Summary

· After positive data reads in the months of October and November, things may finally be looking up for retail spending, but the impact of discounting looms large for many in the space. There are pockets of weakness and strength.

· Aspirational and luxury goods manufacturers and retailers are not only subject to the pressures of the promotional retail environment, but also are subject to additional outside forces such as tourism and brand perception. While not dead, mall traffic has been challenging.

· Whether it is next-generation wearable technology, a refined online presence, a reduction in markdown allowances, or an enhanced shopping experience, luxury goods companies continue to invest for sustainable growth. Fossil and Richemont have been caught by surprise, however.

· Though certainly not the strongest companies with respect to brand equity, Coach and Michael Kors remain opportunistic valuation considerations in an aspirational and luxury goods space that continues to face myriad challenges.

Kris Rosemann

Our top two speculative ideas in the luxury goods industry, Coach (COH) and Michael Kors (KORS) have provided us with plenty of ups and downs since their additions to the Dividend Growth Newsletter portfolio and Best Ideas Newsletter portfolio, respectively. The aggressive and competitive discounting environment we’ve seen in the retail space as of late has not been conducive to maintaining aspirational brand equity, and these two ideas have not been spared the pain and may continue to ebb and flow as they work to rebuild the elite-status branding both once enjoyed. Let’s have a look at pockets of weakness and strength in retail sales, and identify important trends that are impacting the aspirational and luxury space, in particular.

The department-store retail space, particularly J.C. Penney (JCP) and Sears Holdings (SHLD), remains under considerable pressure as consumer spending patterns shift away from big box clothing retail. Millennials (MILN) appear to be more fixated on spending their disposable income on memorable experiences than material possessions, and wearable technology has become the new fashion statement. For example, while overall electronic-store sales remain under pressure, according to recent Census data, Best Buy’s (BBY) third-quarter earnings report, released November 17, revealed strength in sales of mobile phones and wearables, propelling the stock to nearly $50 per share, almost a decade-long high. Mall traffic, however, continues to be under pressure, and while gross margins performed well at Best Buy in its third quarter ended October 29, many retailers have been pursuing aggressive discounting. According to a December 14 article by the Wall Street Journal, “the number of receipts that included promotions jumped 79% in November from the same period a year ago.” The price discounting has continued into December, which could have profound implications on the broader retail group’s levels of profitability during the fourth quarter of 2016.

That said, retail store sales have been in positive territory during the months of October and November, a welcome change from recent performance. According to estimated monthly retail sales by the US Census Bureau, released December 14, while general merchandise (department) stores and electronics and appliance stores continue to struggle during the holiday season, clothing and clothing accessories store sales have been largely a mixed bag, advancing during November but declining in October on a year-over-year basis. Aside from trends toward e-commerce spending (non-store retail), a good portion of the strength in year-over-year retail sales has been coming from the auto parts and building material industries, perhaps a positive sign for Advanced Auto Parts (AAP) and AutoZone (AZO) and Lowe’s (LOW) and Home Depot (HD), respectively. Podcast: “Housing Is Back! Trends in Home Improvement.” Food services and drinking places continue to do well, too, according to the Census data.

To a large extent, retail sales remain a mixed bag with both pockets of weakness and strength, and we’ll be watching just how much the level of discounting impacts the group’s profitability levels during the fourth quarter of 2016. Nevertheless, traditional consumer spending seems to be returning to healthier levels in the US. US third quarter GDP growth, for example, was revised higher November 29 to 3.2% (the fastest rate in two years) from 2.9% on the back of better-than-expected household spending. The upward GDP revision was largely due to incremental data from the Alcohol and Tobacco Tax and Trade Bureau, monthly retail sales figures, motor vehicle registrations, and improved household utility data. Consumer spending power continues to grow as well, as the gain in wages and salaries in the third quarter of 2016 was also recently revised higher. Retailers may also experience a benefit from a reduction in consumers’ tax burden. President-elect Donald Trump’s choice for Treasury Secretary Steven Mnuchin has stated that his first priority will be tax reform, specifically in the areas of the middle-class and corporate tax rates. Any increase in disposable income for consumers bodes well for retailers.

Let’s now dig into the aspirational and luxury brands, in particular. These entities not only are subject to the typical pressures of the broader retail space, but they also draw a portion of sales from their flagship locations in major cities, the traffic of which is driven in part by tourism. Currency movements, namely the recent appreciation of the US dollar against most currencies, have negatively impacted tourism spending in many such American cities. Though Macy’s (M) recently reported strong traffic at its New York City flagship store on Black Friday, others including Michael Kors have noted weakened trends in tourism from Europe and South America as reasons for a slower pace of sales in the US. While international tourists at Coach’s stores increased in its fiscal first quarter of 2017, it experienced declines in tourist traffic from China. Tiffany’s (TIF) flagship store has been negatively impacted by the hoopla of the Presidential election given its proximity to Trump Tower, but the company posted a better-than-expected report on the top- and bottom-lines November 29.

