Amgen’s share price has run up in anticipation of positive results from its key pipeline product Repatha. Now that the results are out, doubt has crept in concerning the overall viability of the product. Let’s examine.

By Alexander J. Poulos

Amgen (AMGN) remains a biotech bellwether, as the company continues to profit from its legacy product line. The established product line enhances the equity’s appeal as the cash flow generated is returned to shareholders in the form of a generous dividend. The company currently yields ~2.8%. For many conservative, income-seeking investors Amgen remains a top consideration in what many perceive as a “risky industry.” Amgen’s Dividend Cushion ratio >>

That said, what many hopeful investors may not realize is that Amgen’s legacy product line is now under assault through the rise of biosimilar products. Similar to the traditional pharma players, a biosimilar is a copy of the original branded product that can be marketed by a competitor once the patent exclusivity lapses. The biotech industry has been shielded from this reality for quite some time with Amgen the largest beneficiary of this trend. To offset the future biosimilar challenge, Amgen will need to increase innovation.

Amgen, thus far, seems up to the challenge with the company’s best hopes of replacing the lost revenue coming from the recently approved Evolocumab which is marketed under the brand Repatha. Repatha belongs to the PCSK9 class, a novel new way for clinicians to lower cholesterol. The PCSK9 works by increasing the liver’s ability to remove LDL-C (Low-Density Lipoprotein or otherwise known as “Bad Cholesterol”) cholesterol. The PCSK9 gene is thought to play a crucial role in the reduction of LDL cholesterol, Repatha is indicated for those afflicted with familial hypercholesterolemia, a genetic disorder that reduces the number of LDL receptors found in the liver the main organ that breaks down cholesterol.

Image Source: Amgen

The product is a rousing success for the initial indication, but the overall market for those afflicted with Familial Hypercholesterolemia is rather small, by most measures. For Amgen to grow overall top line revenue, the prescribing label for Repatha would need to expand considerably. The goal could be to include those with stubbornly high cholesterol to the mix, a far larger overall market.

The price of Repatha likely remains the greatest stumbling block to increased market share; a yearly therapy of Repatha lists for $14,000, a major hurdle. Traditional statin treatments to lower cholesterol sold under trade names such as Lipitor and Crestor have all lost patent protection with many retailing for under $10 per month. With cost containment, the principal activity in healthcare today, the hurdle rate for Repatha looms large. To exceed the barrier and expand the overall market, definitive proof of superior outcomes would need to be presented. Amgen recently revealed the details of its outcomes trial dubbed, Fourier on March 17.

