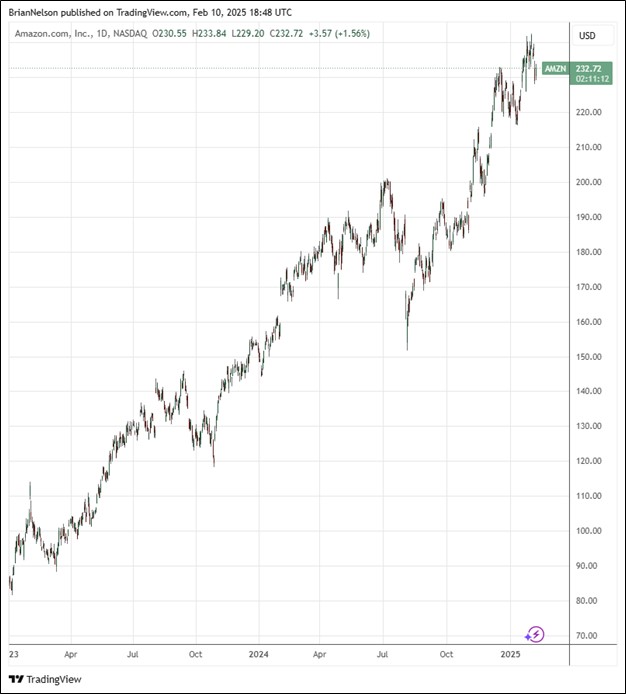

Image: Amazon’s stock has done quite well in recent months.

By Brian Nelson, CFA

Amazon (AMZN) reported better than expected fourth quarter results February 6 that showed a beat on both the top and bottom lines. Net sales advanced 10% in the quarter on a year-over-year basis and 11% excluding foreign exchange. North America sales increased 10%, International segment sales increased 8% (9% excluding changes in foreign exchange rates), while AWS sales increased 19%, to $28.8 billion, slightly lower than expectations. Operating income surged higher to $21.2 billion in the fourth quarter, up from $13.2 billion in the same period last year. Net income increased to $20 billion in the fourth quarter, equating to $1.86 per diluted share, up from $1.00 per diluted share in the fourth quarter of 2023 and ahead of the consensus estimate of $1.48 per diluted share.

Management had the following comments about the quarter in the press release:

The holiday shopping season was the most successful yet for Amazon and we appreciate the support of our customers, selling partners, and employees who helped make it so. When we look back on this quarter several years from now, I suspect what we’ll most remember is the remarkable innovation delivered across all of our businesses, none more so than in AWS where we introduced our new Trainium2 AI chip, our own foundation models in Amazon Nova, a plethora of new models and features in Amazon Bedrock that give customers flexibility and cost savings, liberating transformations in Amazon Q to migrate from old platforms, and the next edition of Amazon SageMaker to pull data, analytics, and AI together more concertedly. These benefits are often realized by customers (and the business) several months down the road, but these are substantial enablers in this emerging technology environment and we’re excited to see what customers build.

Amazon’s operating cash flow increased 36%, to $115.9 billion for the trailing twelve months, while free cash flow for the trailing twelve months was $38.2 billion compared to $36.8 billion for the trailing twelve months ended December 31, 2023. Purchases of property and equipment were $27.8 billion in the fourth quarter of 2024, up from $14.6 billion in the same quarter last year. Capital spending is expected to be north of $100 billion in 2025. Looking to the first quarter of 2025, Amazon’s net sales are expected to be between $151-$155.5 billion (below the consensus forecast of $158.3 billion), or to grow between 5%-9%, while operating income is expected to be between $14-$18 billion, compared with $15.3 billion in the first quarter of 2024. Cash and marketable securities at the end of the calendar year totaled $101.2 billion, while long-term debt was $52.6 billion. We continue to like Amazon as a holding in the Best Ideas Newsletter portfolio.

—–

Brian Nelson owns shares in SPY, SCHG, QQQ, QQQM, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, QQQM, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, QQQM, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.