Image Source: Melanie Tata

Altria’s business has grown increasingly complex recently as it has levered up to add exposure to new growth opportunities. We don’t find the convoluted company attractive, even after considering its lofty yield, and its core cigarette business continues to face material industry-wide volume declines.

By Kris Rosemann

We extinguished Altria (MO) from the simulated Dividend Growth Newsletter portfolio December 21 after assessing the announcement of its deal to acquire a 35% stake in US e-cigarette leader JUUL Labs. Here’s our conclusion from the announcement of our decision, “Parting with Altria on News of Stake in JUUL:”

We think Altria may have thrown in the towel on harvesting its core smoking demographic and may now be entering into a long rebuilding period, as it repositions for the future. This means that we could see even more value-destroying deals, which could further threaten dividend growth. Unfortunately, it looks like the time has come to part with one of the best performing stocks in history.

Following Altria’s recent share price decline, shares now offer a lofty dividend yield of ~6.6%, but we’re not looking to add back exposure to the company in the simulated Dividend Growth Newsletter portfolio any time soon.

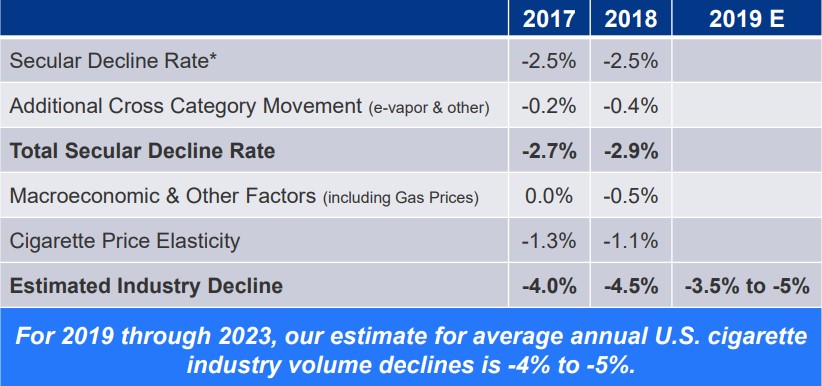

The company has its hands in a number of businesses via economic interests in global beer giant AB InBev (BUD), Canadian marijuana company Cronos Group (CRON), and privately-held JUUL Labs, and its increasingly convoluted structure has only increased the haze surrounding the stock. The amount of regulatory uncertainty facing the group of businesses alone is reason for pause. Throw in a core cigarette business that is in secular decline — volumetrically speaking at least as US cigarette volumes are estimated to decline by 4%-5% per year from 2019-2023 — and we find ourselves comfortably sitting on the sidelines.

Image source: Altria fourth quarter presentation

Net revenues at Altria in the fourth quarter of 2018, results released January 31, were roughly flat on a year-over-year basis as higher pricing roughly offset volume declines in both smokeable and smokeless products. Total cigarette market share declined by 60 basis points over the full year 2018 to 50.1%, while smokeless product market share held steady at 54%. Adjusted operating companies income (OCI) margin in its ‘Smokeable Products’ segment (~87% of total fourth quarter revenue) contracted 10 basis points in the fourth quarter from the year-ago period as lower volumes, higher investments in strategic initiatives, and higher resolution costs were only partially offset by higher pricing and lower promotional investments. Adjusted diluted earnings per share in the period rose 4.4% on a year-over-year basis to $0.95 thanks in large part to a lower tax bill and lower share count.

Management has yet to release its cash flow statement for the full year 2018, but it disclosed the significant increase in financial leverage as of the end of the year due to its active deal making in the year. The company ended 2018 with more than $25.7 billion in total debt and $1.3 billion in cash and cash equivalents, but it lists its investments in AB InBev and JUUL at $17.7 billion and $12.8 billion, respectively. Debt-to-consolidated EBITDA at the end of the year sat at 2.5x. Altria paid ~$5.4 billion in cash dividends in 2018, a figure it could have covered with free cash flow generation through only three quarters of the year, and it bought back nearly $1.7 billion of its shares at an average price of $60 each.

In 2019, Altria expects to deliver adjusted diluted earnings per share in a range of $4.15-$4.27, which represents growth of 4%-7% over 2018. This guidance takes into account higher interest expense related to its significantly higher debt load, savings from its cost reduction program (which is expected to hit annualized savings of $575 million in 2019), investments related to Philip Morris USA’s plans for launching IQOS (assuming it is authorized by the FDA), and it assumes no earnings contributions from the Cronos or JUUL investments. Management maintains its long-term target dividend payout of 80% of adjusted diluted earnings per share, but its expectations for its bottom-line in 2019 come up short of its long-term target of 7%-9% annual growth in adjusted diluted earnings per share.

Our fair value estimate for Altria currently sits at $54 per share.

Tobacco: BTI, MO, PM, SWM, VGR

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Kris Rosemann does not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.