The Fourier Trial

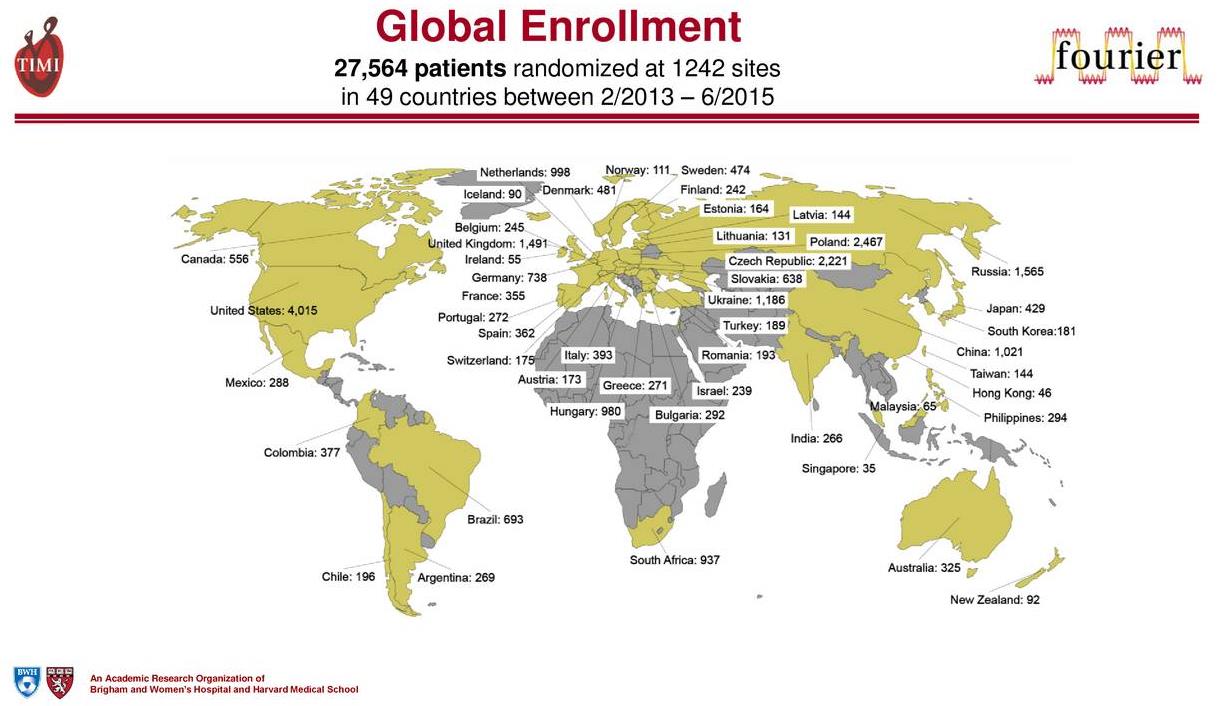

The trial is a massive multicenter trial conducted from all corners of the world. The large patient population poll was designed to include the largest swath of the eligible patient population in order to conclusively demonstrate superior outcomes over the use of conventional statin therapy.

Image Source: Amgen

The primary endpoint of the trial is the reduction of cardiovascular events, which are defined as cardiovascular death, stroke and myocardial infarction (heart attack) or the acronym MACE (Major Adverse Cardiovascular Events). The secondary endpoint is time to cardiovascular death, myocardial infarction, and death. Amgen share price gapped up in early February 2017 upon the press release heralding that Repatha met both its primary and secondary endpoints in the Fourier trial. To say the least, expectations were running high.

