Image Source: Fortune Live Media

By Callum Turcan

Berkshire Hathaway Inc (BRK.A) (BRK.B), specifically Class B shares trading as BRK.B, is a top holding in Valuentum’s Best Ideas Newsletter portfolio. The massive holding company is invested in much more than just insurance (a portfolio which includes Geico, Cornhusker Casualty Company, General Re, Oak River Insurance Company, and more), Berkshire has exposure to American railroads (through its ownership of BNSF), global consumer goods sales–through its ownership of See’s Candy and stake in Kraft Heinz Company (KHC)–and a slate of other industries. We give shares of BRK.B a fair value estimate of $229, with a fair value range of $183/share – $275/share. As BRK.B trades at the lower end of our fair value range and is supported by a massive cash position, we like its capital appreciation prospects. The company does not currently pay out a dividend.

On August 3, Berkshire Hathaway published second-quarter 2019 earnings. Net income grew 17% year-over-year to $14.1 billion and its outstanding share count moved lower, resulting in the GAAP EPS of BRK.B shares growing to $5.74 in the second quarter (up from $4.87 in the same period last year). That was largely due to Berkshire Hathaway recording some large investment gains ($7.8 billion in the second quarter), as its operating income weakened in the second quarter on a year-over-year basis. Please note Berkshire Hathaway’s bet on Kraft Heinz has not panned out favorably as of late, but its other bets are going well.

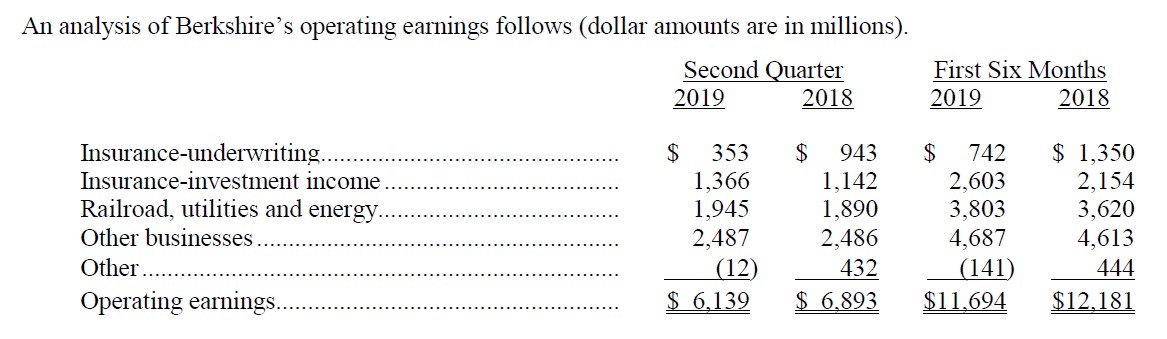

A sharp drop in Berkshire Hathaway’s insurance-underwriting operating income and “other” operating income led to its total second-quarter operating income moving lower by 11% versus the same period last year. Strength at its railroad, utilities and energy segment, supplemented by strong insurance-investment income growth, wasn’t enough. That’s to be expected in the insurance-underwriting business as exogenous events can (and often do) create volatility in the financial performance of this segment, that’s the whole point of insurance after all.

Image Shown: An overview of Berkshire Hathaway’s performance by operating segment. Image Source: Berkshire Hathaway – Second quarter 2019 earnings press release

During the first six months of 2019, Berkshire Hathaway reported growth at most of its operating segments which we appreciate. At the end of June 2019, the holding company’s “Insurance and Other” segment had $119.1 billion in cash, cash equivalents, and short-term investments in US Treasury Bills. How Berkshire Hathaway puts that to use will be interesting, with Warren Buffett and Charlie Munger likely looking to see what asymmetrical upside opportunities will be created by ongoing market turbulence. Company-wide, Berkshire Hathaway generated $16.8 billion in net operating cash flow while spending $6.7 billion on capital expenditures during the first two quarters of 2019, leaving ample free cash flow to cover $2.1 billion in share buybacks.

Please note that Berkshire Hathaway is getting ready to invest $10.0 billion in a preferred issue by Occidental Petroleum Corporation (OXY) as the oil & gas company successfully acquired Anadarko Petroleum Corporation (APC) on August 8. We covered that deal in detail here, and think Berkshire Hathaway is raking Occidental over the coals on this one given the very generous terms Warren Buffett negotiated with OXY’s CEO Vicki Hollub (OXY warrants plus a high 8% coupon).

For BRK.B shareholders, that’s good news. This is how Berkshire Hathaway plans to put some of its large ~120 billion cash position to use and represents a great way to generate long-term value for shareholders. We continue to like BRK.B as a quality capital appreciation idea and maintain Berkshire Hathaway Class B shares as a top holding in our simulated Best Ideas Newsletter portfolio.

Data Sheet on Stocks in the Insurance Industry

Tickerized for companies in the SPDR S&P Insurance ETF (KIE)

—-

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Berkshire Hathaway Inc (BRK.A) (BRK.B) Class B shares are included in Valuentum’s simulated Best Ideas Newsletter portfolio. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.