|

Altria and Philip Morris to Tie the Knot?

—

Hi everyone,

—

Trust you are doing great. In case you missed it, we wanted to make sure that you saw our team’s comments on the latest economic developments. They can be accessed at the following link, “The Valuentum Team Talks Powell Speech and Threat of Global Recession.”

—

In these Economic Roundtable notes (e.g. the link above), we blend thoughts from President of Investment Research Brian Nelson, Co-editor of the Newsletters and Associate Investment Analyst Callum Turcan and Independent Financials Contributor Matthew Warren. Like Brian, Matt worked at Morningstar for many years, and he is credited with turning around the performance of the company’s equity financials team during the Financial Crisis.

—

The Valuentum team has significant and relevant experience across various market environments to provide you with insights under any economic or stock-market conditions. Even if you aren’t investing in stocks directly (perhaps you own mutual funds or ETFs), we think Valuentum’s economic and market commentary is simply a must-have. The team approach at Valuentum has been vital to all aspects of our research, and we hope you continue to enjoy it.

—

Hitting the wires today is some news that has been rumored in the past, but seems to now be confirmed: Philip Morris (PM) and Altria (MO) are in merger talks. Though a deal is not definitive yet, and it will have to be approved by regulators, CNBC is reporting that Philip Morris and Altria are weighing a 59%/41% split, respectively, in an all-stock merger-of-equals deal. The deal would reverse the separation of these two firms, completed more than a decade ago.

—

Though the tobacco industry remains in secular decline as cigarette volumes wane, the group benefits from considerable pricing power, which keeps earnings and dividends moving in the right direction. The tobacco industry is also experiencing significant change with vaping popularity and the legalization of cannabis. In this context, we like the proposed deal on a strategic basis, as it will facilitate the combination of two innovative companies to address structural changes across the tobacco arena.

—

We have updated our stock and dividend reports for both names, but we haven’t made any material changes to the fair value estimates. Though Philip Morris’ shareholders may be getting the short end of the stick as it relates to the value split, long term, we would expect synergies to more than offset this shortfall. Philip Morris’ shares are trading lower on the deal, while Altria’s shares are higher on the announcement.

—

—

—

—

—

We’re still digesting the details of this announcement, and we expect to profile this transaction in the next edition of the High Yield Dividend Newsletter. You can learn about the High Yield Dividend Newsletter here. If you have any questions at this time, please let us know.

—

Thank you,

—

The Valuentum Team

valuentum.com/

|

|

The Exclusive

The Exclusive publication is simply one-of-a-kind. It offers readers an income idea, a capital-appreciation idea and a short-idea consideration each month, and the success rates have been phenomenal. You can add this publication to your regular premium membership.

—

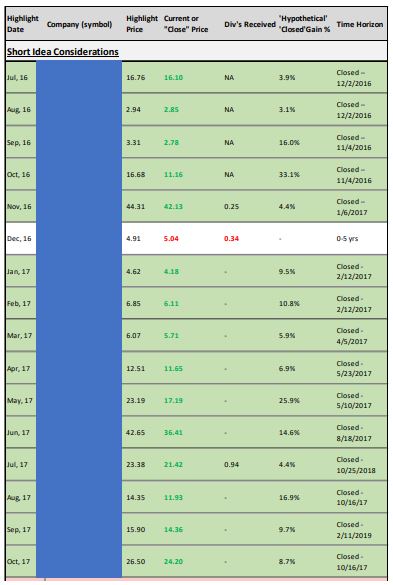

We hope you enjoy this publication greatly. Did you know: Out of the first 16 short-idea considerations that were highlighted in the publication, 15 of them have “worked out.” We think the publication is invaluable for investors seeking a diverse collection of ideas as well as funds that are looking for both long and short considerations.

Image: A list of the first 16 short-idea considerations, with their names blocked out. 15 of the first 16 short ideas “worked out.”

|