The Valuentum process waits for a stock’s price to be moving higher before it is considered. The stock must not only be undervalued on both a discounted cash-flow basis and relative value basis, in our view, but the market must also believe that its true intrinsic value should be higher, too, as evidenced by a rising share price. The process is symmetrical. We also would wait for a company’s share price to break down before we may consider removing an overpriced stock. In some cases, the information contained in prices can even provide clues when to remove an underpriced stock, as in the case of General Electric.

By Brian Nelson, CFA

There should be no confusion. General Electric (GE) was removed from the simulated newsletter portfolios May 15, 2017, at a price of $28.04 per share. The company’s equity is now changing hands at less than $14 at the time of this writing. Do you know what that means? The move in anticipation of the massive drop in shares of GE’s price last year saved more than half of the position! Sometimes readers get lost in a one-sided endeavor to find stocks that they think will go up, but it’s also important to note that avoiding stocks that will collapse is often the more important part of the equation. GE is but the latest example of our efforts to get investors ahead of what was to come.

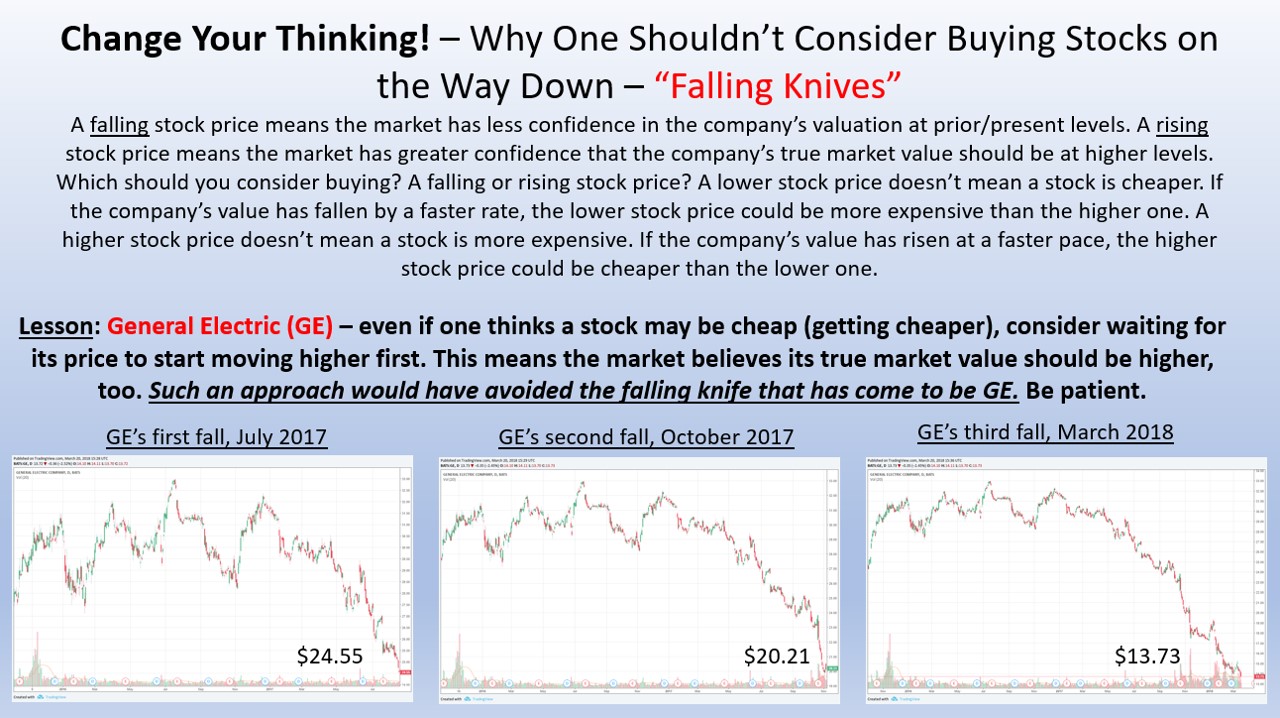

So far year-to-date through March 12, 2018, out of the ideas included in the simulated newsletter portfolios from the Dow Jones Industrial Average (DIA), we’ve identified 6 out of the top 7 performers! This is incredible, but what we think is even more incredible is that we removed the worst performer in GE long before its shares collapsed. We got our members ahead of the drop, and we didn’t fall into the trap of jumping back into shares too quickly either. The Valuentum process uses an extra layer of checks and balances before considering whether even stocks we think are underpriced should be added to the simulated newsletter portfolios. That extra layer is as simple as waiting for a stock’s price to start advancing. In GE’s case, there hasn’t been one instance where we grew excited since we removed it, even as our fair value estimate sits above its share price.

We care just as much about what the market thinks about fair value as we do. After all, the market has to eventually agree with us for us to be right, and the information contained in stock price activity can never be ignored. The market can sometimes know more than us. We’re putting together an excellent 2018 thus far with the ideas in the simulated newsletter portfolios, as well as with the decisions to remove some of the worst-performing companies before things really got bad. We continue to set the bar high for our team, and you can even see that in ones that we don’t always get “right.”

You may remember this, too, and if you recall, we removed Teva Pharma’s (TEVA) shares from the simulated Best Ideas Newsletter portfolio at $28.67 in May 2017. The company’s equity is now trading at ~$17 per share. Sometimes it’s easy to focus on our big winners such as Boeing (BA) or Visa (V) or Apple (AAPL), and the list goes on and on, but the cases of General Electric and Teva Pharma, on the other end of the spectrum, are just as important, even more so. Remember – it takes a 100% gain to replace a 50% loss. This is why Warren Buffett’s No. 1 rule is “Never Lose Money,” and rule No. 2 is “Don’t forget rule No. 1.”

If you may have thought General Electric was undervalued during its fall these past many months, use it as a learning lesson to wait for a company’s share price to start moving higher before considering it (this is why we spend so much time on the Valuentum Buying Index). Being patient for the stock price to turn higher (momentum) could save you from a lot of pain, as in doing so, you might just avoid catching a “falling knife” like GE has been. Don’t ever forget either that it takes a stock price to double for that position to get back to even, after a 50% loss. In this light, the decisions to remove GE and Teva Pharma from the simulated newsletter portfolios at the time we did were as good as adding Boeing or Dollar General (DG), for example.

We hope you are enjoying our work!

————————-

Brian Nelson does not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.