Member LoginDividend CushionValue Trap |

Our Thoughts on Newmont’s Bright Outlook

publication date: Sep 11, 2020

|

author/source: Callum Turcan

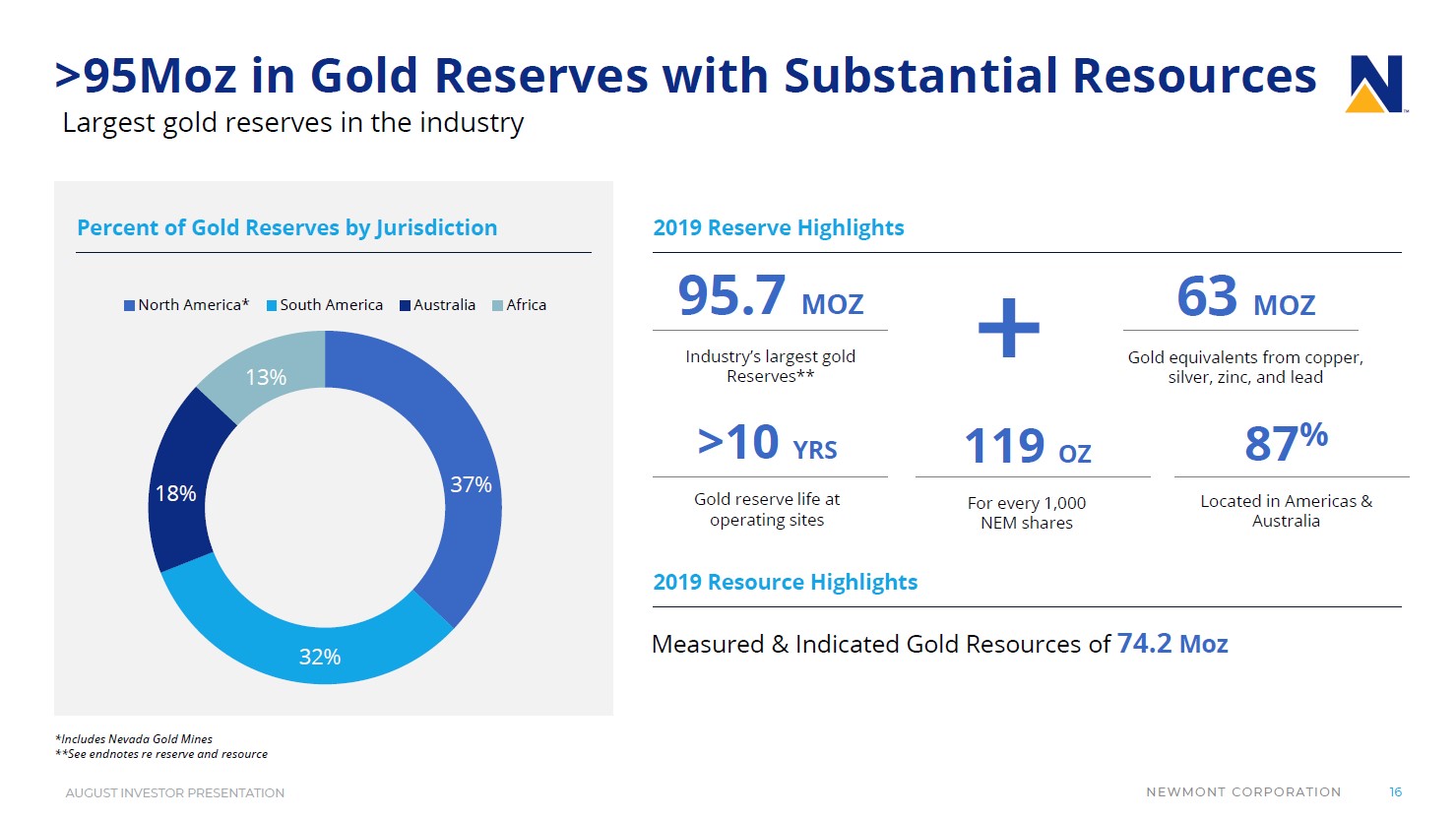

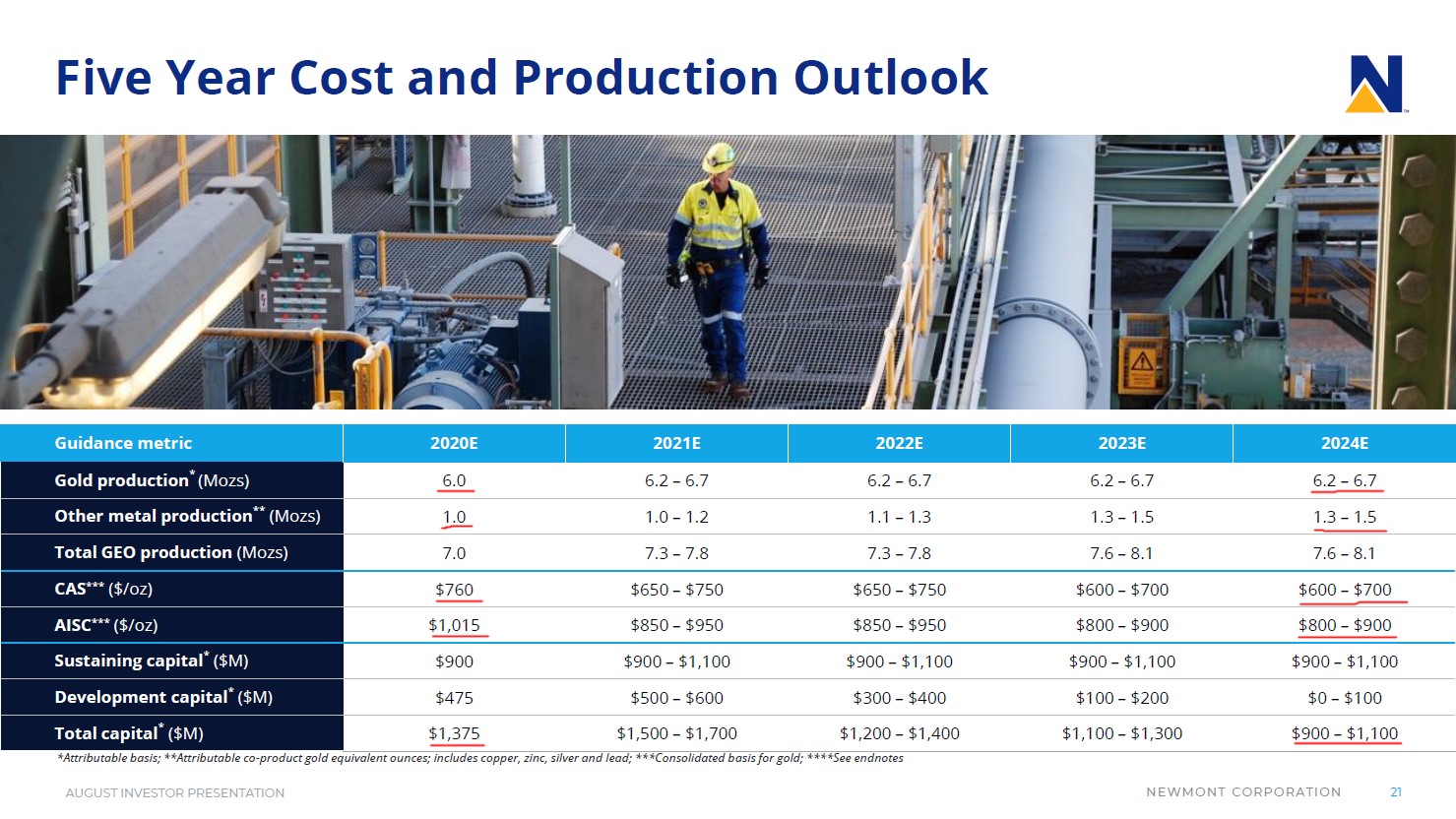

Image Shown: Newmont Corporation’s gold reserves are extensive and should support the gold miner’s ability to generate meaningful cash flows over the years and decades to come. Image Source: Newmont Corporation – August 2020 IR Presentation By Callum Turcan Back on January 13, we added shares of gold miner Newmont Corporation (NEM) as a holding to the Dividend Growth Newsletter portfolio (link here). In July, we significantly increased our fair value estimate for Newmont and please note the top end of our fair value estimate range sits at $72 per share of NEM (Newmont’s 16-page Stock Report can be accessed here). We will cover why we boosted our fair value estimate in just a moment. As of this writing, shares of NEM yield ~1.5% on a forward-looking basis, and we view its forward-looking dividend coverage as rock-solid given Newmont has a Dividend Cushion ratio of 3.2, earning the firm an “EXCELLENT” Dividend Safety rating (Newmont’s two-page Dividend Report can be accessed here). In our view, Newmont offers investors a combination of income growth and capital appreciation upside, and we continue to like Newmont as a holding with a modest weighting in our Dividend Growth Newsletter portfolio. Our Dividend Cushion ratio and Dividend Safety rating factors in our expectations that Newmont will steadily grow its per share dividend over the coming years. Background Part of the reasoning behind the fair value estimate increase was due to Newmont’s management team communicating to