Image Shown: Shares of Apple Inc continue to climb higher and we like the name in both our Best Ideas Newsletter and Dividend Growth Newsletter portfolios. This is a long-term holding with substantial potential capital appreciation and dividend growth upside.

By Callum Turcan

Apple Inc (AAPL) is a top holding in both our Best Ideas Newsletter and Dividend Growth Newsletter portfolios, with shares of AAPL yielding ~1.1% as of this writing. The top end of our fair value range estimate for shares of AAPL sits at $280, decently above where shares are trading at as of this writing. Considering the favorable technicals Apple has experienced of late, we see substantial room for shares to move higher still. Please keep in mind that as things stand today, we intend on including Apple in our newsletter portfolios over the long haul. This company comes with a pristine balance sheet, stellar free cash flows, great dividend coverage, substantial share buybacks, and a nice growth outlook that’s supported by Apple’s growing high-margin services business. For reference, Apple’s fiscal 2019 ended on September 28, 2019.

iPhone Commentary

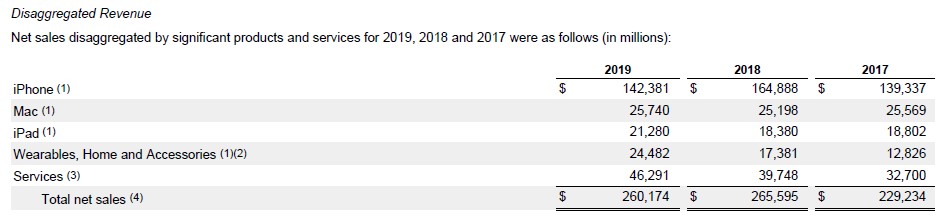

From fiscal 2018 to fiscal 2019, Apple’s total GAAP revenues declined by 2% to $260.2 billion due to a large drop in iPhone sales as you can see in the graphic below. While Apple’s ‘Mac’, ‘iPad’, ‘Wearables, Home, and Accessories’, and ‘Services’ segments all reported meaningful year-over-year revenue growth in fiscal 2019, that wasn’t enough to offset sharply lower iPhone sales. The iPhone 11 series was launched near the end of the fourth quarter of fiscal 2019, indicating there’s room for improvement in the near-term as investors and excited consumers get ready for Apple’s eventual 5G iPhone offering that might be coming next calendar year. From fiscal 2017 to fiscal 2019, Apple’s GAAP revenues still grew by well over 13% with strong growth reported across the board (especially in wearables, home and accessories and services).

Image Shown: Apple’s growing Services segment is crucial to supporting its long-term free cash flow growth trajectory. Image Source: Apple – Fiscal Year 2019 Annual Report

It isn’t known when Apple will pull the trigger and launch its true next generation iPhone with 5G capabilities, which will likely depend in large part on the pace of the rollout of 5G infrastructure around the world. Qualcomm Inc (QCOM) has had a very rocky past with Apple to say the least, but the semiconductor player still seeks to supply Apple’s next iPhone series with 5G modems. Apple bought out Intel Corp’s (INTC) smartphone modem business earlier this year, but any potential in-house 5G modem offerings reportedly remain a few years away still, leaving open a medium-term opportunity for Qualcomm. Please note that Apple and Qualcomm reached a truce covering their longstanding legal disagreements back in April 2019.

There has been a great push in the North American, Eastern Asian, and Western European regions to make 5G consumer services widely available by the end of 2020 or the early-2020s, depending on the country. It is conceivable that Apple may want to wait longer than 2020 to put out its 5G iPhone to allow for network infrastructure to catch up first, but the tech giant may worry about the risk of losing premium smartphone market share should competitors with serious 5G capabilities enter the scene next year. Samsung Electronics Co Ltd’s (SSNLF) S10 offering comes to mind as a potential competitor.