We’ve made mention in the recent past of how many aspirational and luxury brands are attempting to regain or maintain the luster of their products, “Brand Image Taking Center Stage in Aspirational Goods.” Coach is among the companies that are working hard to maintain the aspirational perception of its current product portfolio. In addition to closing ~250 of its locations in the department-store channel and issuing a reduction in markdown allowances, the company is looking to improve its brand image via differentiating its store environment and emotional marketing. It is also hoping to bring its Coach 1941 brand into a higher focus in its outreach efforts, and a marketing revamp has helped the firm reign in operating costs. Also, on its fiscal first-quarter 2017 conference call, November 1, the company said it was limiting its promotional efforts online, which management says has a greater negative impact on the long-term health of the brand than the positive impact such promotional activity may have on near-term results.

Generally, our coach.com retail site demand is similar to our retail stores. For most of the category, the dotcom channel is overwhelmingly a promotional one, with most of our competitors having perpetual sale shops available. As you’re aware, we have a clear strategic direction to limit our promotional stance online, given the negative impact on long-term brand health. – Andre Cohen, President North America and Global Marketing

Coach isn’t the only luxury brand limiting its online presence. LVMH (LVMHF), for example, plans to keep its products off of Amazon (AMZN), since the massive online marketplace does not fit with the perception its brands aspire to hold. Concerns over pricing and counterfeits have reduced the attractiveness of online marketplaces for many luxury brands, which are based on aspirational exclusivity and not affordable prices for the mainstream population. However, Chinese Internet-giant Alibaba (BABA) continues to vigorously fight against counterfeit products on its platforms, and recent sales trends remain robust for the e-commerce behemoth. For example, on widely-followed Singles’ Day (November 11), gross merchandise volume and mobile sales advanced considerably, with brands like Nike (NKE), Adidas (ADDYY), and Phillips (PHG) fan-favorites.

As with Coach, Michael Kors is also accepting short-term pain for long-term brand health as it works to rebuild and maintain the aspirational perception of its products by consumers. Specifically, the company is reducing the sell-in of inventory in its US wholesale channel in hopes of doing away with the brand-damaging aggressive discounting taking place across most of the retail industry. The rebalancing of its business is expected to result in an increase in average transaction value in both its retail and wholesale businesses, but will reduce the number of units it sells in the luxury goods marketplace in North America. This should help gross margin, and Michael Kors’ store growth continues to be a driver mitigating same-store sales pressure. During its second quarter of fiscal 2016 (ends October 1, 2016), for example, new store openings totaled nearly 200 on a net basis.