investors that the gold miner expected its merger with Goldcorp in 2019 would yield greater synergies than first expected ($500 million in run-rate pre-tax synergies are expected by 2021 versus $365 million initially). Cost savings greatly enhance Newmont’s ability to generate free cash flows in any gold pricing environment over the long haul. Additionally, Newmont’s strong operational execution during the initial stages of the ongoing coronavirus (‘COVID-19’) pandemic combined with the rally in gold prices (GLD) seen over the last year indicated that the gold miner’s near-term cash flow outlook was bright as well. In early-August, we covered Newmont’s second quarter earnings report and we encourage members that have not yet read that note to please do so (link here). Some of the key highlights included Newmont reducing its net debt load from the end of 2019 to the end of June 2020, largely by generating ample free cash flows during the first half of this year. Additionally, Newmont is getting closer to resuming normal operations at its Musselwhite gold mine up in Canada after mining activities were disrupted by a fire last year, operations that will be enhanced by a soon to be completed materials handling project at the site (this project is expected to reduce per unit operating costs). By the end of this year, Newmont aims to begin ramping up production at the Musselwhite mine in earnest. Looking Ahead As longtime members know, we place a tremendous amount of emphasis on a company’s future expected financial performance and its expected future free cash flows (net operating cash flow less capital expenditures). Historical performance can be used as a baseline to begin gauging the future expected performance