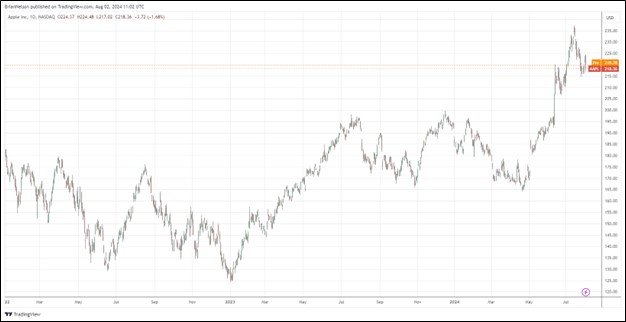

Image: Apple’s shares have done quite well since the beginning of 2022.

By Brian Nelson, CFA

Apple (AAPL) reported calendar second quarter (fiscal third quarter) results on August 1 that beat the consensus estimate for both revenue and GAAP earnings per share. The iPhone maker put up June quarter records for both revenue and earnings per share while its Services revenue hit a new all-time high. Quarterly revenue was up 5% year-over-year, while quarterly earnings per diluted share came in at $1.40, up 11% on a year-over-year basis. Apple’s quarterly commentary was positive:

During the quarter, we were excited to announce incredible updates to our software platforms at our Worldwide Developers Conference, including Apple Intelligence, a breakthrough personal intelligence system that puts powerful, private generative AI models at the core of iPhone, iPad, and Mac. We very much look forward to sharing these tools with our users, and we continue to invest significantly in the innovations that will enrich our customers’ lives, while leading with the values that drive our work…During the quarter, our record business performance generated EPS growth of 11 percent and nearly $29 billion in operating cash flow, allowing us to return over $32 billion to shareholders. We are also very pleased that our installed base of active devices reached a new all-time high in all geographic segments, thanks to very high levels of customer satisfaction and loyalty.

In the quarter, Products revenue came in at $61.6 billion, while Services revenue came in at $24.2 billion, both above the consensus forecast. Apple’s iPhone sales ticked down a bit on a year-over-year basis, while Mac and iPad sales advanced, coming in better than expectations. Though revenue in Apple’s Wearable’s business fell in the quarter, the segment’s revenue came in better than expectations, too. Revenue in Greater China fell in the quarter to $14.7 billion from $15.8 billion in the year-ago period, lower than what the Street had been expecting.

Apple ended the quarter with cash and marketable securities of $153 billion and term debt of $98.3 billion, good for a solid net cash position on the balance sheet. For the nine-month period ended June 29, 2024, Apple’s cash flow from operations increased to $91.4 billion from $88.9 billion in the year-ago period, while capital spending fell to $6.5 billion from $8.8 billion previously. Free cash flow came in at $84.9 billion in the first nine months of its fiscal year, handily covering its cash dividends paid of $11.4 billion over the same time period. Apple has repurchased $69.9 billion in stock over the past nine months.

All told, we liked Apple’s calendar second quarter (fiscal third quarter) results, as the firm outpaced consensus expectations for both Products and Services revenue. Apple’s balance sheet remains pristine, and its strong free cash flow easily covers its dividend. The company continues to buy back stock, and while there were pockets of weakness in the quarterly report, including revenue in Greater China, we like the company’s positioning in artificial intelligence, as we await a strong upgrade cycle for its next-generation iPhone. Shares yield 0.5% at the time of this writing.

—–

NOW READ: 12 Reasons to Stay Aggressive in 2024

NOW READ: 2023 Was a Fantastic Year! Are You Ready for 2024?

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.