Image Source: Parsons Corporation – February 2020 IR Presentation

By Callum Turcan

Parsons Corporation (PSN) is a provider of technical design, engineering, and software solutions to markets within the realm of defense, intelligence, threat detection and mitigation, cybersecurity, critical and transportation infrastructure, mobility solutions, connected communities, and more. The company went public in May 2019 and has since used those IPO proceeds to fund its growth story, including the acquisition of OGSystems during the first half of 2019 (which focuses on “geospatial intelligence, big data analytics, and threat mitigation”) and QSR in the second half of 2019 (which “specializes in radio frequency spectrum survey, record and playback; signals intelligence; and electronic warfare missions”). The company continues to generate value with its M&A program, and we would expect this to continue.

For easier viewing of the images that follow in this piece, access its latest slide deck presentation here (pdf).

Image Shown: Parsons is a serial acquirer, with M&A representing a big part of its corporate growth strategy. Image Source: Parsons – February 2020 IR Presentation

In order to keep business momentum firing on all cylinders, Parsons is targeting opportunities at its ‘Federal Solutions’ segment which includes catering to US defense and intelligence agencies by offering a whole slate of services (cybersecurity solutions, geospatial analysis, military training, technology services for nuclear waste treatment, infectious disease control analytics, and more).

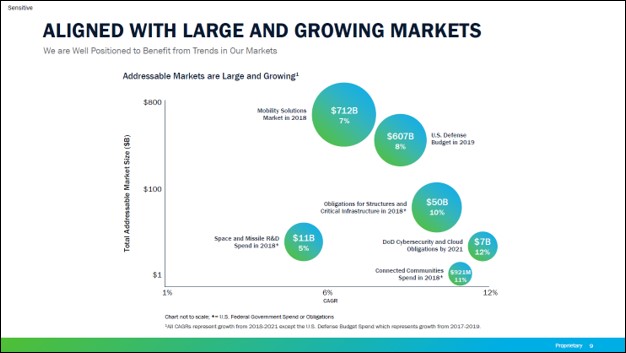

During the first nine months of fiscal 2019, Parsons’ ‘Federal Solutions’ segment posted 29% revenue growth (assisted by acquisitions) and 25% in non-GAAP adjusted EBITDA growth (attributable to Parsons) on a year-over-year basis. On the other hand, its ‘Critical Infrastructure’ segment posted a 2% drop in sales but a 27% jumped in adjusted EBITDA attributable to Parsons during this period on a year-over-year basis. In the graphic below, management highlights the various growth markets the firm is capitalizing on. Its ‘Mobility Solutions Market’ opportunity is particularly attractive with a $712 billion addressable market, growing at a nice 7% annual clip.

Image Shown: Parsons is aggressively pushing into markets in the realm of US defense, intelligence, and space operations to augment its growth trajectory. Image Source: Parsons – February 2020 IR Presentation

US defense, intelligence, and critical infrastructure spending tends to be very stable (and historically has grown over time), allowing for Parsons to post consistent financial performance with room for upside. It’s highly unlikely the US would cut funding towards missile defense systems, for example, and the US Department of Defense (‘DoD’) budget continues to grow as does the technological needs of the US military and intelligence apparatus at-large. That’s where Parsons comes in, as it provides the digital-oriented solutions needed to manage and maintain the various operations within this framework. While its revenue is roughly split between its ‘Federal Solutions’ and ‘Critical Infrastructure’ segments, the former represents a larger chunk of Parsons’ adjusted EBITDA generation as you can see in the upcoming graphic down below.

Image Shown: An overview of Parsons’ financials and where those results come from in term of its two main operating segments. Image Source: Parsons – February 2020 IR Presentation

Parsons’ project backlog has been steadily growing over the years, and that trend has continued of late. The firm won a seat on a potential $249 million contract with the Naval Information Warfare Center Pacific (‘NIWC Pacific’) concerning software and hardware life cycle services for various systems and networks (announced in February 2020). It also won a task order from the General Services Administration (‘GSA’) concerning space operations and the security needs of those missions (announced in January 2020), and it won a role on a $427 million contract with the Air Force Research Laboratory concerning Global Application Research, Development, Engineering and Maintenance (‘GARDEM’) software (announced in January 2020). Here’s some key commentary from management on some of the firm’s other recent contract wins, and how that ties in with Parsons’ M&A strategy:

“During the third quarter, we registered 3 single-award wins over $100 million, including a $590 million cyber contract. I should also highlight that we only booked $112 million on this contract, in line with our conservative approach to booking new contract wins in the backlog. Notable third quarter awards included the new $590 million single-award Combatant Commands Cyber Mission Support contract by the General Services Administration. Under this contract, we will be researching, developing, testing and evaluating tailored cyber solutions for cyberspace operations, advanced concepts and technologies and integrating operational platforms across multiple domains…