of the company in question, but any investor that is attempting to use ambiguous backward-looking price-to-sales or price-to-earnings metrics to derive an intrinsic value is looking in the wrong direction. Equities are valued based on the forecasted future free cash flows of the firm in question (under reasonable assumptions), discounted at the appropriate rate. We covered this topic in great detail in the second edition of our book Value Trap which includes our commentary on how the pandemic impacted equities and capital markets at-large (included in the updated preface). In the upcoming graphic down below, Newmont highlights its outlook over the next five years. We underlined the key guidance metrics that members should pay close attention to. For instance, Newmont expects its annual gold production and ‘other metal production’ (copper, silver, lead, zinc) will steadily grow from 2020 to 2024 as various expansion projects are completed and its Musselwhite mine resumes normal operations. During this period, Newmont expects its operating costs will move significantly lower per ounce of gold production, highlighted by the forecasted decline in its gold costs applicable to sales (‘CAS’) and gold all-in sustaining costs (‘AISC’) on a per ounce basis. Finally, please note that Newmont’s guidance calls for the gold miner’s annual capital expenditures to trend lower over this period, though this could change should Newmont sanction new projects. Rising production (acts as a tailwind for potential future revenue growth), lower per unit operating costs, and a steady decline in capital expenditures speaks favorably to Newmont’s medium-term outlook, especially considering where gold prices have been trading of late.