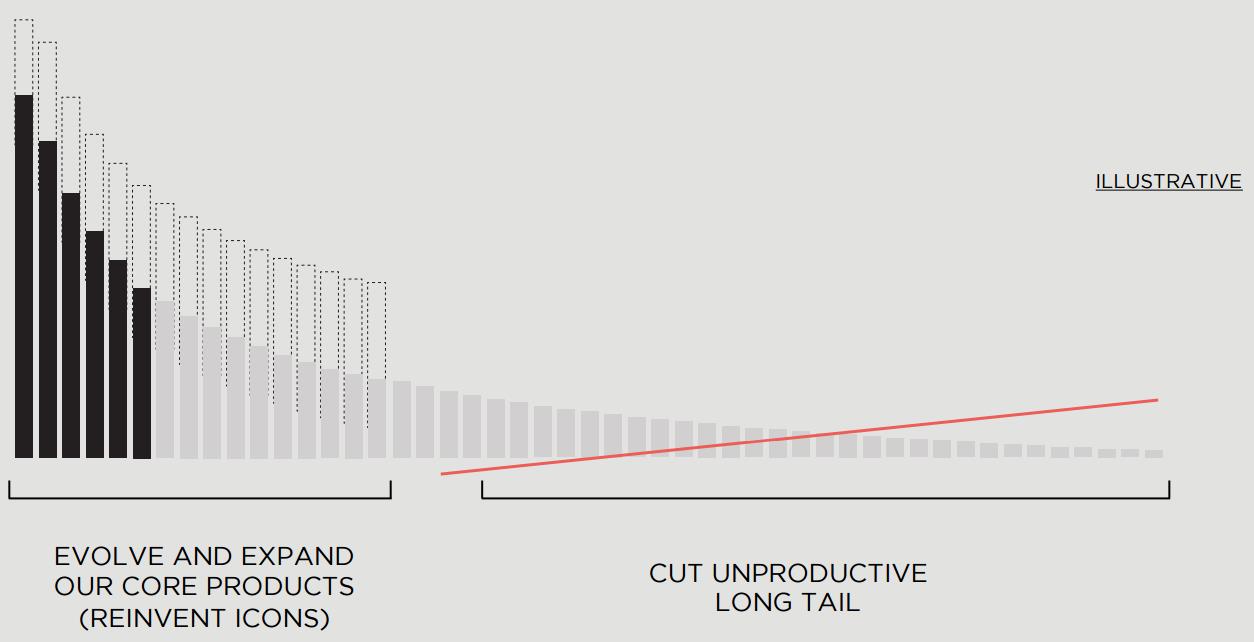

Ralph Lauren (RL) is a prime example of a luxury brand that may have gone “too mainstream.” According to recent Investor Day presentation, the company has not a sufficient focus on core brand strength, and its operating model has at times led to excess inventory, which in turn has created an unhealthy environment of overly-aggressive discounting. The retailer’s three core brands–Ralph Lauren, Polo, and Lauren–account for the vast majority of its brand strength and performance, and marketing initiatives focused on these core brands coupled with a renewed shopping experience can be expected moving forward. The company’s sales remain under intense pressure at the moment, however, falling 8% on a constant-currency basis during the fiscal second-quarter of 2017. Fiscal 2017 guidance also calls for a decline in revenue at an even-worse, low-double digit rate.

Image source: Ralph Lauren investor presentation

Another trend working against aspirational and luxury brand companies is falling demand for traditional watches as the adaptation of wearable technology becomes more commonplace. Such a trend has impacted the likes of Fossil (FOSL), Michael Kors, and Richemont (CFRUY), among others. Fossil is particularly dependent on watch sales, as roughly three-quarters of its revenue is generated by it watch business. Meanwhile, Swiss watch maker Richemont plans to cut 200 jobs in its high-end watch business, a sign that it is not expecting a material rebound in demand in the space in the near term. The traditional fashion watch may very well be on its way out for good.

Fossil and Michael Kors are taking the wearable technology challenge head-on by developing their own smartwatches. Though Michael Kors’ smartwatch products, which are a result of a partnership with Fossil and Google (GOOG, GOOGL), have not been able to fully replace the lost demand for its traditional fashion watches, they helped to mitigate the declines to a degree. In one of the most interesting recent developments in the luxury space, Luxottica (LUX) has partnered with Intel (INTC) to develop a smart eyewear product, Radar Pace, which was launched in early October 2016. Though its capabilities are currently limited to running and cycling training support, its ability to collect and interpret real-time data leaves the imagination open to a wealth of possibilities.

Whether it is next-generation wearable technology, a refined online presence, a reduction in markdown allowances, or an enhanced shopping experience, it is clear that luxury goods firms are well aware of the relationship of the perception of their brands and their long-term success. Trading near-term sales pressures for long-term brand equity looks to have become a common theme in the space, more so now than ever, and we think the stage may be set for a rebound in consumer sentiment via potential tax cuts for consumers, facilitating more discretionary spending on aspirational and luxury goods. Any step-change increase in consumer spending will likely fall into the hands of those dominating next-generation digital and wearable technology, but execution risk remains. One doesn’t have to look much further than GoPro (GPRO) to see a company that dropped the ball this holiday season.

Given that Michael Kors is a rather small weighting and is included more for speculative, opportunistic reasons in the Best Ideas Newsletter portfolio, we’re not rushing to make any changes to its weighting there. Michael Kors is certainly struggling to overcome the current operating environment, which has pressured its same-store sales considerably, we believe its brand still has room to grow, and its valuation opportunity remains enticing. Shares are currently changing hands at less than 11x next fiscal year’s (ending March 2018) earnings, and below the lower bound of our fair value estimate range. Perhaps growing disposable income among the US consumer will be the catalyst shares need for price-to-fair value convergence to take place.

As for Coach, we’re holding on to shares for now, too, despite being disappointed by reports that it made multiple takeover offers for UK luxury goods retailer Burberry (BURBY). Similar to the situation that unfolded with the recent acquisition of the Stuart Weitzman brand, we think management may be willing to stretch a bit too far in looking for incremental brand strength to offset core business weakness. At this point, however, our position in the company has largely been capital-appreciation neutral since the addition of shares to the Dividend Growth Newsletter portfolio in 2014, but we remain fond of its dividend growth profile in the event it does not pursue a large acquisition; shares currently yield ~3.6%. Coach’s Dividend Cushion ratio of 1.9 remains solid, but the December dividend may very well end up being the last one collected by the Dividend Growth Newsletter portfolio.

Luxury Goods – Ultra & Aspirational: BID, CFRUY, COH, CTHR, FOSL, KORS, LUX, LVMHF, RL, TIF