Critical Questions

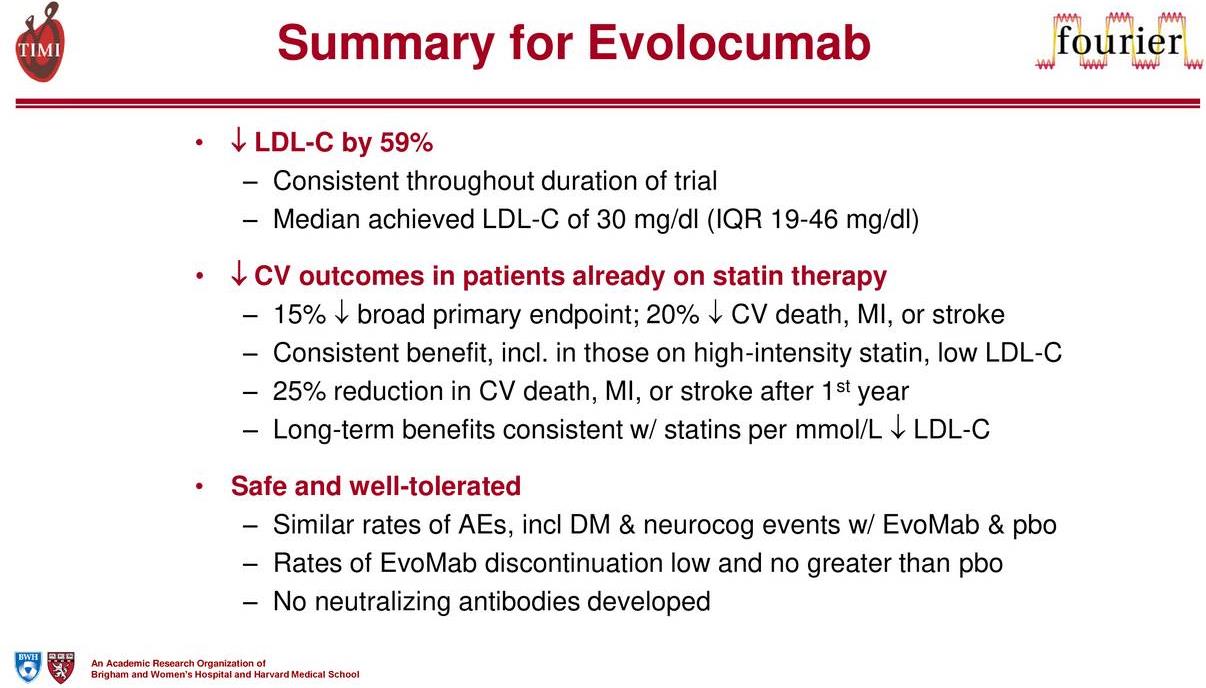

Image Source: Amgen

The results from the trail at first glance seemed impressive, but upon further review, critical questions have been raised.

Repatha registered a 15% decrease in MACE, its primary endpoint, with a 20% drop in MACE to meet its secondary endpoints. The key portion of the secondary outcome is the inclusion of a statin therapy in addition to Repatha. The unfortunate outcome is the use of Repatha did not have a positive impact in lowering cardiac death versus statin alone, in our view a negative for the future prospects of the entire class.

The lowering of LDL-C, as shown by the Fourier trial does have a positive impact, but the goal of reducing cardiac death remains elusive. The ability to drop LDL-C is a significant step in lowering the overall risk but remains just part of the process. Additional work will need to be conducted with other mechanisms to produce the desired outcome.

From a business perspective, we feel the mixed results do not improve the significant hurdles that the PCSK9 group faces. We found it interesting that Amgen spent a considerable part of the post-release conference call discussing the pricing strategy that will evolve.

Pricing Strategy

PBM Pressure on Repatha?

The inability of Repatha to conclusively improve cardiac deaths will be the cudgel that the pharmacy benefit managers (PBM) use to extract significant pricing concessions in an attempt to keep pricing rational. The vast majority of plans require the arduous prior authorization process to limit the overall patient population from being prescribed the therapy. The reasoning is straightforward–before the release of the Fourier data, the small subsection that is afflicted with Familial Hypercholesterolemia, which accounts for the rather weak initial sales tally of Repatha versus expectations. Amgen needs the product to become a rousing success to patch the looming gap in the company’s product lineup, in our view.

Enbrel Troubles?

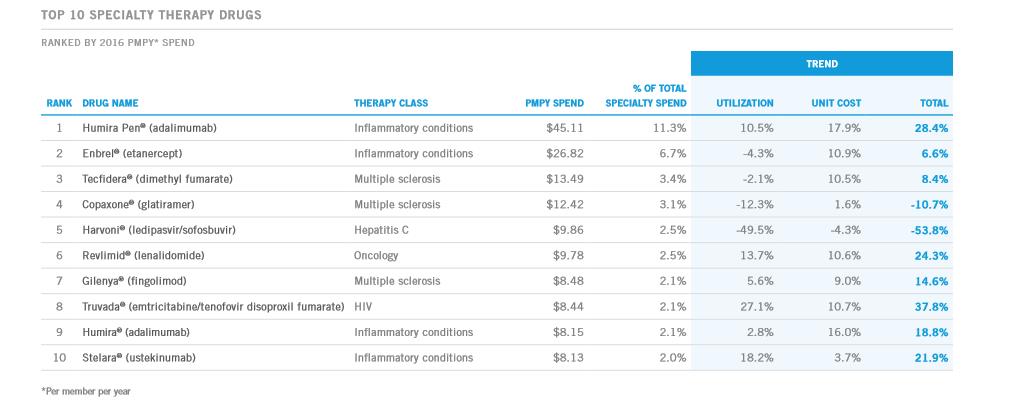

Amgen’s top seller remains, Enbrel, a treatment for various inflammatory diseases. The payers have begun to push back on the pricing strategy employed by pharma/biotech where significant annual price hikes are handed down. The drop in Amgen’s share price in October 2016 came on the heels of the revelation that it expects little contribution from price hikes this year on Enbrel.