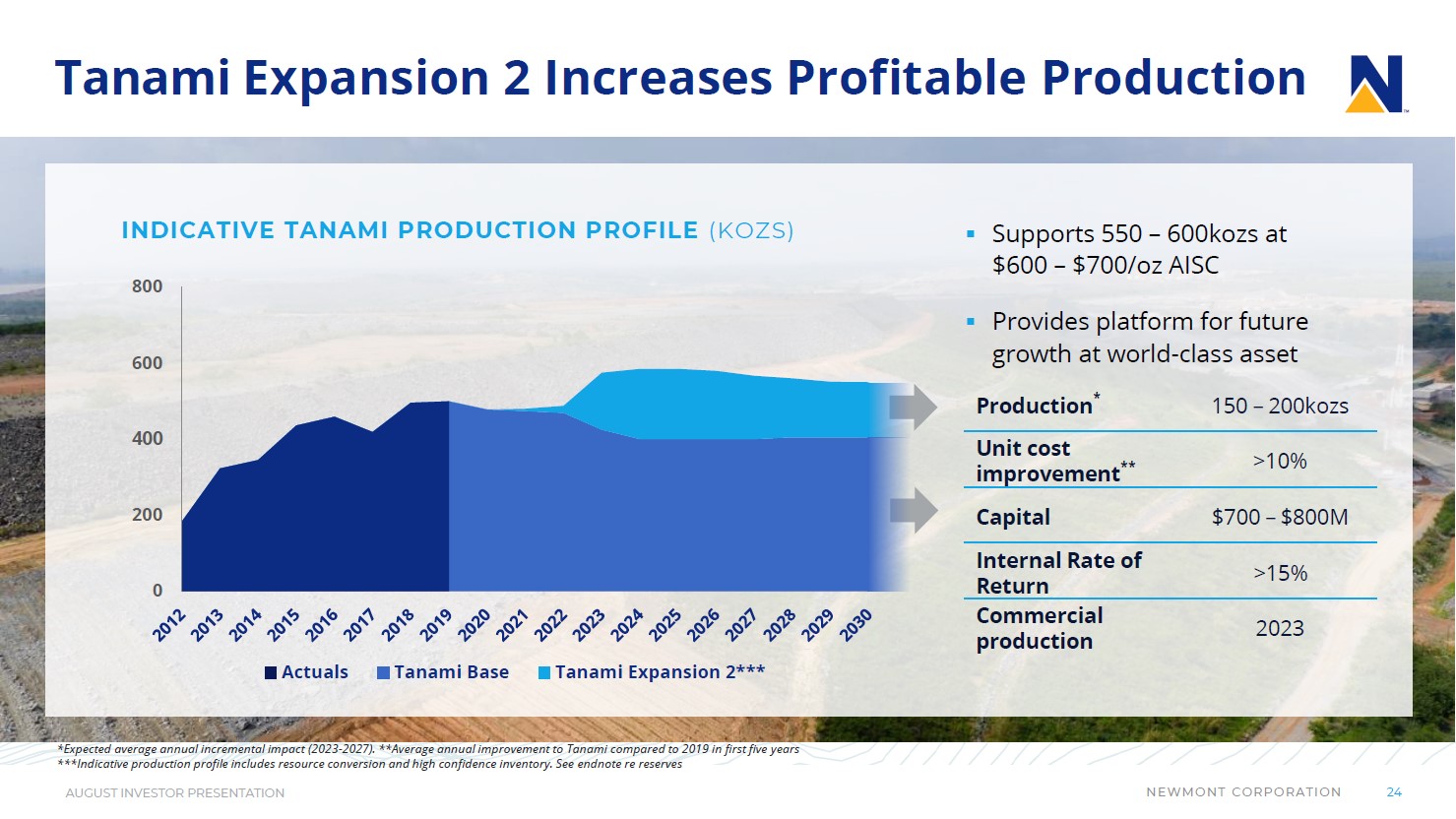

Image Shown: We underlined key guidance metrics in red to highlight why Newmont’s medium-term outlook is quite promising. Image Source: Newmont – August 2020 IR Presentation with additions from the author Key Projects We will stress here that fluctuations in gold prices and the possibility that new growth projects will be sanctioned will significantly influence the trajectory of Newmont’s free cash flows. Newmont has already approved some big endeavors that are factored into its medium-term guidance including the Tanami Expansion 2 development. The Tanami gold mine is located in Australia’s Tanami Desert, and Newmont owns the entire asset outright. By 2023, the Tanami Expansion 2 development is expected to significantly bolster production at the site. Management expects the development will cost $700 million - $800 million to complete, and the forecasted uplift in Newmont’s production can be seen in the upcoming graphic down below. As these are low cost resources, the associated revenue streams should be quite lucrative for Newmont.