This is where Qualcomm’s nascent truce with Apple comes into play. Should Apple decide to launch a 5G capable iPhone in calendar year 2020, that offering will likely be supported by Qualcomm’s 5G modems. Over the long-term, Apple seeks to develop its own 5G modem that will help keep a greater portion of internal component design in-house, but for now, working with Qualcomm may be required to stay at the top of the pack.

Financial Commentary

The tech giant’s free cash flow profile remained stellar in fiscal 2019. Apple generated $69.4 billion in net operating cash flows and spent $10.5 billion on capital expenditures last fiscal year, allowing for $58.9 billion in free cash flows. That easily covered $14.1 billion in dividend payments while some of Apple’s $66.9 billion in share repurchases were funded by the balance sheet. From fiscal 2017 to fiscal 2019, Apple’s annual free cash flows averaged $58.3 billion.

At the end of September 28, 2019, Apple was sitting on a net cash position of $97.9 billion (including long-term marketable securities and short-term debt). That pristine balance sheet and its enormous free cash flows is why we give Apple a Dividend Cushion ratio of 5.4x as of this writing, which supports its EXCELLENT Dividend Growth and Dividend Safety ratings. Please note Apple resumed its common dividend program in 2012 after an almost two decade long hiatus.

Due to Apple’s substantial share buybacks, the firm’s outstanding diluted share count fell from 5,252 million in fiscal 2017 to 4,649 million in fiscal 2019. The company’s GAAP diluted EPS climbed from $9.21 to $11.89 during this period. On the other hand, Apple’s GAAP operating expenses climbed 28% over this period as its R&D expenses jumped by 40%, while the firm’s GAAP gross margin dropped by ~65 basis points. Rising services revenue will help support Apple’s gross margin over time as that segment’s margins are quite dear, but near-term iPhone sales performance remains paramount. Here’s what Apple’s CEO Tim Cook had to say during the firm’s latest quarterly conference call (emphasis added):

“We established new all-time highs for multiple services categories including the App Store, AppleCare, Music, cloud services and our App Store search ad business. We are well on our way to accomplishing our goal of doubling our fiscal year ’16 Services revenue during 2020. I want to touch on a number of services in brief.

We had all-time record revenues from payment services. For Apple Pay, revenue and transactions more than doubled year-over-year with over 3 billion transactions in the September quarter exceeding PayPal’s (PYPL) number of transactions and growing four times as fast. Apple Pay is now live in 49 markets around the world with over 6,000 issuers on the platform. We believe that Apple Pay offers the best possible mobile payment experience and the safest, most secure solution on the market. We’re glad that 1000s of banks around the world participate. Apple Card launched in the US in August, and we’ve been thrilled by the positive reception we’ve seen.”

Apple Pay is supported by Goldman Sachs Group Inc (GS), and analysts are supportive of the service’s high-margin growth trajectory. Payment processing and financial tech at-large are very hot growth areas right now, supported by powerful secular growth tailwinds as some consumer groups have switched from cash to card to phone/mobile.

Concluding Thoughts

We like Apple’s pristine balance sheet, top quality free cash flow profile, and decent growth outlook. The company retains an enormous amount of firepower for additional share buybacks and material dividend increases going forward. Depending on whether the US decides to impose additional tariffs on Chinese imports soon will be very material to Apple’s near-term performance, but the long-term trajectory remains the same. Beyond Apple Pay, the company has its new streaming offering (Apple TV+) which launched on November 1 to drive services-related revenue growth.

Broad Line Semiconductor Industry – AMD AVGO FSLR INTC TXN

Integrated Circuits Industry – ADI MRVL MCHP NVDA SWKS TSM XLNX

Computer Hardware Industry – AAPL BB HPQ IBM TDC

Financial Tech Services Industry – MA MELI PYPL VRSK V

Related: GS, SSNLF

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Apple Inc (AAPL), Intel Corporation (INTC), PayPal Holdings Inc (PYPL), and Visa Inc (V) are all included in Valuentum’s simulated Best Ideas Newsletter portfolio. Apple and Intel are also both included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.