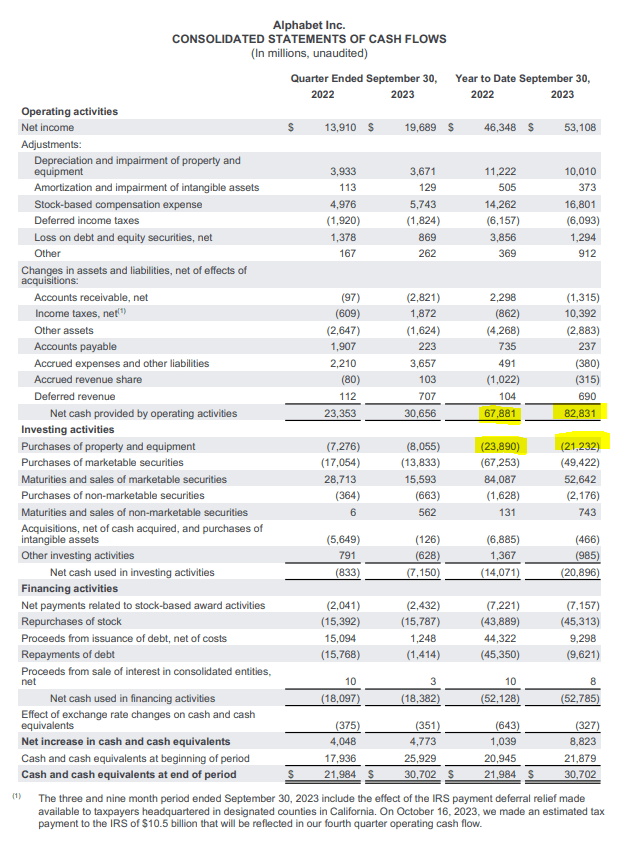

Image: Free cash flow growth at Alphabet has been phenomenal during the first nine months of 2023.

By Brian Nelson, CFA

The market was laser-focused on the quarterly reports coming from Alphabet (GOOG) (GOOGL) and Meta Platforms (META) the past couple days. We believe the market’s reaction to Alphabet’s third-quarter report was overblown, as the equity traded down more than 9% during the session October 25. Meta Platforms has returned to being a net-cash-rich, free-cash-flow generating, secular-growth powerhouse, and its third-quarter 2023 results spoke clearly to this view. In this article, let’s review Alphabet’s and Meta’s cash-based sources of intrinsic value: net cash on the balance sheet and traditional free cash flow generation.

Alphabet ended the third quarter of 2023 with total cash, cash equivalents and marketable securities of ~$119.9 billion versus long-term debt of just ~$13.8 billion, good enough for a huge net cash position. The company’s free cash flow during the first nine months of 2023 came in at a whopping ~$61.6 billion, up from $44 billion during the same period a year ago. Meta Platforms ended the third quarter of 2023 with total cash, cash equivalents and marketable securities of $61.12 billion versus long-term debt of ~$18.4 billion, also good for a very nice net cash position. Meta’s adjusted free cash flow came in at $31.5 billion through the first nine months of 2023, up materially from the depressed levels of ~$13.2 billion it achieved during the same period a year ago.

For the three months ended September 30, 2023, revenue growth at Alphabet was 11%, while it came in at 23% for Meta, both measures on a year-over-year basis. Alphabet’s operating margin came in at 28%, while Meta’s operating margin was 40%, the latter twice what the firm achieved in the third quarter of last year. As noted above, both Alphabet and Meta are net-cash-rich, free-cash-flow generating, secular-growth powerhouses. Though cloud revenue growth and the pace of expense expansion at Alphabet are concerns, and while Meta may experience some softness in advertising revenue during the current quarter, both entities’ quarterly performances during the calendar third quarter showcased why they have been market darlings during 2023.

Note: We’ve corrected our updated report on Alphabet. We had previously uploaded an incorrect version, but this version (pdf) has now been corrected. There is no change to the updated fair value estimate of $133 per share.

NOW READ: There Will Be Volatility

———-

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, QQQ, and SCHG. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.