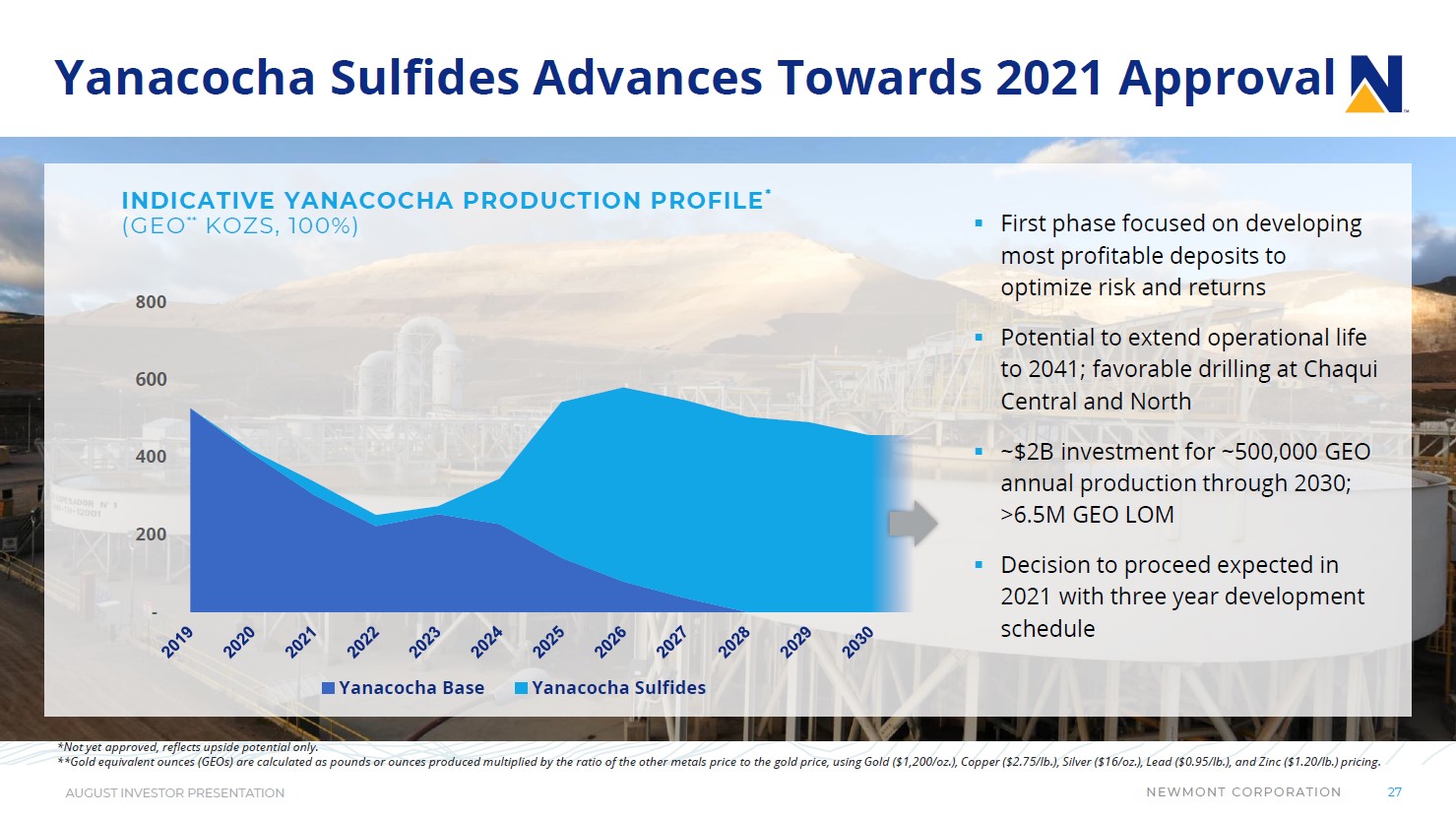

Image Shown: Newmont’s Tanami Expansion 2 development is partially why Newmont forecasts that its company-wide production will move higher over the medium-term. Image Source: Newmont – August 2020 IR Presentation Another important development to keep in mind that has not yet been sanctioned is the Yanacocha Sulfides project, which would see production at the Yanacocha mine in Peru (Newmont owned just over 51% of this project at the end of 2019) shift meaningfully higher by the middle of this decade. Before then, production from the mine is expected to drop significantly over the coming years. Management expects to make a decision on this endeavor next year. Please note that Yanacocha mine houses gold, copper, and silver resources (though gold is the primarily target here).

Image Shown: Newmont is considering expanding production at its Ahafo gold mine in Ghana. Image Source: Newmont – August 2020 IR Presentation Concluding Thoughts We continue to like Newmont as a holding in our Dividend Growth Newsletter portfolio. The gold miner’s outlook is extremely promising, and we see room for significant dividend growth over the coming years. Should Newmont’s management team continue to focus on reducing the company’s net debt load going forward, that would go a long way to further improving the company’s dividend coverage on a forward-looking basis, which we would strongly appreciate. ----- Diversified Mining Industry – BHP FCX NEM RIO SCCO VALE WPM Related: APAJF, BBL, GLD, SLV, GOLD, MITSY, ITOCY, PKX, GMBXF, FXI, MCHI, KWEB, JJCTF, RTPPF, COPX, DBB, CPER, JJC, TECK, HBM, AAUKF, AAUKY, GLCNF, GLNCY, FSUMF, ANFGF, SIL, USLV, PSLV, AGQ, SIVR, SILJ, SLVP, EWW, MXF ----- Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free. Callum Turcan does not own shares in any of the securities mentioned above. Newmont Corporation (NEM) is included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies. |

0 Comments Posted Leave a comment