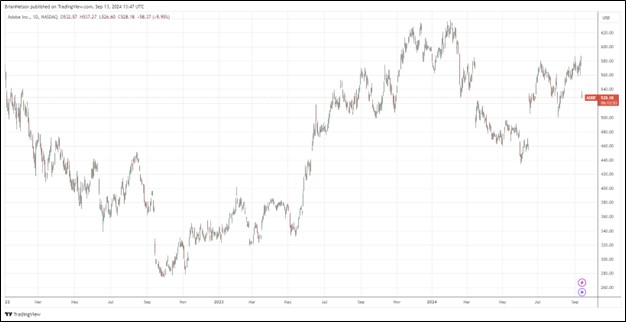

Image: Adobe’s shares traded down on a weaker than expected fiscal fourth quarter outlook.

By Brian Nelson, CFA

Adobe (ADBE) reported better than expected fiscal third quarter 2024 results on September 12, but the company’s outlook left something to be desired. In the quarter, Adobe grew revenue 11%, while non-GAAP earnings per share came in at $4.65, both above the consensus forecast.

Non-GAAP operating income was $2.52 billion, while non-GAAP net income reached $2.08 billion. Operating cash flow was $2.02 billion, up from $1.87 billion in the year-ago quarter, while it exited the period with remaining performance obligations (“RPO”) of $18.14 billion. During the quarter, Adobe bought back 5.2 million shares. Free cash flow in the quarter was $1.96 billion.

Management spoke positively in the press release:

Adobe’s record Q3 performance is a testament to our relentless innovation and commitment to delivering value to our customers. With groundbreaking advancements in AI across Creative Cloud, Document Cloud and Experience Cloud, we are empowering millions of users worldwide.

In Q3, Adobe delivered cash flows of over $2 billion and exited the quarter with record RPO, demonstrating the power of combining growth with world-class profitability. Given the massive markets we are catalyzing, I’m confident in our ability to drive growth and industry leadership.

Adobe ended the fiscal third quarter with $7.5 billion in cash and short-term investments versus total debt of $5.6 billion, good for a nice net cash position. Looking to the fourth quarter of fiscal 2024, management expects revenue in the range of $5.5-$5.55 billion, short of the consensus estimate of $5.6 billion, with non-GAAP earnings per share in the range of $4.63-$4.68, the midpoint below consensus of $4.67 per share.

Though Adobe’s outlook for the fiscal fourth quarter came up short, we continue to like its net-cash-rich balance sheet and strong free cash flow generation. We’re already quite tech heavy in the simulated newsletter portfolios, so we won’t be considering Adobe for inclusion, but the company is worth watching closely, especially as shares dip following its fiscal third quarter report. The high end of our fair value estimate range stands north of $660 per share.

—–

NOW READ: What to Do During This Market Selloff

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.