Finally, the integration of our OGSystems and QRC acquisitions continue to go well. As I previously mentioned, both companies play a key part in our $590 million single-award cyber win. As a partner to Perspecta Engineering, OGSystems was awarded a subcontract on the National Geospatial-Intelligence Agency Enterprise Engineering single-award IDIQ contract to perform full life cycle systems engineering and integration.” — Carey Smith, President and COO of Parsons, during the firm’s third quarter of fiscal 2019 conference call

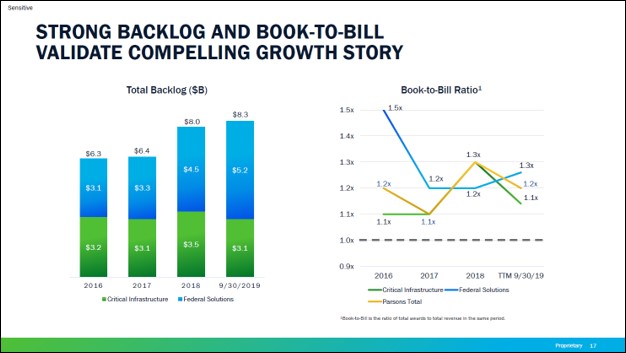

At the end of Parsons’ third quarter of fiscal 2019, the firm had a total project backlog of $8.3 billion, and furthermore, its ‘Book-to-Bill’ ratio (total awards divided by the total revenue during a given period) has consistently been over 1.0x historically. In the upcoming graphic down below, Parsons highlights its growing project backlog, specifically from its ‘Federal Solutions’ segment.

Image Shown: Parsons has done a solid job securing work on new projects, which has substantially increased its project backlog over the years. Specifically, Parsons has had the most success at its ‘Federal Solutions’ segment. Image Source: Parsons – February 2020 IR Presentation

In fiscal 2018, Parsons noted it had a free cash flow conversion ratio of 104%, assisted by a ~90 basis point expansion in its non-GAAP adjusted EBITDA margin from fiscal 2016 to fiscal 2018 (aided by its more lucrative ‘Federal Solutions’ segment which is growing at a faster clip). Having a free cash flow conversion ratio north of 100% is a promising sign. During the first three quarters of fiscal 2019, Parsons generated $100 million in net operating cash flow while spending $19 million on its capital expenditures, allowing for material free cash flows. The firm allocated $73 million towards share repurchases during this period, and Parsons does not pay out a common dividend at this time.

Parsons had a net debt load of $103 million at the end of September 2019 when including $13 million in restricted cash on hand, and none of its debt was classified as current. We view its net debt load as manageable given its sizable free cash flows and lack of common dividend obligations, and considering Parsons had $134 million in cash and cash equivalents on hand at the end of September 2019 (not including restricted cash), its liquidity buffer remains intact even after its recent acquisitions. Due to its past acquisition activity, Parsons’ income statement is a messy read due to one-time expenses and other factors.

Concluding Thoughts

US defense spending has historically been very recession-resistant, and we expect that to continue being the case going forward which is why we added shares of Lockheed Martin Corporation (LMT) to our Dividend Growth Newsletter portfolio and shares of SPDR Aerospace & Defense ETF (XAR) to our Best Ideas Newsletter portfolio back on January 13, 2020 (link here).

As we’ve mentioned in the past, budgeted US defense spending for fiscal 2020 is set to increase by $21 billion over budgeted fiscal 2019 levels, hitting approximately $738 billion. That includes both base spending levels and funding for overseas operations. Additionally, the creation of a US Space Force provides for incremental upside and Parsons has already capitalized on some of that potential via the aforementioned task order win from the US GSA. Parsons is well-positioned to capitalize on all of this upside.

For 2019, we’re forecasting adjusted EBITDA of ~$330 million, so the stock is not necessarily cheap trading at a 12.1x EV/EBITDA multiple, though we note adjusted EBITDA has advanced ~23.5% thus far in 2019, and ‘Book-to-Bill’ trends remain highly encouraging as new business is recognized on the top line in future periods. On a third-quarter 2019 annualized run-rate basis, adjusted EBITDA comes in at $356 million, which roughly mirrors our forecast for 2020 numbers, implying a more-reasonable 11.2x EV/EBITDA multiple.

All things considered, Parsons has a compelling product line-up that is aligned with strong and growing end markets. The company generates material free cash flow, and its balance sheet remains strong, with 0.4x net leverage and a strong liquidity position. Its valuation isn’t too stretched, and the firm has a deep bench in the executive suite. We like Parsons, and will have more to say when the firm reports its fourth quarter earnings for fiscal 2019 before the market opens on March 10.

Prime Aerospace & Defense Industry – BA FLIR GD LMT ROC RTN

Conglomerates Industry – MMM DHR GE HON UTX

Aerospace Suppliers Industry – ATRO HEI HXL TDY TXT SPR

Related: PSN, XAR

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. The SPDR Aerospace & Defense ETF (XAR) is included in Valuentum’s simulated Best Ideas Newsletter portfolio. Lockheed Martin Corporation (LMT) is included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.