A) (BRK.B) announced it had acquired a ~$0.2 billion stake in upscale home-furnishings company RH (RH), formerly known as Restoration Hardware Holdings, by initiating a position in the company’s equity. Please note RH does not pay out a common dividend at this time, indicating Berkshire Hathaway is seeking capital appreciation with this investment. Additionally, RH’s fiscal 2018 ended on February 2, 2019.

Business Overview

As of February 2, 2019, RH operated 86 galleries and showrooms across the US, Canada, and the UK. That includes galleries highlighting offerings for home décor, lighting, families (child and teen furnishings), bathware, textiles, outdoor and garden, and a variety of other needs. Some of those galleries include wine vaults, cafes, and barista bars to augment the experience of current and potential customers. In 2016, RH joined forces with Waterworks, greatly enhancing its bathware and kitchen-oriented offerings. RH acquired Waterworks for $117 million that year, gaining access to its 15 showrooms in the process (the company continued to operate 15 Waterworks galleries as of February 2).

These operations are supported by its e-commerce presence and various catalogs, highlighting the multiple channels RH utilizes to drive interest in its products and ultimately sales. The galleries and catalogs represent the backbone of RH’s advertising and branding strategy.

RH also offers a membership program, where for an annual fee, members get access to discounts, preferred financing plans, and complementary interior design work. Back in March 2016, the ‘RH Members Program’ was launched “as an alternative to prior practices involving numerous event-driven promotions”. We view recurring revenue streams and sales from repeat customers as sticky (to varying degrees), whereas one-time sales bumps due to promotions and special events provide for lower quality cash flow profiles.

Financial Overview

In fiscal 2018, RH generated $164 million in free cash flows ($301 million in net operating cash flows less $137 million in capital expenditures). As the company does not pay out a dividend at this time, those free cash flows were directed towards share repurchases. RH bought back $250 million of its stock in fiscal 2018. While down from the large ~$1.0 billion in stock RH bought back in fiscal 2017, share repurchases were still very material last fiscal year. For reference, the company did not buy back a meaningful amount of its stock in fiscal 2016, in part due to its acquisition of Waterworks.

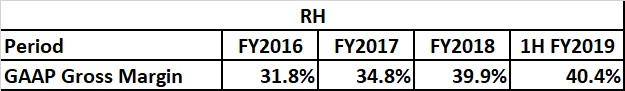

RH sources a material amount of its goods from China. During the company’s fiscal 2018, 41% of its sourced products by dollar volume came from China, down from 46% in fiscal 2017, but still enough to leave the firm very exposed to the US-China trade war. That being said, RH has done a tremendous job passing along any cost increases to its customers and then some. In the table down below, please note the stellar growth in RH’s GAAP gross margin over the past few fiscal years, which continued during the first half of fiscal 2019 (period ended August 3, 2019).

Image Shown: RH’s GAAP gross margins have thrived despite the ongoing US-China trade given, something that’s particularly noteworthy given the firm’s reliance on goods sourced from China. Image Source: RH – FY2018 Annual Report, Q2 FY2019 10-Q Filing – Table made by the author

Keeping in mind that RH’s GAAP revenues climbed from $2.1 billion in fiscal 2016 to $2.5 billion in fiscal 2018, it appears the company is very well positioned to ride out near-term geopolitical turbulence. During RH’s latest quarterly conference call, management referred to these (related to the US-China trade war) tariffs as “a little rock” and as a “distraction”, highlighting the company’s focus on its core business. Given the company’s rising revenues and gross margins, we can see why RH’s management team is looking out towards the future.

Balance Sheet Overview

We caution, however, that RH had ~$1.0 billion in net debt (inclusive of short-term debt) at the end of the second quarter of fiscal 2019 (period ended August 3) when including; ‘cash & cash equivalents’, ‘convertible senior notes due 2020—net’, ‘asset based credit facility’, ‘FILO term loan—net’, ‘second lien term loan—net’, ‘equipment promissory notes—net’, and its ‘convertible senior notes due 2023—net’ in this calculation. The company’s free cash flows provide for decent debt coverage, and as RH doesn’t pay out a common dividend, the firm retains the financial flexibility needed to manage this burden.