The lack of pricing power will have an adverse impact on overall sales as Amgen’s top seller faces increasing competition from recently-approved products such as Stelara. The commercial plan data from Express Scripts (ESRX) denotes a drop in utilization for Enbrel with price hikes more than making up for the loss in volume in 2016. We doubt Enbrel will be able to generate volume gains; with the absence of pricing power Enbrel sales in the commercial level will likely remain under pressure.

Image Source: Express Scripts commercial plan data.

The Need for an Innovative Pricing Scheme

In order to capture the bulk of the sales potential of Repatha, an innovative pricing scheme will need to be put forth. To the credit of Amgen’s management team, the company thus far seems to be receptive to the idea of structuring reimbursements based on patient outcomes. The willingness of Amgen to accept a different rate of pay based on clinical results is a watershed moment for the industry, long vilified by many for the prices charged for therapy. Amgen put forth an interesting argument over the pricing of cholesterol meds in general–the following quote from Josh Ofman, Amgen, Inc. – SVP, Global Value, Access, and Policy neatly sums up the case:

The budgetary issues that you refer to, I think a lot of payers say, listen, this is really a budget problem; we just can’t afford these medicines. And we just have to put that in perspective.

Currently, Express Scripts, PBMs, and other payers are paying per-member/per-month rates well above $0.50; sometimes well above $1 for diabetes drugs. They were paying that for Crestor before it went off patent. They are paying those per-member/per-month rates.

Right now for Repatha, they are paying $0.05 or $0.10 per-member/per-month, and in 2016 and 2017, because of the patent expiry of both Crestor and Zetia, there is about $11 billion to $12 billion of spending on those medicines alone that the payers no longer have to burden. So there is plenty of room to accommodate a novel, innovative therapy to treat our sickest patients who need protection from cardiovascular events and I think the payers will understand that.

We suspect the real battleground will be over the patient profile that falls into the category of “sickest patients.” A large cohort of the patients treated with Crestor and Zetia fall in the category of mild to moderate hyperlipidemia, not an ideal candidate for PCSK9 therapy.

The PCSK9 class is priced based on what is widely-suspected to be the pricing model that most payers utilize. The plans model for $150,000 per quality life years saved, with LDL-C > 70 priced at $7,700-$11,200 and LDL-C >100 priced at $10,400 to $15k. Amgen’s argument is its treatment can drop the LDL-C level below 40 and sustain it there for well over 100 weeks as proven with the Fourier trial. Hence, utilizing the above pricing parameters should justify a net price in the $8,000-$11,000 range.

To add further flexibility to maximize the number of eligible patients, Amgen is willing to enter into either of two pricing models. The first is a Performance and Outcomes-based contract where Amgen would refund the cost of therapy if certain parameters are not met. Also, it is willing to enter into an LDL-C based contract or a Cardiovascular events contract. In essence, Amgen would be paid based on the net lowering of LDL-C or reduction in expected Cardiovascular events, a significant departure from standard contracts. The standard contract model is also available where Amgen would offer volume discounts based on the number of members utilizing the product.

Competitive Threat

The most immediate threat to Repatha dominance in the PCSK9 class is Praluent which is marketed by Sanofi (SNY). Amgen is looking to bar the sale of Praluent claiming the product infringes on some of its patent estates, a point a recent court decision found to be valid. The case is highly technical, yet Amgen is playing hardball to dominate the class.

We feel the most likely outcome is a royalty will be paid to Amgen with both products remaining in the marketplace. We find it a stretch to believe the US government will remove a competing product from the market in what could potentially evolve into a $10 billion dollar market with Amgen handed supreme pricing power and virtual monopoly as other competitors remain in the distance.

From our perspective, it is important to keep in mind that just because a company has a competing product in the lab does not guarantee success. The failure of Bococizumab in Phase 3 trials underscores the risky nature of the drug discovery process. There are no guarantees the competing products in the lab will ultimately gain approval.

We will continue to follow the progress of the class carefully and will post a timely update when warranted.