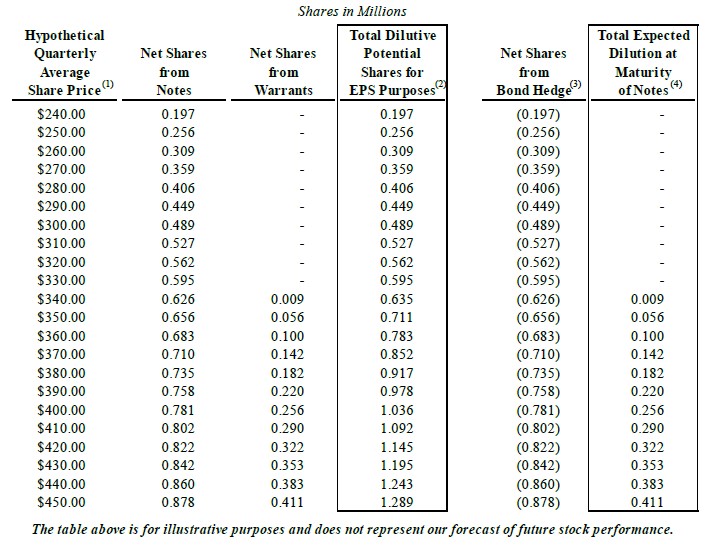

A recent refinancing scheme is set to materially boost RH’s financial performance and flexibility going forward. The company issued out $0.35 billion in convertible notes due 2024 with a 0% coupon to retire $0.2 billion of its outstanding second lien debt along with borrowings under its revolving credit line, with the convertible bond issuance completed in September 2019. RH mentioned that the initial conversion price on those convertible notes is approximately $211.40 per share, decently above where shares of RH are trading at as of this writing (~$180 per share). During its fiscal third quarter, the company also issued out warrants for just under 1.7 million of its common stock in conjunction with the convertible bond offering, with a strike price of $338.24 per share. Please note a bond hedge will materially influence the ultimate dilutive effect, which we’ll cover in a moment.

This refinancing scheme allowed for management to recently raise RH’s adjusted (non-GAAP) EPS guidance for fiscal 2019 by $0.25 to $10.78-$11.01. In fiscal 2020, this refinancing scheme will provide a $0.75 per share tailwind to RH’s adjusted (non-GAAP) EPS. Due to a bond hedge, the dilutive nature of this issuance can be difficult to determine, which is why RH provided a table to highlight what may happen under different scenarios that members can view below:

Image Shown: RH highlights the potentially dilution of the aforementioned refinancing scheme under different scenarios. Image Source: RH – IR Press Release

Here’s more from RH’s press release covering the issue (emphasis added):

“In Q3 2019, we issued $350 million aggregate principal amount of 0.00% convertible senior notes due 2024 (the “Notes”). The initial conversion rate applicable to the Notes is 4.7304 shares of common stock per $1,000 principal amount of Notes, which is equivalent to an initial conversion price of approximately $211.40 per share. These Notes have a dilutive effect on GAAP EPS while the Notes are outstanding, but once converted or settled, there is anticipated to be no actual dilution as we entered into a bond hedge in September 2019 that is intended to offset the actual dilution related to these Notes.

The bond hedge is not included in the calculation of diluted GAAP EPS as it is anti-dilutive. In Q3 2019, we also sold warrants for 1,655,640 shares of our common stock, which represents the number of shares of our common stock underlying the Notes. The warrants had a strike price of $338.24. These warrants could separately have a dilutive effect on GAAP EPS to the extent that the market price per share of our common stock exceeds the strike price and could cause actual dilution.”

We would like to stress that the calculations behind RH’s GAAP and adjusted non-GAAP EPS figures can be quite different for the reasons mentioned above (namely, GAAP doesn’t allow for the bond hedge to be included in diluted EPS calculations because it’s anti-dilutive). Going forward, please keep the bond hedge in mind when reviewing RH’s per share financial performance.

Concluding Thoughts

Having reviewed RH’s business model, capital allocation priorities, and financial position, it’s clear why Berkshire Hathaway would like the business. Strong free cash flows, rising margins, and a management team that’s very capable of adapting to shifting macro forces makes RH a quality company.

We continue to like Class B shares of Berkshire Hathaway as a top holding in our Best Ideas Newsletter portfolio, and while its investment in RH is modest compared to a company as big as Berkshire Hathaway, this investment is a sound one in our view. Members interested in reading more about Berkshire Hathaway should check out our third quarter earnings review here—->>>>

Specialty Retailers Industry – AAN BBBY BBY GME HD LOW LL ODP SHW TSCO WSM

Household Durables – ETH LEG LZB NWL SNBR TPX WHR

Data Sheet on Stocks in the Insurance Industry

Tickerized for companies in the SPDR S&P Insurance ETF (KIE)

Related – KSS RH

—-

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Berkshire Hathaway Inc (BRK.A) (BRK.B) Class B shares are included in Valuentum’s simulated Best Ideas Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.